Dumb and Dumber Energy Advice from NYT

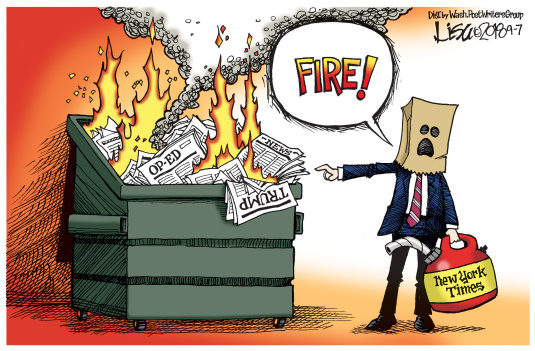

Benjamin Zycher at Real Clear Markets takes the NYT to task for its stupid article about fossil fuel infrastructure, awarding it The Dumbest New York Times Op-Ed of 2021. Of course there are many months left for NYT to publish even worse inanities this year. Excerpts in italics with my bolds. I have reorganized the content to juxtapose the wild claims with sober facts.

Summer still is weeks away, but already we have a winner in the fierce competition for the coveted title of “Dumbest New York Times opinion column of 2021.” The envelope please… and the winner is “Why Charles Koch Wins When Our Energy System Breaks Down,” by someone named Christopher Leonard. One really does have to read this column to grasp — actually, to marvel at — the inanity of Leonard’s argument, which can be summarized as follows.

Claim:

Our fossil-fuel infrastructure — pipelines in particular, and refineries as well — is “increasingly unreliable” and “dominated by a very small group of very profitable companies.”

Fact:

Leonard does not tell us what he means in his assertion that U.S. pipelines are “increasingly unreliable” — it is easy to infer that he has no idea — but if we define “reliability” as the annual number of adverse pipeline incidents, there has been no trend since 2002, even as pipeline mileage increased almost 63 percent between 2004 and 2019.

Claim:

The Colonial Pipeline shut down in 2016, and again this month due to a cyberattack, but the five companies that own Colonial “profit handsomely off its operations and earn outsize profits in the face of the bottlenecks and supply squeezes caused by shutdowns.”

Fact:

That is absurd: The pipeline generates revenue only when it is moving product; if it is not operational it is not generating revenue.

Claim:

The 2016 shutdown “didn’t seem to hurt the owners’ earnings” in that afterward “Colonial boosted its annual dividends — at least in part because of the Trump administration’s 2017 tax cuts.” The growth in Colonial’s investments in updating and protecting the pipeline have been “modest, while dividend payments have risen sharply.”

Fact:

Apart from Leonard’s confusion about whether it is due to the 2016 shutdown or to the 2017 tax cut, he apparently has no concept of the factors addressed by corporate managers as they determine the appropriate dividend. In particular, a dividend change is driven by the evaluation of the after-tax return to shareholders from retaining more financial capital within the firm compared with that from distributing more to the shareholders. An increase in the dividend suggests that the latter has increased relative to the former, presumably in this case because of the nuances of the 2017 tax bill. Were the Kochs responsible for that?

Claim:

Charles Koch “has profited for years off similar energy bottlenecks in the upper Midwest” because of such infrastructure investments as the Pine Bend refinery, which “owes its profitability to its location in the middle of a broken fuel market.” Koch “buys cheap crude” in a market “oversupplied” with Canadian crude oil, after which “Koch then sells its finished fuel into an undersupplied gasoline market in the upper Midwest.”

