The Energy Bad Boys provide a road map at their blog 7 Quick Energy Takeaways from the 2024 Election. Excerpts in italics with my bolds and added images.

The Energy Bad Boys provide a road map at their blog 7 Quick Energy Takeaways from the 2024 Election. Excerpts in italics with my bolds and added images.

How a Donald Trump second term could reshape energy policy

Donald Trump’s comeback victory in the presidential election, which included carrying all seven swing states and winning the popular vote, along with Republican majorities in the Senate and potentially the House of Representatives, means big changes are coming to our nation’s energy policies.

Here are 7 quick takeaways for what might change in the next administration.

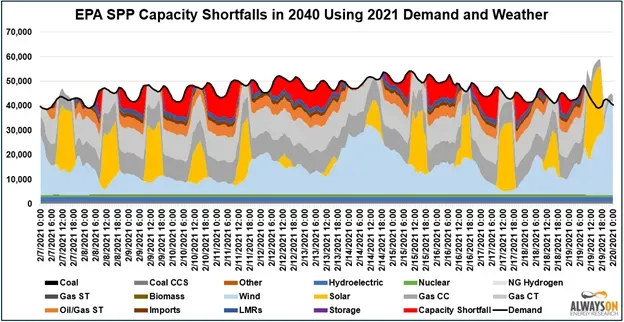

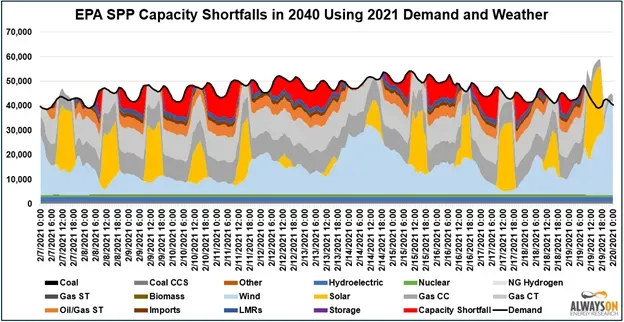

The D.C. Circuit Court is set to hear arguments on the Clean Power Plan 2.0—which we determined would leave millions of Americans in the dark—in the coming months.

Capacity shortfall events – or blackouts – in Southwest Power Pool (SPP) when we modeled EPA’s proposal for carbon mandates, stemming from the agency’s use of 80% or higher capacity values for solar energy.

The U.S. Supreme Court declined to stay the rules at this time, so the outcome of the case will likely impact the Trump administration’s strategy in addressing these rules. They may opt to do a scaled-down version of the rules, similar to when they replaced the Clean Power Plan 1.0 with the Affordable Clean Energy rule. Time will tell.

What we know now is this: the Biden Administration’s goal

of imposing carbon dioxide limits on existing

natural gas plants is dead in the water.

The repeal or reworking of several of the electricity-sector mandates imposed by the Biden-Harris administration will mean states have more say in their energy affairs.

