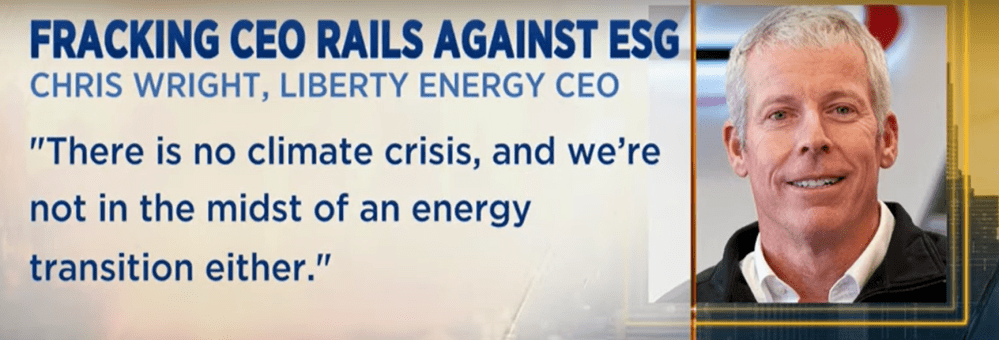

Last year Chris Wright dished out climate and energy realism in an interview on CNBC Squawk Box hosted by Andrew Ross Sorkin. Now he is to be appointed Secretary of Energy in the coming Trump administration. Here are his candid and unvarnished views from inside the energy industry.

For those who prefer reading below is a transcript lightly edited from the closed captions in italics with my bolds and added images. AS refers to Sorkin’s questions and CW to responses from Wright.

AS: President Biden conceded last week that the U.S is going to be needing oil and gas for as he says at least the next decade as the country transitions to Renewables. But our next guest says that we are not in the midst of an energy transition and claims the so-called climate crisis is overblown. Last month he railed against what he called an alarmist move away from fossil fuels in a video on LinkedIn. The Microsoft owned company removed the post citing misinformation, only put it back up days later.

So let’s talk right now to Chris Wright–Chairman and CEO of Liberty Energy, North America’s second largest fracking company Chris good morning to you.

Reaction to the State of the Union

AS: Let’s start with your reaction after watching the State of the Union. President Biden makes the statement twice actually. The first time he says we’re going to need fossil fuels for a while. Later he follows up with: We’re going to need it for something like a decade or so. There was laughter in the chamber, certainly from the GOP, but it very well might have been both sides of the aisle at that point.

CW: Yeah, likely it was. Of course it’s great to see an acknowledgment the world run on oil and gas and we need that. But to throw out a decade, it’s just an absurd time frame. We’re not going to meaningfully change the demand for oil and gas one way or the other in the next decade. And I think politicizing energy and opposing infrastructure is standing in the way of Today’s Energy System before we’ve built a new Energy System. There’s just no upside in that.

Realistic timeline for energy

AS: When you think about the timeline, what do you think is a realistic timeline to the degree you think there is one.