Fact:

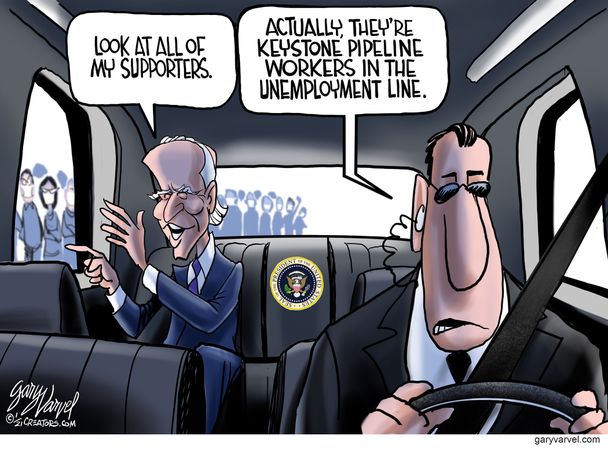

And about that “oversupplied” (whatever that means) midwestern market for Canadian crude oil: The midwestern refinery market would be far less “oversupplied” had the Keystone XL pipeline been approved at long last, delivering heavy Canadian crude oil to the Gulf coast refineries designed to refine it. Did Charles Koch urge the Biden administration to reject the pipeline? Has Leonard criticized that decision? I can find no record of any such stance on his part.

And then there is Leonard’s assertion that the gasoline market in the upper Midwest is “undersupplied” (whatever that means). The Energy Information Administration divides the U.S. gasoline market into five regions (“PADDs”). As of May 24, Gulf Coast gasoline prices were the lowest, followed by the Midwest, and then (in ascending order) the East Coast, the Rocky Mountain states, and the West Coast, the last of which had the highest prices even excluding California. What is Leonard talking about?

Claim:

“Regulatory hurdles have paved the way for these profits for decades.” “The Clean Air Act… made it nearly impossible for competitors to open a refinery near Pine Bend” to increase competitive pressures.

Fact:

The comedy highlight of Leonard’s column is the assertion that it is the Clean Air Act, regulatory obstacles to new pipeline investment, and general “regulatory stasis and dysfunction” that have yielded the “outsize profits” enjoyed by the Kochs. Leonard seems actually to believe this: “Just by letting the broken market limp along, Koch Industries reaps extraordinary profits from a broken system.” So the Kochs are vastly more powerful than anyone could imagine, responsible for the regulatory morass, for the ideological leftist political opposition to fossil infrastructure, for NIMBYism, and for allowing the “broken market” to “limp along.” Just as the pipeline owners win whether the pipelines are operating or not, Leonard clearly believes that they earn “outsize profits” whether the regulatory environment is light or dysfunctional. Who knew?

Claim:

Regulatory fights benefit big refiners that can afford expensive legal experts and lobbyists: “Koch benefits from regulatory stasis and dysfunction.”

Fact:

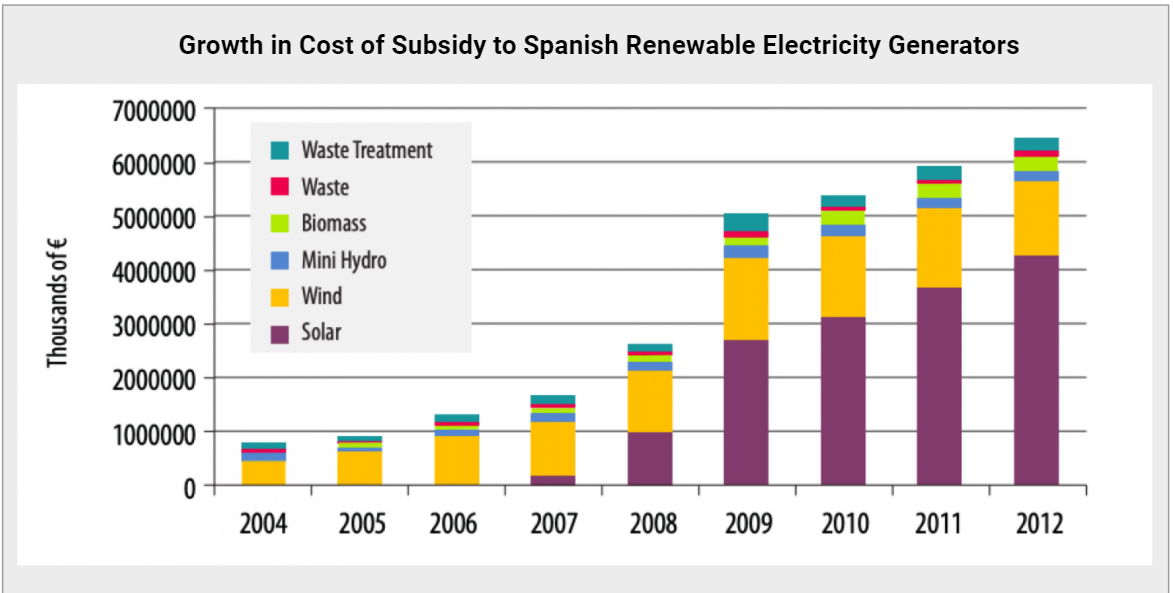

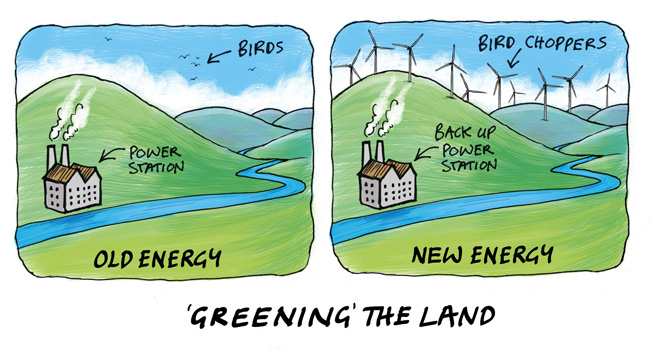

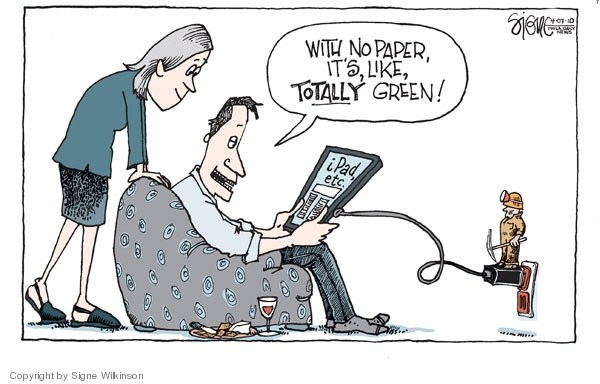

The utter stupidity of Leonard’s argument is illustrated by his assertion toward the end of the column that “new wind farms or solar installations could open up a whole new energy market.” Somehow, I was led to believe that Leonard’s argument was about pipelines and refineries and gasoline prices, and the ability of the Kochs to earn large profits no matter what. But no: An endorsement of unconventional electricity, expensive and environmentally destructive, just had to be shoehorned in as an exercise in virtue-signaling par excellence despite the reality that it has nothing to do with Leonard’s silly central argument. Or does he want to argue that more wind farms will reduce gasoline prices in the Midwest?

