Cyril Widdershoven writes at Oil PriceThe Dutch Government Is Gambling Billions On Green Hydrogen. Excerpts in italics with my bolds.

- Green hydrogen is making headlines around the world as many consider it a cornerstone of a successful energy transition

- The Netherlands is ready to spend billions in its attempt to become a global green hydrogen hub, but some observers are becoming increasingly skeptical

- The economic viability of this new investment is unclear and a growing number of critics see these investments as the government gambling with billions of euros

The future of green hydrogen looks very bright, with the renewable energy source becoming something of a media darling in recent months. The global drive to invest in green or blue hydrogen is picking up steam and investment levels are staggering. Realism and economics, however, seem to be lacking when it comes to planning new green hydrogen projects in NW Europe, the USA, and Australia.

At the same time, blue hydrogen, potentially an important bridge fuel, is being largely overlooked. The Netherlands, formerly a leading natural gas producer and NW-European gas trade and transportation hub, is attempting to establish itself as a main pillar of the European hydrogen economy. According to the Dutch government, the Netherlands is ready to provide whatever is needed to support the set-up of a new green hydrogen hub and transportation network. During the presentation of the 2021-2022 government plans in September (Prinsjesdag), Dutch PM Mark Rutte committed himself to this green hydrogen future.

Without any real assessments of the risks and potential economic threats, plans are being discussed and implemented for a multibillion spending spree on green hydrogen, involving not only the refurbishment of the Dutch natural gas pipeline infrastructure but also the building of major new offshore wind parks, targeting the construction of hundreds of additional windmills. These wind parks are going to be set up and owned by international consortia, such as the NorthH2, involving Royal Dutch Shell, Gasunie (owned by the government), and others.

The optimism about these projects is now being questioned, not only by skeptics but increasingly by parties, such as Gasunie, that are part of the deals.

Dutch public broadcaster NOS reported yesterday that questions are popping up about the feasibility and commercial aspects of these large-scale plans as well as the potential risks of a new “cartel” of offshore wind producers. The multibillion-dollar investment plans, supported by the government, are even being questioned by experts of the Dutch ministry of economy, as it is not clear at all if green hydrogen production in the Netherlands, such as the NorthH2 project in Groningen (formerly known as the Dutch natural gas province), will ever be feasible or take-off.

The commercial viability of green hydrogen is a major issue as it still needs large-scale technical innovation and scaling up of electrolyzers. At the same time, there is uncertainty over demand as industry (the main client) does not appear to be interested at present. Dutch parties are also asking themselves if the current set up of the planned offshore wind parks are not a precursor to a new wind-energy cartel in the making. Some Dutch political parties and even insiders from Gasunie are worried about a monopoly position of the likes of Shell in the future.

The increased criticism by some, such as Gasunie and political parties, with regards to the power position of commercial parties, is also very strange. Some could argue that the current hydrogen strategy of Shell and others is what society and Dutch judges have forced them to do. Shell could and should argue a very simple position “we are doing what the Dutch legal system is forcing us to do”. For parties such as Shell, at least in the Netherlands or the EU, taking up green hydrogen strategies is a new License to Operate. International energy giants such as Shell do not want to be minor players in this market. For an international player, a pivotal position in any market is a must.

In the coming weeks, especially after COP26, as criticism is now being muted by most, a potential storm could be brewing.

If assessments are pointing out that the risks being taken by the Dutch government are too high in light of the benefits, and potential higher bills for customers, potential opposition to green hydrogen plans could be growing. At the same time, the Dutch hydrogen plans are seen by most as pivotal, even in light of the EU Commission’s Green Deal plans. A full-scale backlash to hydrogen could be a reality if Dutch political parties are going to constrain implementation, while other European countries will be more skeptical about their own plans. Billions, or potentially trillions, of euros will be at risk if this new hydrogen infrastructure turns out not to be economically viable. Without the power and technology of existing energy players, especially Shell, Total, BP, or ENI, behind the set-up, the future of this new power source will remain uncertain.

Comment on Hydrogen Fundamentals

What’s Not to Love About Green Hydrogen Energy? Let us count the ways.