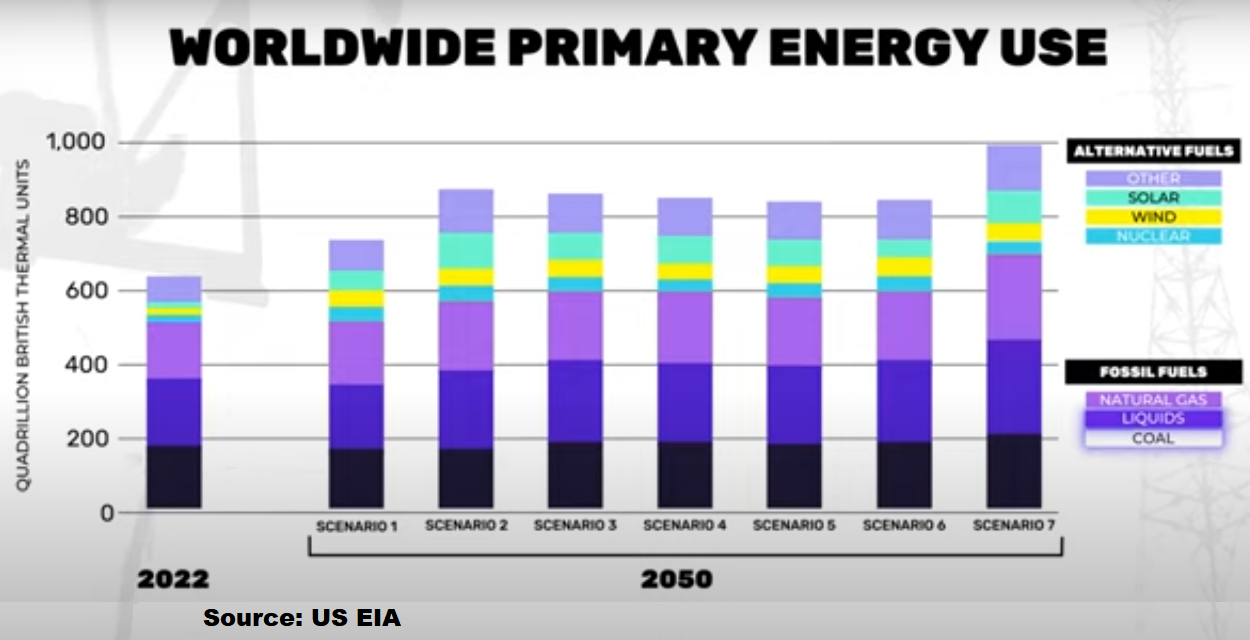

CW: It’s multiple, as we’ll talk about that. The Energy Information Administration is our government agency that projects forward demands for varied energy sources, They have in 2050 roughly flat demand for oil and gas as what we have today; maybe it rises a little bit the next decade or two, maybe it comes down a little bit in the next decade or two after that. Maybe that’s true, but I think you’ll see no meaningful change of our hydrocarbon system in the next three decades. I’m all for investing in new energy sources: nuclear has a great future if we could regulatorily issue a permit. We haven’t issued a new permit for a nuclear plant in 50 years.

There’s great new things we can bring; but standing in the way

of what runs the world today just isn’t productive.

Nuclear energy

AS: I’m a big fan but it’s quite unpopular talking about nuclear energy. Usually when I say something on the air it causes some kind of strange firestorm. Do you think there’s any realistic chance we have nuclear energy in the United States in the next decade?

