Terence Corcoran shines light on the emerging global control structure in his Financial Post article Is the global march towards sustainable development unsustainable? Excerpts in italics with my bolds and added images.

Regulations related to climate risks could prove a costly burden

for Canadian corporations, institutions

The planned reset of global corporate capitalism to save the planet continues to stumble toward the great unknown, in the sense that even after decades of effort the machinery to expand regulatory control over investment and business decisions remains bogged down in murky conceptual clay. Developments in regulatory and legal circles suggest 2024 will be a pivotal year for the revolutionary ideas that are supposed to lead to a fundamental transition from bad economic policy to green.

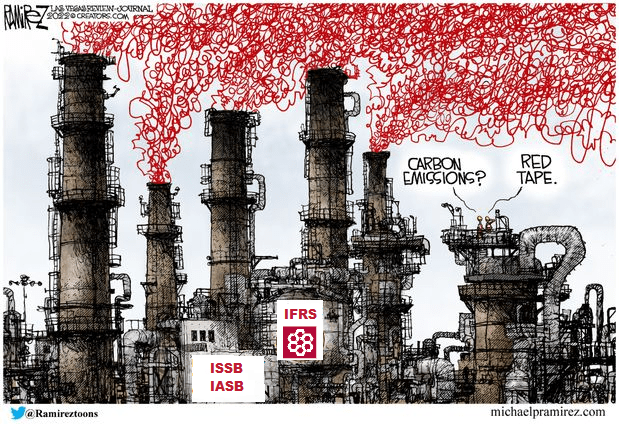

One of the symposium sessions was titled: “Get ready for jurisdictional adoption: How regulators are responding to the ISSB” — the International Sustainability Standards Board. Released last June, the ISSB standards will require corporations and investment organizations around the world to adopt common reporting approaches to climate and other environmental issues. It’s an authoritarian, top-down and anti-competitive regime that leaves no country or sector free to set its own rules.

One of the symposium sessions was titled: “Get ready for jurisdictional adoption: How regulators are responding to the ISSB” — the International Sustainability Standards Board. Released last June, the ISSB standards will require corporations and investment organizations around the world to adopt common reporting approaches to climate and other environmental issues. It’s an authoritarian, top-down and anti-competitive regime that leaves no country or sector free to set its own rules.All nations and regulators are to be locked in a global climate-control structure.

Canada is part of that structure through the Canadian Sustainability Standards Board, which this month announced a public consultation to advance adoption of sustainability disclosure standards in Canada. The consultation begins in March and runs through to June. One objective is to determine, with provincial securities regulators, how to impose mandatory reporting to replace voluntary standards on climate and environmental issues.

The Canadian Securities Administrators (CSA), which includes provincial securities commissions, is being pressured to take action on the grounds that Canada could get left behind. A paper released earlier this month by the Canada Climate Law Initiative at the University of British Columbia urged regulators to move forward quickly with new sustainability standards. Failure to act in concordance with the ISSB could cause Canada to lose international investment flows, the report claims.

The document continues through 20 pages of detailed recommendations covering climate-related strategies, investments, metrics, targets, performance, cash flows, scenarios, climate transition plans and science-based taxonomies. How any of this massive effort relates to corporate performance for shareholders is not addressed.

Looking to the future, the Law Initiative suggests the CSA should also begin thinking about requiring future reports related to a corporation’s “relationship to terrestrial, freshwater and marine habitats, ecosystems and populations of related fauna and flora species, including diversity within species, between species and of ecosystems, and their interrelation with Indigenous and affected communities.”

Internationally, Canada must also deal with the uncertainty surrounding the differing emerging global standards, including the still-to-be-determined U.S. Securities and Exchange Commission (SEC) approach to sustainable development. As the consulting firm EY put it in an updated report last month, “Entities with significant operations in multiple jurisdictions need to understand the key differences among the SEC proposal, the ESRS [European Sustainability Reporting Standards] and the ISSB standards because they might be subject to more than one set of requirements.” Another EY report this week warns that sustainable development “continues to face a range of challenges” in terms of costs, technologies and standardization.

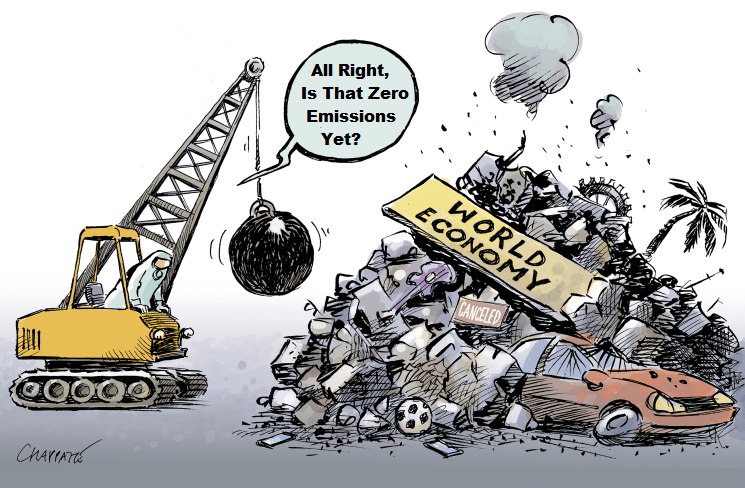

The legal proposals would burden Canadian corporations and institutions with massive reporting responsibilities and costs related to climate risks. On corporate governance, for example, the Climate Law Initiative calls for securities issuers to “disclose the governance processes, controls, and procedures it uses to monitor, manage, and oversee climate related risks and opportunities.”

All of this is taking place on a shaky theoretical foundation

in economics and environmental change.

The 1987 Brundtland Commission simplistically defined sustainable development as “development which meets the needs of the present without compromising the ability of future generations to meet their own needs.” Exactly what “needs” are is unclear. Maybe it was intended to capture Marx’s slogan: “From each according to his ability, to each according to his needs.” Meaning: Take from wants of the developed world and give to the needs of the developing world?

The missing fundamentals of the 50-year-old movement to reshape the corporate model should receive a little more attention in the months ahead. Could it be that sustainable development is unsustainable?

Postscript

Meanwhile, the sustainability movement is transitioning to students. In Kelowna, B.C., and Toronto this week the goal is to inspire the next woke generation of environmentally active citizens. At the Toronto event, the organizers summarized their plan. “We welcome high school students and their teachers to this dynamic one-day conference that brings together youth and community organizations from across Ontario to discuss, collaborate and learn how to make sustainable and equitable change in our world.”

One comment