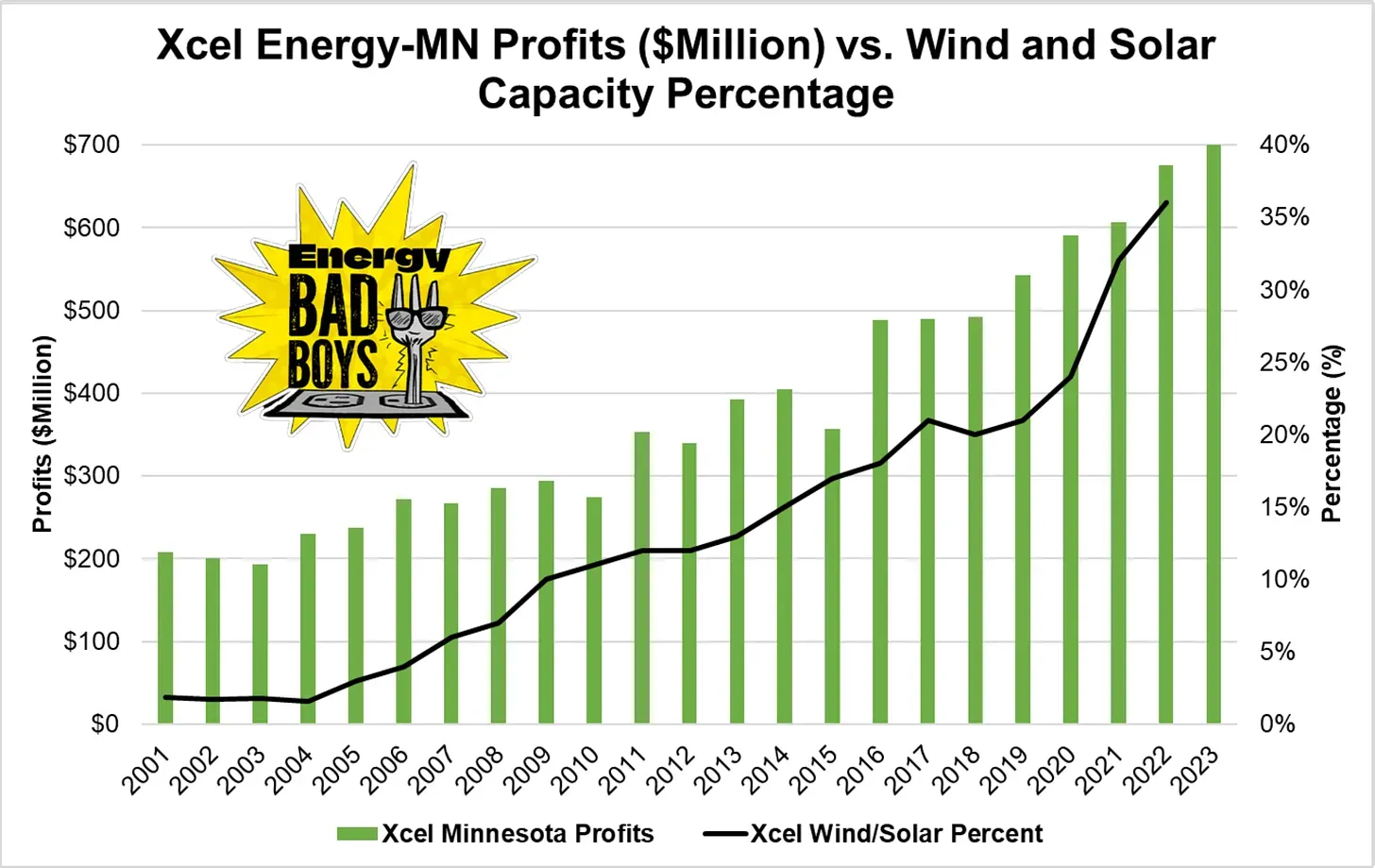

This is both a blessing and a curse, as blue states pursue aggressive renewable buildouts, and utilities in red states attempt to boost their corporate profits by “green plating” their grids. Utilities do this by enacting internal carbon-free goals that are similar to policies in blue states, hoping it goes unchecked by regulators and lawmakers.

