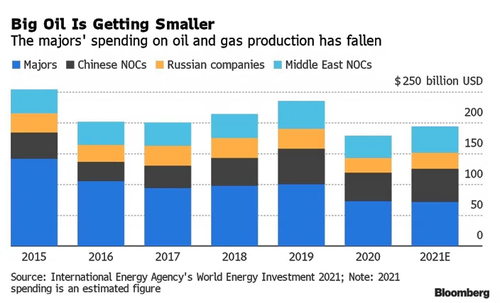

A previous post reprinted at the bottom warned that the ESG movement is a threat to the free world, as well as endangering supply of cost-effective energy. Part of the issue is the way private sector energy companies are being undermined by regulations and ESG priorities, and shaming, which shifts market advantage to national producers like Russia and Saudi Arabia, among others. Tyler Durden explains in his zerohedge article Fossil Fuels Aren’t Dying, They’re Shifting To National And State Backed Companies. Excerpts in italics with my bolds.

Despite the activist shareholder battles, calls for ESG changes and just outright negative press about fossil fuels, it looks like rumors of oil’s death have been greatly exaggerated. Fossil fuels aren’t dying – rather, their output is just being shifted to national and state owned companies.

Even as the supermajor oil companies shrink in size and adhere to incessant criticism, fossil-fuel demand holds strong, according to Yahoo Finance. Activists have been the busiest they have been in years…

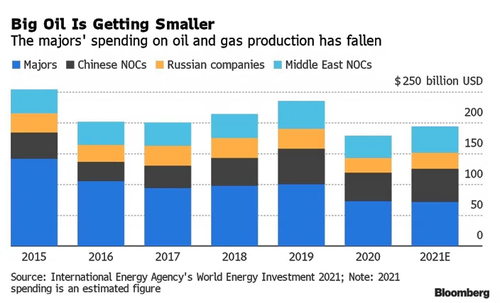

Recent weeks saw Exxon and Chevron rebuked by their own shareholders over climate concerns, while Shell lost a lawsuit in the Hague over the pace of its shift away from oil and gas. . . .and this has been a tailwind for national oil companies (NOCs) and state owned players who aren’t under the same pressure to play ball with activists. The report notes that “Saudi Aramco and Abu Dhabi National Oil Co. are spending billions to boost their respective output capacities”, as is Qatar Petroleum.

NOC’s share of global oil output is expected to rise to 65%, from about 50% today, by 2050. Companies like Exxon and Chevron are keeping output at lows and curtailing future investment in traditional oil and gas infrastructure.

Patrick Heller, an adviser at the Natural Resource Governance Institute, told Yahoo Finance: “We hear government officials and NOC officials say, ‘We look at the divestment of international oil companies from some projects as an opportunity for us to grow. And I do think that’s potentially really risky.”

Jason Bordoff, director of the Center on Global Energy Policy at Columbia University’s School of International and Public Affairs, thinks that the shift to government owners could wind up doing just the opposite of what activists are intending on doing.

“A shift in production to major nationally owned companies — such as in Latin America or the Gulf or Russia — carries geopolitical supply risks, while smaller independents have often demonstrated poorer safety and environmental practices,” he said.

Amrita Sen from consultancy Energy Aspects said: “Oil and gas demand is far from peaking and supplies will be needed, but international oil companies will not be allowed to invest in this environment, meaning national oil companies have to step in.”