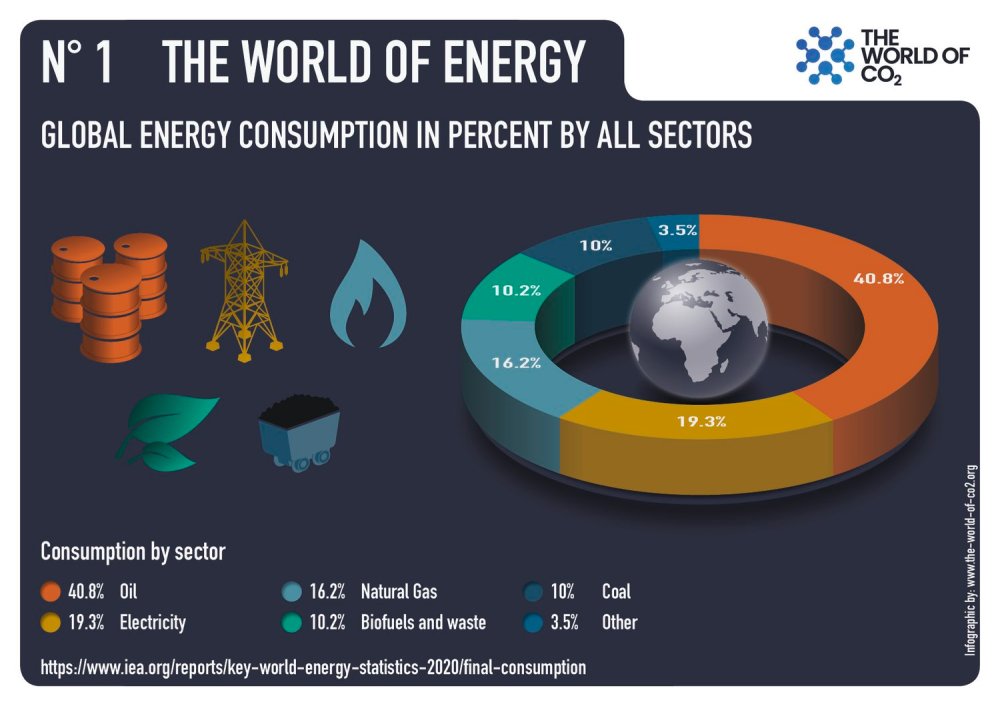

CW: I think probably not in the next decade. Nuclear will have a Renaissance right now, but it more likely starts overseas where there’s a less onerous and less fear-driven regulatory system. I think we’ll see small modular reactors come. What’s great about nuclear is they bring not just electricity which is the only place wind and solar can play. Electricity is less than a quarter of global energy. Process heat that you need for manufacturing is just critical, and nuclear could bring process heat as well as electricity. Today it’s just fossil fuels that bring processed Heat.

SEC disclosure

Rough Seas for Captains of Industry

AS: Chris, I wanted to ask you two big big other questions. One regards the SEC pushing for more disclosure for companies around ESG and and in particular their plans around climate and energy. It

may get softened a bit, in part because of the comments that have come back to them. What is your sense of what the SEC was proposing and where you think they’re going to land?

CW: Well what they proposed is totally nuts. And I wrote a long comment letter on it. A lot of public company CEOs won’t do that, But it’s just making an enormously complicated expensive reporting thing so people can sue us because they think we didn’t quite properly estimate our scope three emissions. Those are emissions from the products we produce when someone else burns them on the other side of the world or on the other side of the country. No one can really account for that.

Why are they doing that? They’re doing it so this Administration can signal they’re against fuels. Again that’s just unproductive.

LinkedIn censorship

AS: Your LinkedIn post went down tell me what happened. People talk about censorship all the time, who should be the Arbiter of Truth and all of that.

CW: Yeah it was crazy. I made a sort of an amateur video just talking about energy climate transition with just some basic data so you can get background on it. And it was taken down as misinformation. I hit the appeal the decision button, and they came back and said it violated their spams and scams policy. I posted it again it’s taken down again from misinformation. Then upon appeal they said sorry, on further review it didn’t violate their policy. That’s probably not LinkedIn but people complaining because I’m not talking the climate alarmist narrative. For LinkedIn to go along and take that down is just a symbol of where we are today, unfortunately.

Oil and Gas Industry Productivity

AS: When we finally hit Peak production again, we haven’t yet since 2019. So there’s a lot of finger pointing on why that is. I mean fracking had its own problems when there was a slow period. When we try to reopen from a pandemic we can’t get the workers that we need for the you know for the whole oil and gas industry. But add in ESG and add in President Biden’s pitch: Read my lips, I will end the fossil fuel industry.” How much do you think ESG and that type of of rhetoric scared away producers? Is ESG a positive or negative for society?

AS: I think from an investor movement it’s a negative. Of course we should care about the environment and the societies we operate in. And of course company and government should be aligned with the owners of businesses, that’s a very real point. The other point is of course that’s what businesses do in a free Society. If you’re not a great member of society, if people don’t believe they’re part of something bigger than just getting a paycheck, you’re going to have trouble getting workers.

So the idea is right but it’s really become sort of a top-down thing: if you’re admitting greenhouse gas emissions you’re bad, if you’re reducing them or shrinking your business there you’re good. And then of course a top-down check box list to decide if we’re socially virtuous or not. These are bad ideas. Investors should care about ESG but it shouldn’t be like a third party imposing a scorecard to tell me who’s virtuous and who’s not.

On the on the margin it has indeed reduced Capital to our industry which absolutely raises the cost of capital on the margin. We produce less oil and gas because of it and the main impact of that is higher oil and gas prices.

One comment