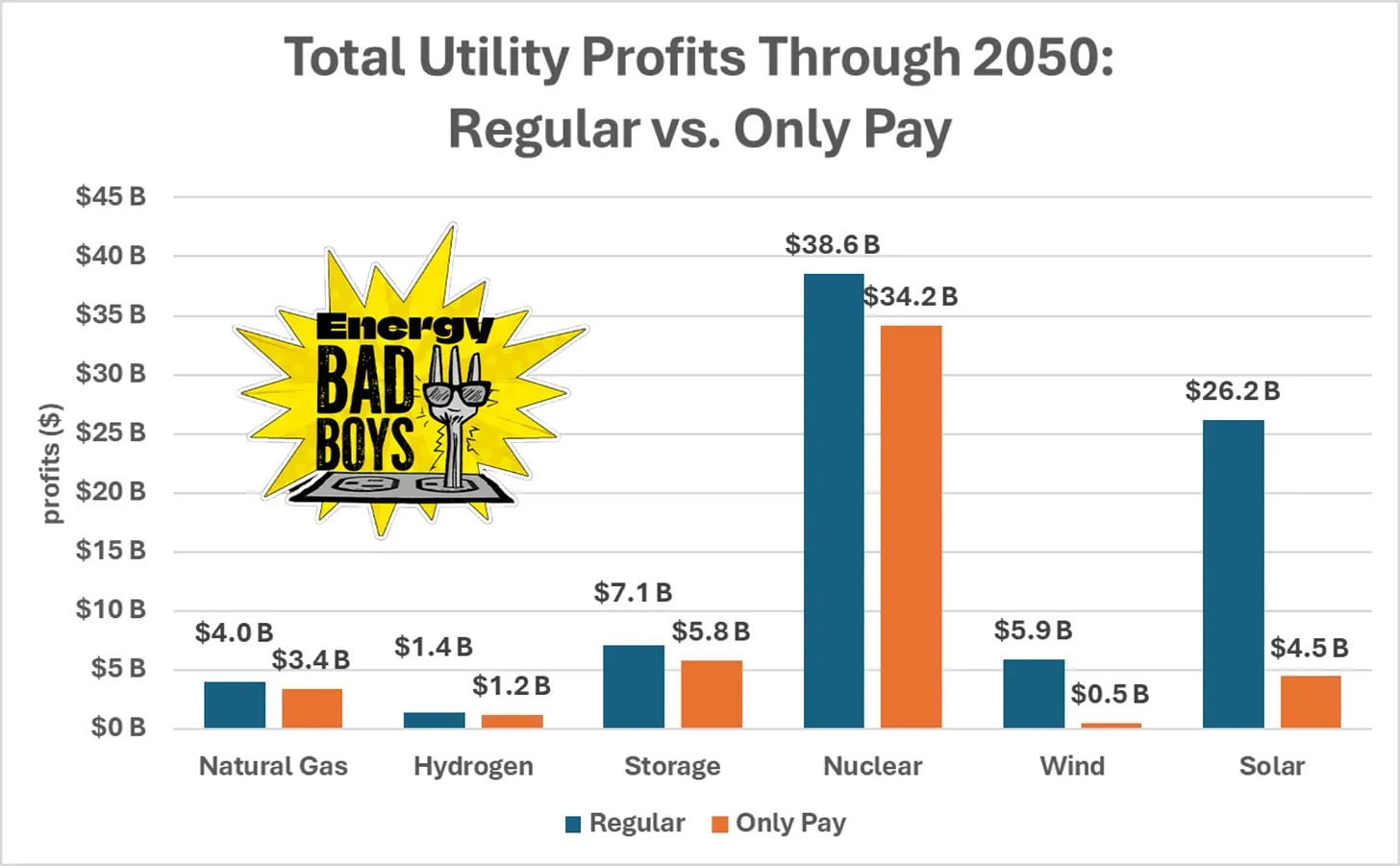

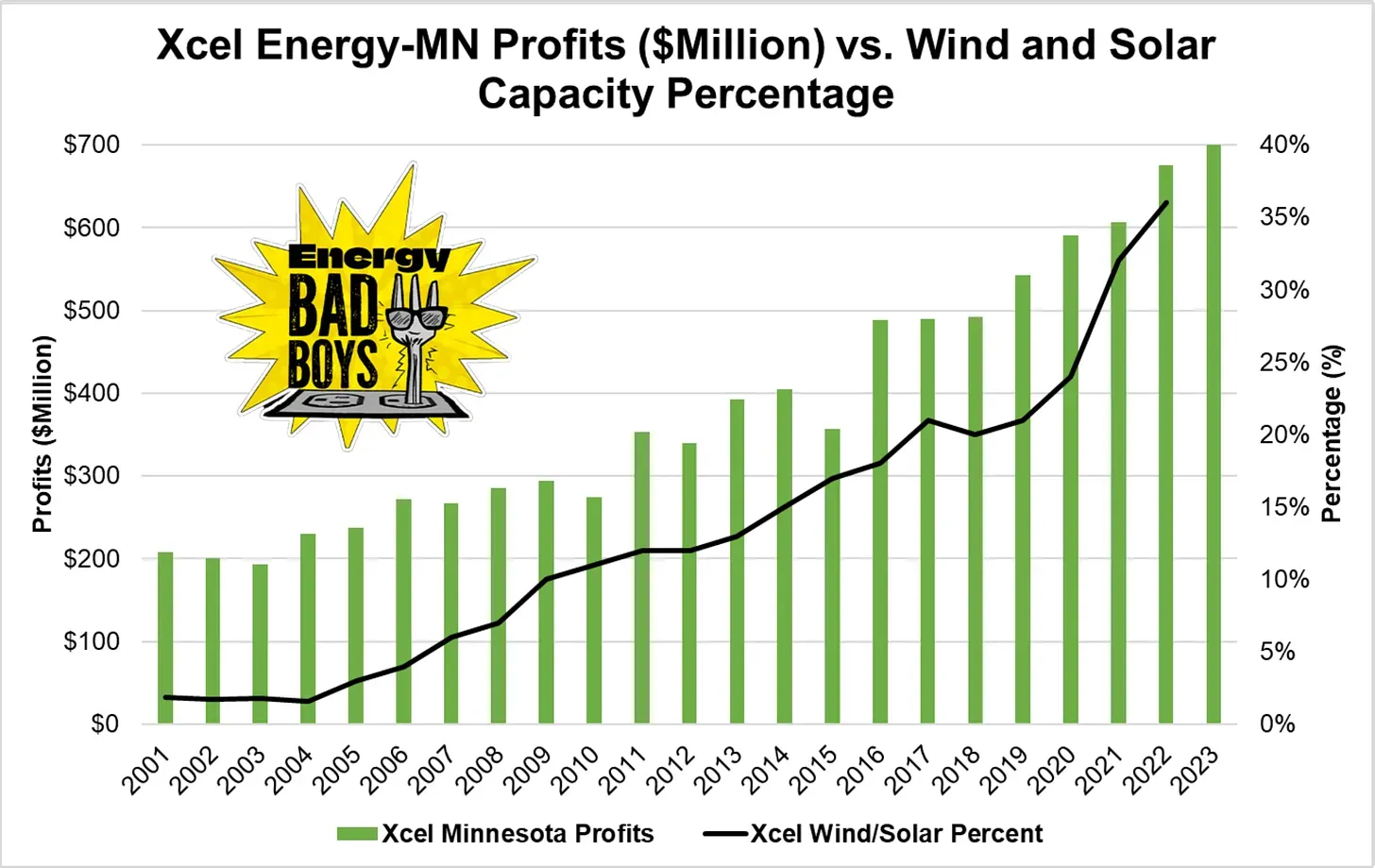

Xcel Energy’s profits in Minnesota have been skyrocketing since the state’s first renewable energy mandate, signed into law in 2007.