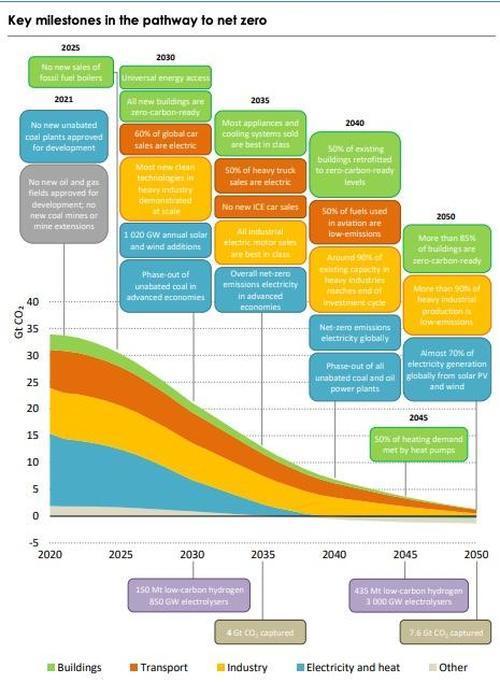

The Saudis, meanwhile, don’t seem quite as alarmed by the issue of climate change. When The International Energy Agency issued guidance last month to scrap all new oil and gas developments, Saudi Energy Minister Prince Abdulaziz bin Salman responded by stating:

“It (the IEA report) is a sequel of the La La Land movie. Why should I take it seriously? We (Saudi Arabia) are … producing oil and gas at low cost and producing renewables. I urge the world to accept this as a reality: that we’re going to be winners of all of these activities.”

A spokesperson from Gazprom jabbed: “It looks like the West will have to rely more on what it calls ‘hostile regimes’ for its supply”.

“Western oil majors like Shell have dramatically expanded in the last 50 years” as a result of the West trying to cut reliance on Middle Eastern and Russian oil, Reuters notes. Now these producers must balance a growing chorus of criticisms about climate change with continued output.

Nick Stansbury at Legal & General, which manages $1.8 trillion, said: “It is vital that the global oil industry aligns its production to the Paris goals. But that must be done in step with policy, changes to the demand side, and the rebuilding of the world’s energy system. Forcing one company to do so in the courts may (if it is effective at all) only result in higher prices and foregone profits.”

While Saudi Arabia claims to have targets to cut carbon emissions, it isn’t beholden to U.N.-backed targets or activist investors like Western companies are. Gazprom has indicated a shift to natural gas to try and manage its carbon emissions.

Western names account for about 15% of all output globally, while Russia and OPEC make up about 40%. At the same time, global oil consumption has risen to 100 million barrels per day from 65 million barrels per day in 1990.

“The same oil and gas will still be produced. Just with lower ESG standards,” one Middle Eastern oil executive concluded.

Background from Previous Post ESG Movement Threatens Us All

Alex Epstein puts out a stern warning in a twitter thread reprinted below with my headers.

What ESG Really Means

Over the last 5-10 years, “ESG”–standing for Environmental Social Governance–has gone from an acronym that virtually no one knew or cared about, to a cultishly-embraced top priority of financial regulators, markets, and institutions around the world.

The preposterous financial pretense of “ESG investing” is that the promoters of it have so accurately identified universal norms of long-term value creation–Environmental norms, Social norms, and Governance norms–that imposing those norms on every company is justified.

In reality, ESG was a movement cooked up at the UN–not exactly a leading expert in profitable investment–to impose moral and political agendas, largely left-wing ones, on institutions that would not adopt them if left to their own devices.

The number one practical meaning of ESG today is: divest from fossil fuels in every way possible, and associate yourself with “renewable” solar and wind in every way possible. That’s why I call it the “ESG divestment movement.”

Modern ESG’s obsession with unreliable “renewable” solar and wind, reflects its political nature. Any serious concern about CO2 emissions means embracing the only proven, reliable, globally scalable source of non-carbon energy: nuclear. But most ESG does not embrace nuclear.

Divesting from Fossil Fuels is Immoral

Divesting from fossil fuels is immoral because:

1. The world needs much more energy.

2. Fossil fuels are the only way to provide most of that energy for the foreseeable future.

3. Any problems associated with CO2 pale in comparison to problems of energy deprivation.

The world needs much more energy

Low-cost, reliable energy enables billions of people to enjoy the miracle of modern machines that make us productive and prosperous. Yet 800M people have no electricity and 2.6B people are still using wood or dung for heating and cooking.

Fossil fuels are indispensable

Only fossil fuels provide low-cost, reliable, versatile, global-scale energy.