Conclusion

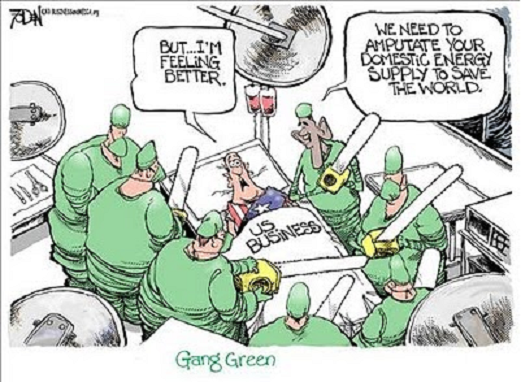

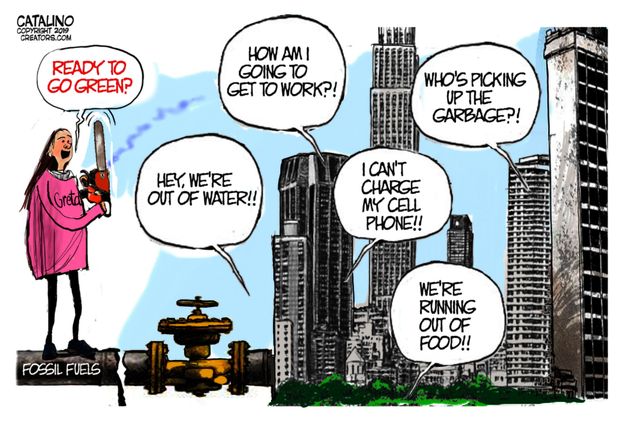

And so we arrive at the larger reality illustrated by the Leonard column. Misguided, illogical, and at odds with the facts, it is of a piece with the broad opposition of the environmental left to energy infrastructure generally, and pipeline investments in particular. Utter incoherence is the inevitable result of that ideological opposition to fossil fuels, one impervious to facts and analytic rigor, and dependent upon arguments fundamentally inconsistent. That opposition is anti-human at its core because it implies opposition to investment in human capital — education, training, health care, etc. — and the improved human well being that has the effect of increasing the demand for energy and its infrastructure. Forget the Kochs; they are a bogeyman and red herring the mere mention of which is intended to elicit a Pavlovian reaction from the enlightened invitees to the right cocktail parties.

The real bogeymen are the New York Times opinion editors who found such drivel fit to print, a measure of the intellectual depths to which they have sunk.