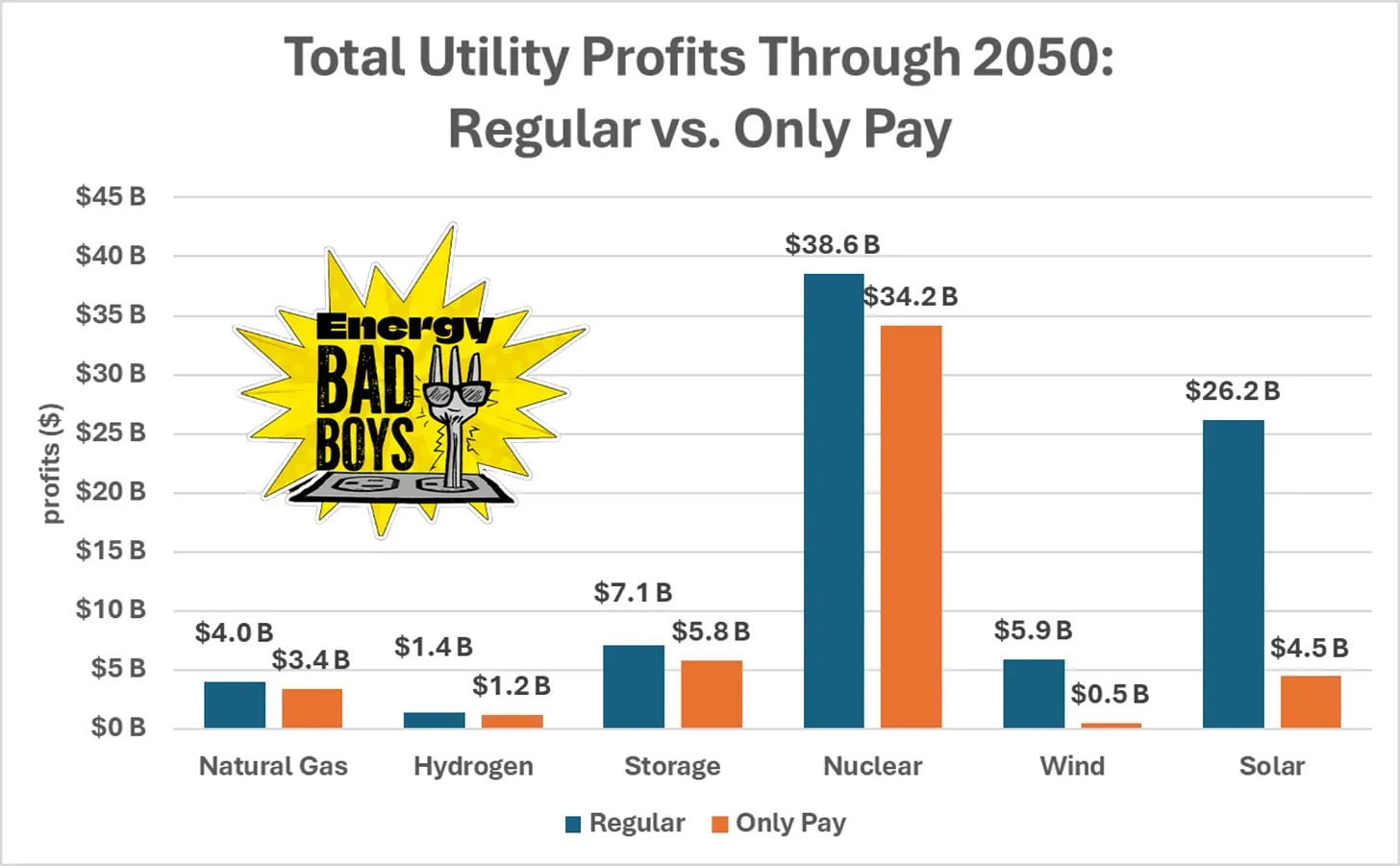

This shows the difference between profits earned by utility companies under normal regulation and what profits would be under Only Pay legislation.

Please feel free to reach out to us if you are interested in learning more about how Always On Energy Research can help policymakers in your state understand the stakes of getting their energy policy correct, and offer forward-looking solutions to the challenges we’ll all face in the coming years.

3. Repeal the IRA?

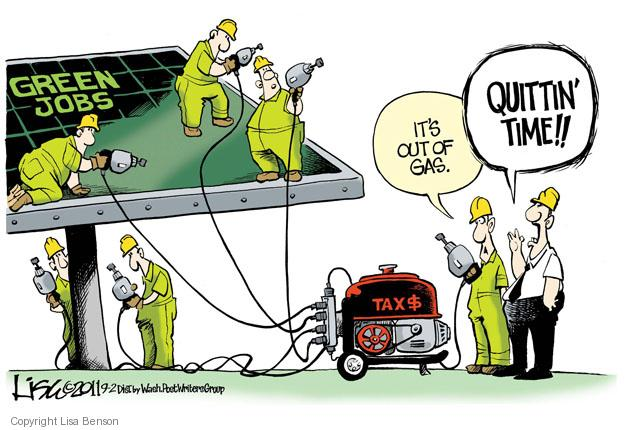

As we noted in our piece, Grassley v. The Grid, subsidies paid to wind and solar operations are no longer harmless feel-good incentives for alternative energy. Today, these subsidies are actively undermining the reliability of our nation’s electric grid.

IRA subsidies paid to wind and solar developers are used as an excuse by utility companies to justify closing down reliable coal, natural gas, and nuclear plants while pretending that their plans to replace them with wind, solar, and battery storage facilities are better for consumers.

As Travis Fisher has noted at his Substack, he estimates that the IRA will cost more than $1 trillion over the next 10 years and between $2 trillion and $4 trillion by 2050. These massive subsidies are so lucrative that companies are pursuing projects that only make sense if the subsidies exist, irrespective of whether they make any sense for customers. This is a recipe for enormous malinvestment of taxpayer dollars.

Repealing the investment tax credits and production tax credits for wind and solar facilities will be an indispensable part of reversing this trend and restoring rational market signals to the electricity sector.

4. Keystone Pipeline

During his appearance on the Joe Rogan Podcast, President Trump said he liked Robert F. Kennedy Jr.’s ideas on a lot of things, but we were relieved the President said he would need to keep him away from environmental policy decisions because he was hostile to “the black gold.”

Always On Energy Research’s oil and gas analyst, Trevor Lewis, notes that beginning day one, the Trump administration can take several steps to ensure America’s economy will have enough oil and gas to fuel decades of growth.