Unreliable solar and wind can’t come close. That’s why fossil fuels continue to grow in the developing world; China and India have 100s of coal plants in development.

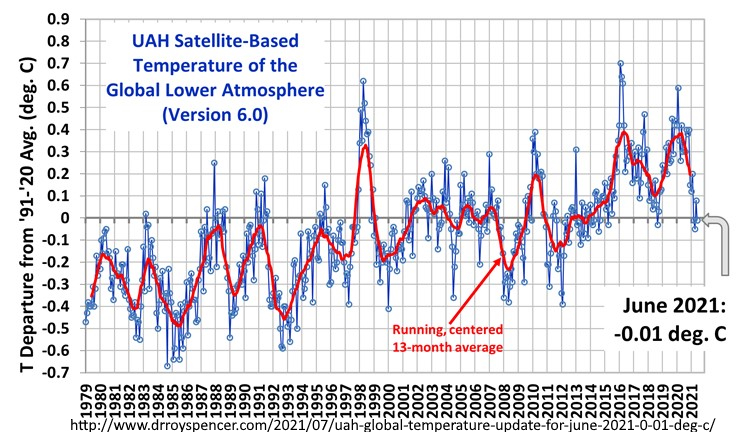

CO2 levels matter much less than energy availability.

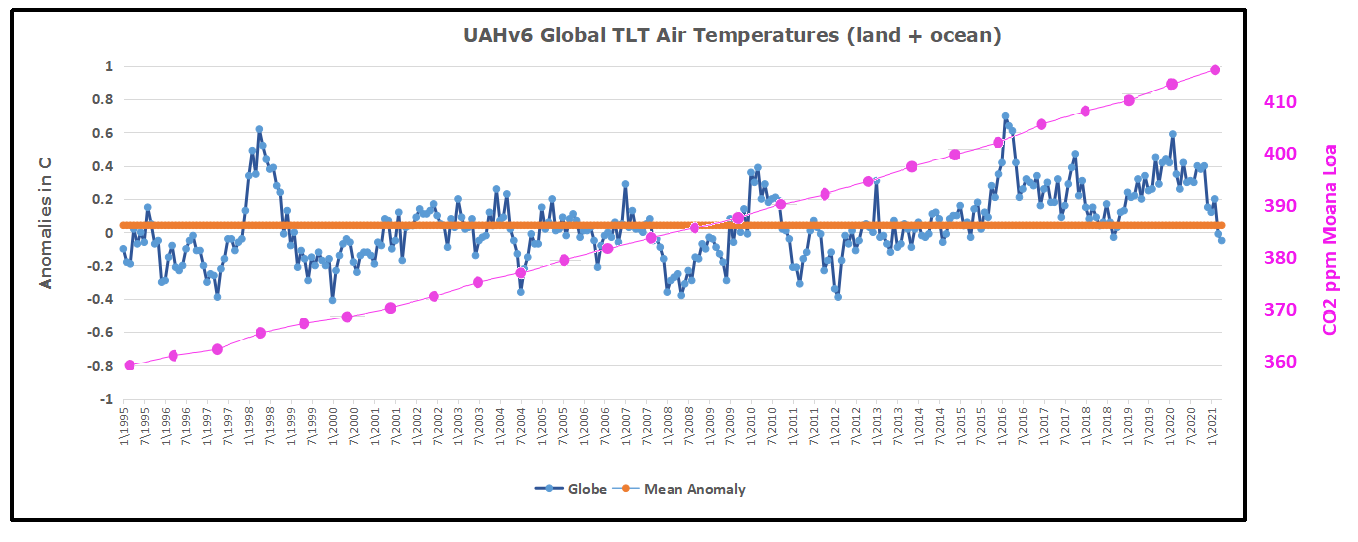

CO2 emissions have contributed to the warming of the last 170 years, but that warming has been minor and manageable—1 degree C, mostly in cold parts of the world. And life on Earth thrived when CO2 levels were >5X today’s.