Background from Reed Smith lawyers

Background from Reed Smith lawyers

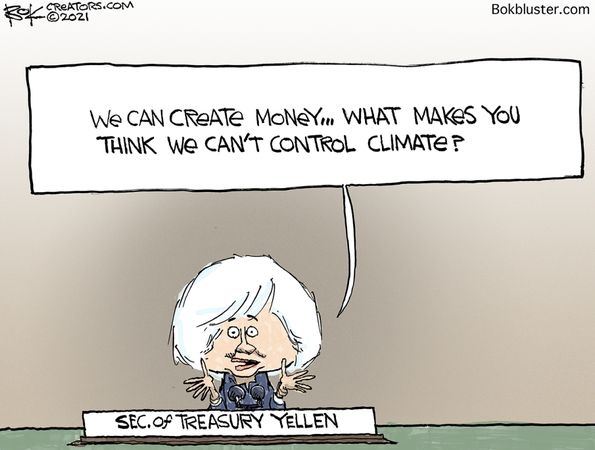

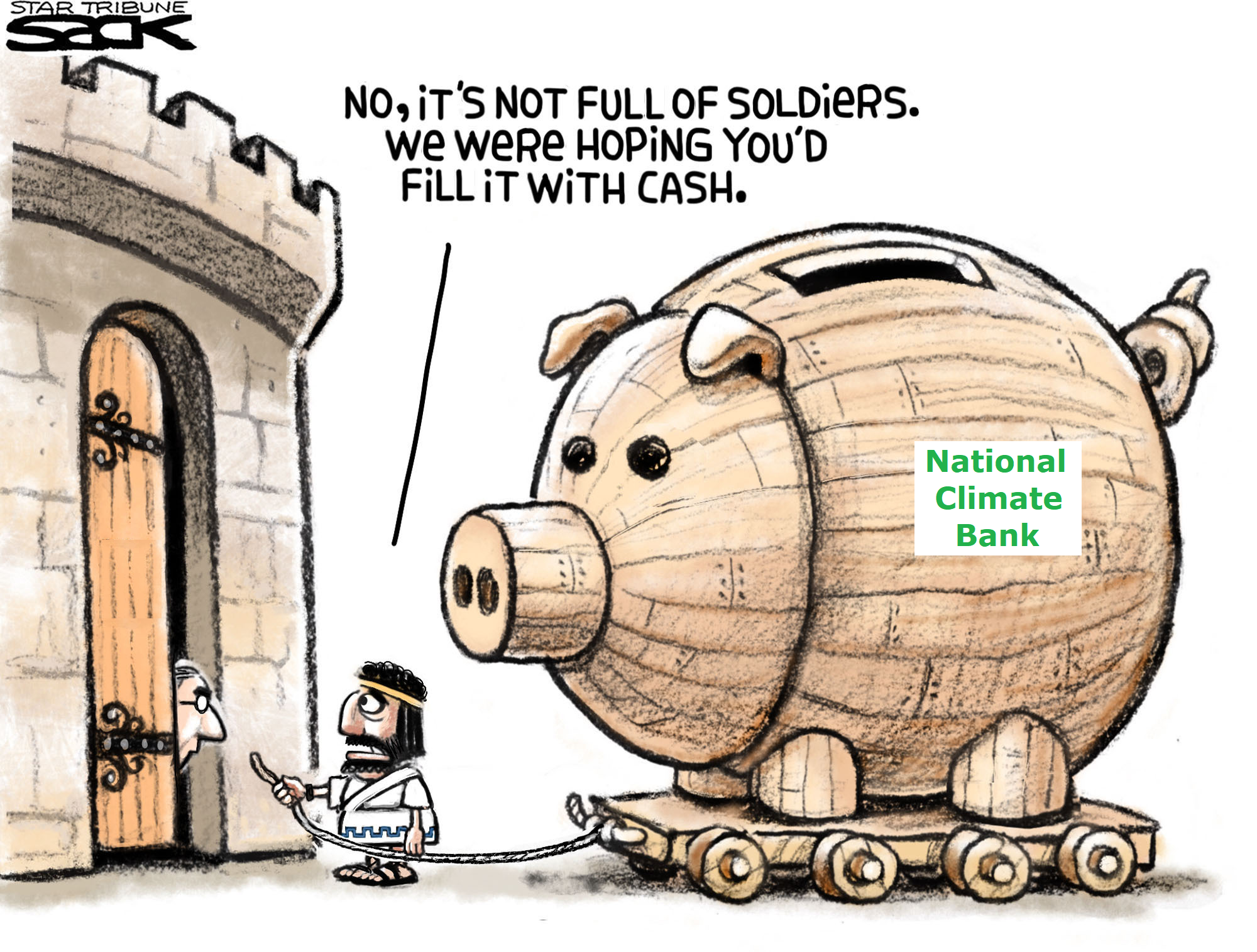

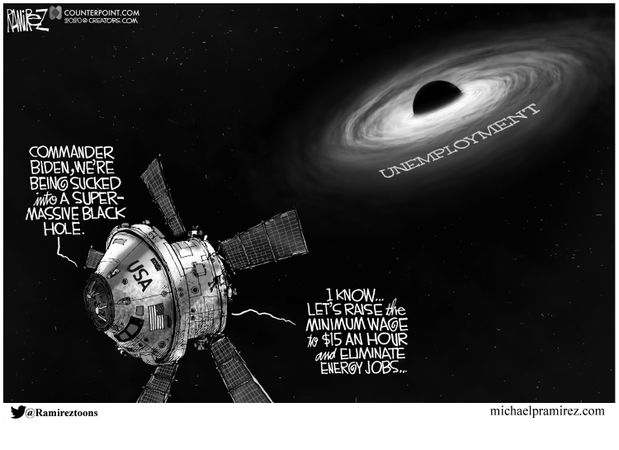

Supposedly the assault on fossil fuels — via regulation; cancellation of pipelines; concocting a huge, wholly imaginary “social cost of carbon”; taxes; and solar and wind mandates — is necessary to save the planet from imminent catastrophe produced by man-made global warming.

Supposedly the assault on fossil fuels — via regulation; cancellation of pipelines; concocting a huge, wholly imaginary “social cost of carbon”; taxes; and solar and wind mandates — is necessary to save the planet from imminent catastrophe produced by man-made global warming.