Restarting construction on the Keystone XL pipeline should be at the top of the list of priorities, which would bring job opportunities and economic activity to countless small towns from North Dakota to Kansas while simultaneously bolstering America’s energy security.

While America has vastly improved its energy independence from the rest of the world, our nation is still importing several million barrels of heavy sour crude from OPEC and other foreign nations. Restarting Keystone will allow American refineries to friend-source crude from Alberta and would, as an added benefit, reduce SO2 emissions from tanker ships, which negatively impact air quality and contribute to ocean acidification.

5. Drill Baby Drill

For domestic production, Trump’s Bureau of Land Management (BLM) will reverse the Biden Administration’s disastrous drilling policies.

In the first two years of the Biden Administration, total leases offered declined by 70 percent. By 2023, Biden’s BLM leased 95 percent fewer acres than Trump in 2019. Trump’s BLM can reverse this trend and award prime oil-rich lands to eager drillers in Wyoming, Montana, and Colorado. Offering these leases will replenish acreage inventories and reverse the 20-year decline in active acres, and the royalties paid on federal lands will be distributed through BLM’s oil and gas revenue splitting program with state governments and local communities.

Trump will also likely reverse the Biden Administration’s pause on permitting new liquefied natural gas (LNG) export facilities and appoint commissioners to the Federal Energy Regulatory Commission (FERC) that will approve the construction of new natural gas pipelines.

6. Solar and Wind on Federal Lands

In 2023, the Biden Administration’s Department of Interior (DOI) gave renewable energy developers a sweetheart deal slashing the annual lease rate for wind and solar on federal lands by 80 percent. Months later, Biden’s BLM announced the Western Solar plan which will bridle 31 million acres of Federal lands – most of which in Western States thousands of miles from Washington D.C. – with 25 gigawatts of solar power.

Unless reversed by the Trump Administration’s BLM, the Western Solar Plan will erect inefficient solar panels over pristine western landscapes while damaging fragile ecosystems in the process. Worse still, communities would not be compensated for the damages done by these solar developers because, unlike oil and gas leases, BLM does not share the revenues paid by wind and solar lease rents or bonus payments on the Federal lands with local communities.

The revenues communities receive from royalties strengthen local budgets, create jobs, and support the care and maintenance of the local environment, which wind and solar currently don’t contribute to. Trump’s BLM will have an opportunity to end Biden’s free ride for wind and solar developers. President Trump can advocate for western lands and their inhabitants by leveling the playing field by ensuring renewable energy developers pay rates equivalent to those paid by oil and gas producers.

7. Halting Offshore Wind

The Biden Administration has pledged to install 30 gigawatts of offshore wind capacity by 2030. To meet this target, the Bureau of Ocean Energy Management (BOEM) offered 10 offshore wind leases and scheduled auctions for 12 more leases through 2028.