Fossil fuels have made climate far safer by powering a highly resilient civilization. That’s why climate disaster deaths—from extreme temps, droughts, wildfires, storms, and floods—have decreased 98% over the last century.

ESG Perpetuates Poverty by Denying Capital for Cost-effective Energy Projects

A moral financial movement would do everything it could to increase capital for all cost-effective energy, including fossil fuels. And including nuclear, which is by far the most promising form of low-carbon energy. Instead, ESG is starving cost-effective energy of capital.

By starving cost-effective energy of capital, the ESG movement is engaging in a fundamental act of mass destruction. Energy is the industry that powers every other industry. By making energy more expensive, ESG makes everything more expensive–hurting the poorest people most.

The most egregious immorality of the ESG movement, led by Larry Fink’s Blackrock, is its effort to destroy vital fossil fuel projects in poor places that desperately need them. This effort is guaranteed to perpetuate poverty.

Example of ESG poverty perpetuation: South Korea canceled new coal plants in South Africa and the Philippines after “Global investors including Blackrock…warned the South Korean utility to drop coal power projects.”

Another example of ESG poverty perpetuation: “International investors are increasingly restricting support to companies involved in extracting or consuming coal, yet nearly 70% of India’s electricity comes from coal plants, and demand for power is set to rise…”

ESG poverty perpetuation is getting worse as activist “investors” with increasing influence on large financial institutions try to stop all fossil fuel projects in poor places.

E.g., HSBC was attacked when it decided to fund 6 new coal power plants in Indonesia and Vietnam.

ESG defunding fossil fuel projects in the poorest parts of the world will mean: more babies die for lack of incubators and other medical equipment, more deaths from lack of water treatment plants and modern sanitation, more deaths from lack of heating and air-conditioning.

Every leading ESG institution should be called out for their genocidal policies toward the poorest parts of the world. They should be shamed for placing their own virtue-signaling above billions of actual human lives. They should lose all moral authority in the realm of energy.

ESG Movement Threatens Free World Security

The ESG movement is also an enormous threat to the security of the free world, because by depriving free countries and poor countries of low-cost, reliable energy, it furthers Communist China’s ambitions to become the world’s superpower using low-cost, reliable fossil fuels.

China has a clear strategy of running its economy on fossil fuels, while encouraging others to run on inferior, unreliable solar and wind — that is made using Chinese fossil fuels, which produce 85% of Chinese energy. China has 247 GW of coal plants (3 TX’s worth) in development.

China dominates the mining and processing of “renewable” materials to a staggering degree. The US does little mining or processing of the needed materials, largely because of “green” regulations. Our dependence on China for “renewables” dwarfs past Mideast oil dependence.

Energy security is national security. When hostile foreign powers can meaningfully cut off our access to energy they can manipulate us politically. Examples: US appeasement of Saudi Arabia and European appeasement of Russia.

Energy security is national security, above all in wartime. War requires continuous high-energy manufacturing and continuous fueling of high-energy mobile machines such as planes and aircraft carriers. Both world wars were won by the side with the most oil, the fuel of mobility.

What does the modern ESG movement do about the danger of an energy-dominant China? Deny reality and serve as “useful idiots.”

Example: Larry Fink’s sole mention of China in his influential letter to CEOs was to praise China’s “historic commitments to achieve net zero emissions”!

Renounce ESG and Commit to Long Term Cost-effective Energy

The ESG divestment movement should be publicly shamed as a virtue-signaling, financially idiotic, and most importantly immoral movement that perpetuates poverty and threatens freedom. All legal pressures to adopt it should be eliminated. ESG should be boycotted wherever possible.

The anti-energy, anti-freedom ESG movement should be replaced with a voluntary *long-term value creation movement*. Creating sustained value for companies’ owners requires a long-term perspective. But a long-term perspective means valuing cost-effective energy, not destroying it

Samuel Allegri explains in his Epoch Times article

Samuel Allegri explains in his Epoch Times article