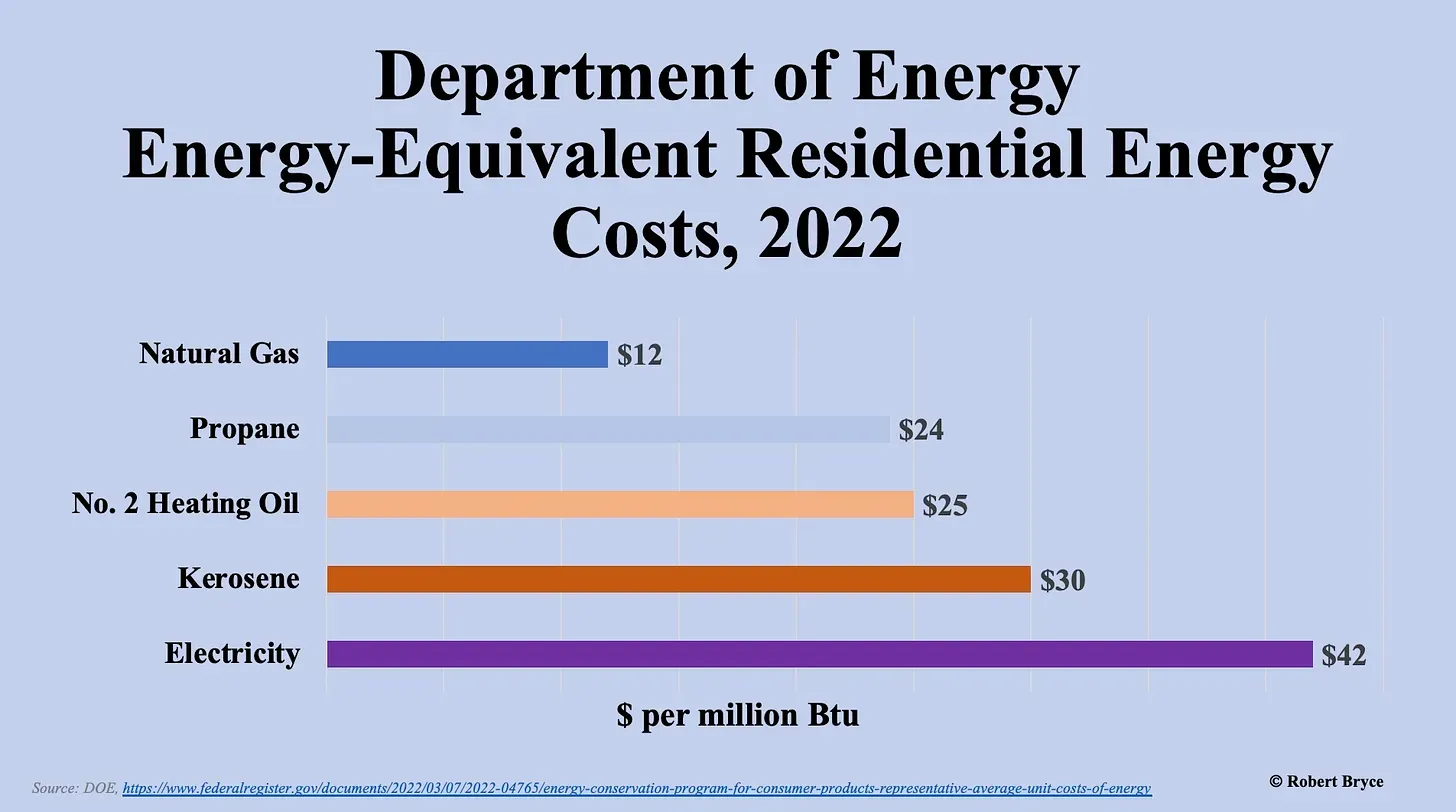

Offshore wind energy is one of the most expensive energy sources on the grid—even before accounting for the hidden costs of maintaining reliability with intermittent electricity generation.

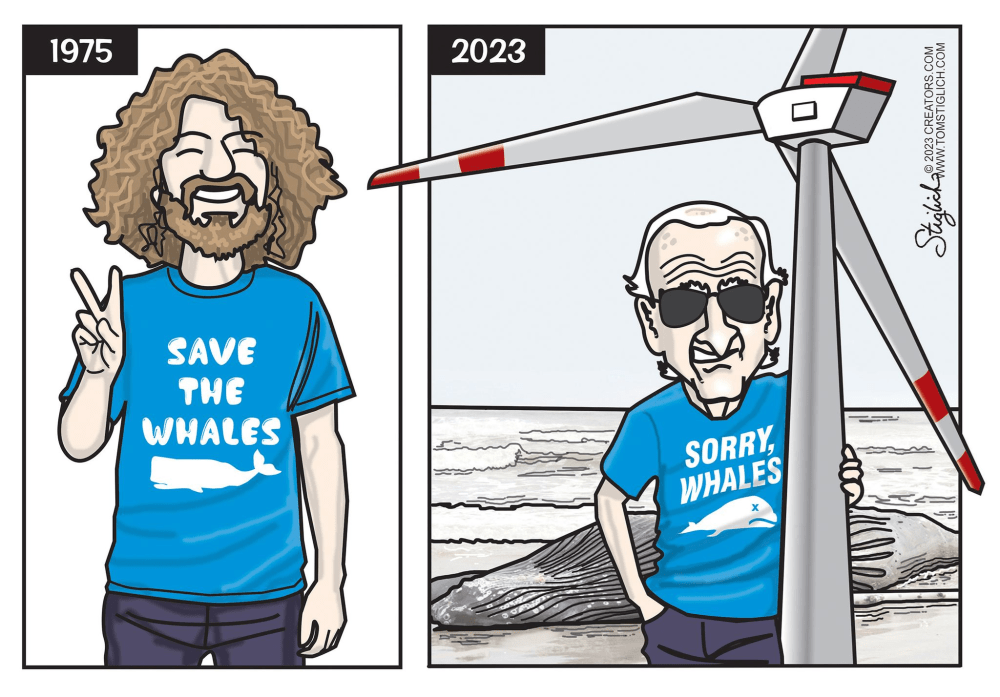

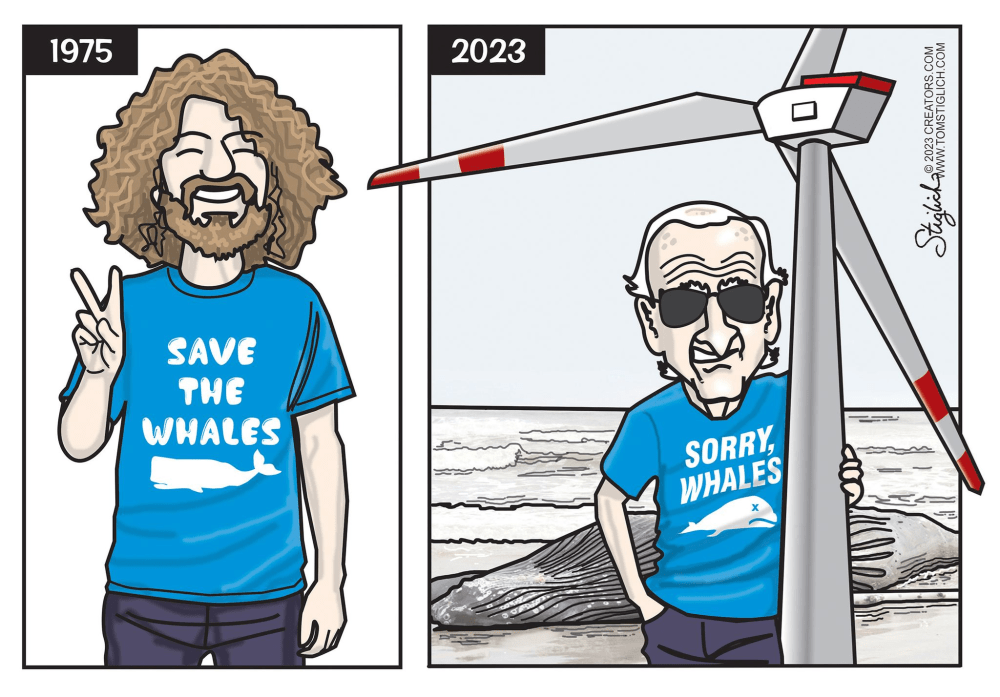

Additionally, offshore wind has been the center of ongoing environmental controversies, from killing whales to the breakdown of blades in the middle of the ocean, only to washup onshore

To prevent another Vineyard wind disaster, in addition to saving consumers from expensive and unreliable energy, Trump should direct the BOEM to terminate the 12 scheduled leases. As for the 10 auctioned leases, Trump could (and should) rescind these leases from offshore developers, in a similar move to Biden rescinding Alaskan oil and gas leases.

French Fishermen Join U.S. Fishermen in Fighting Offshore Wind – IER

Conclusion

Biden Bad, Trump Good.

After 4 years of one of the worst presidencies for reliable and affordable energy, the Trump administration has the opportunity to unleash energy dominance by ensuring a level playing field for all energy resources, ending the subsidies and handouts to renewable and battery developers, repealing egregious regulations aimed at prematurely retiring coal and natural gas plants, and promoting an energy dominant policy which will help end Bidenomic’s policy of energy inflation.

The Energy Bad Boys provide a road map at their blog

The Energy Bad Boys provide a road map at their blog

The building association worries the new energy code will raise the state’s already high housing costs, locking out potential buyers. The code requires that new buildings meet a certain environmental “score.” Without the points from an electric heat pump, a builder will have to make up the difference with other green measures that run between $15,000 and $20,000 in a single-family home. “Every time they raise the price $1,000, it prices out another 500 Washington families,” says Greg Lane, the association’s executive vice president.

The building association worries the new energy code will raise the state’s already high housing costs, locking out potential buyers. The code requires that new buildings meet a certain environmental “score.” Without the points from an electric heat pump, a builder will have to make up the difference with other green measures that run between $15,000 and $20,000 in a single-family home. “Every time they raise the price $1,000, it prices out another 500 Washington families,” says Greg Lane, the association’s executive vice president.