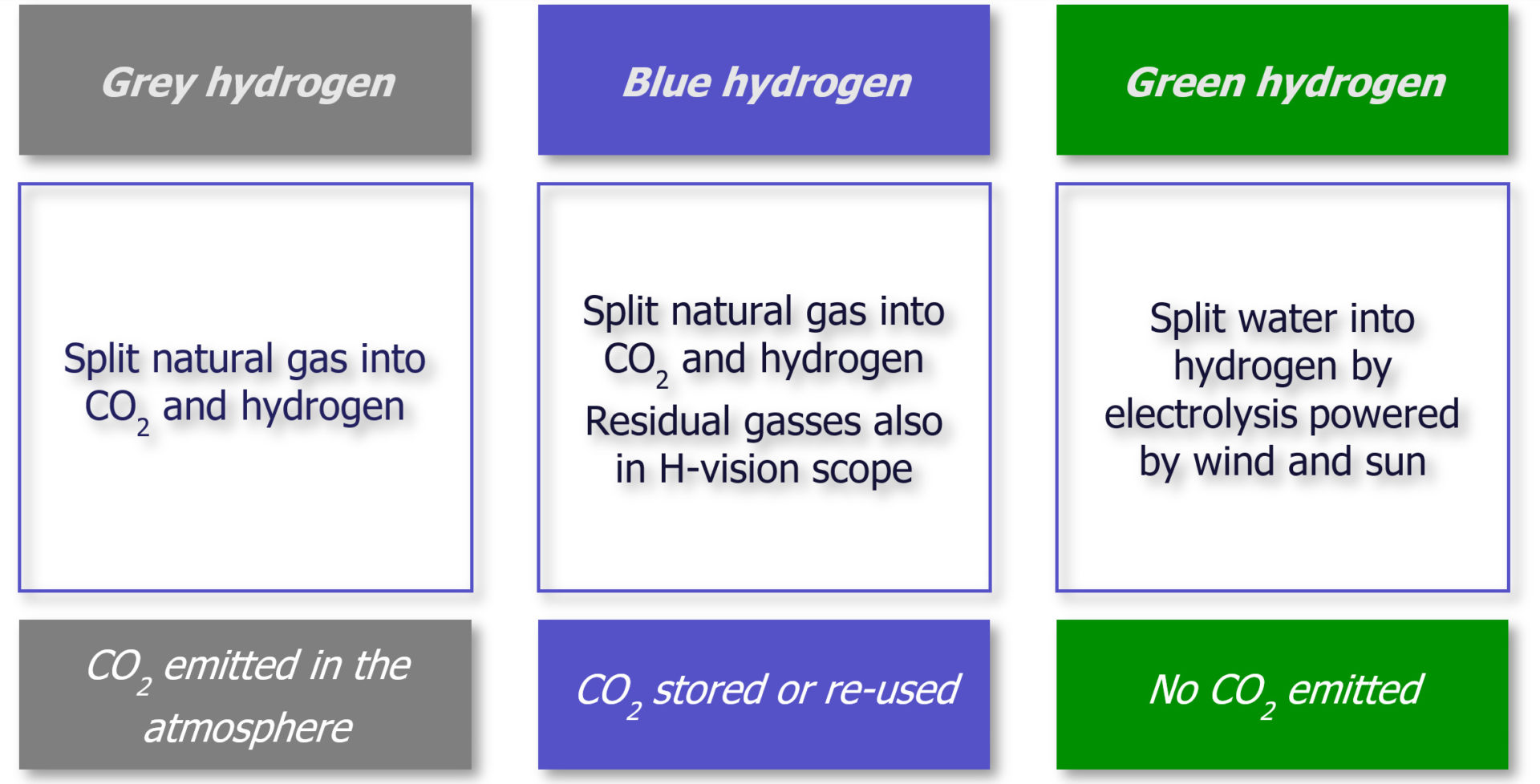

The only cost-efficient way to produce H2 presently is electrolysis of H2O, powered by natural gas. This is called grey hydrogen. Objections: Burning the CH4 to generate the electricity gives off CO2, albeit less emissions than coal would. But because of energy losses in the process, the resulting H2 put into fuel cells delivers less energy than the CH4 that was burned. Better to run the cars using CH4 as fuel directly.

To lower the carbon footprint, some propose blue hydrogen, defined as H2 produced with fossil fuels, but including carbon capture to use or bury the CO2 emitted. Objections: Carbon Capture has not yet been scaled to be commercially viable, and in any case increases the cost of the resulting H2. And it is still less energy output than was input.

The latest dream is green hydrogen, which is H2 produced by electrolysis powered by wind or solar farms. Some proposed that this is a clean way to store intermittent renewable energy for use on demand. Objections: Wind and solar power is not clean or cheap, but involves high tech machinery requiring the extraction, transportation and refining of rare metals. Extensive tracts of land must be allocated to these installations, or else locating them offshore. Transmission lines must be built and maintained, and the panels or windmills depreciate rapidly. As well, the highly flammable H2 must be transported and stored prior to making fuel cells.

And the elephant in the room: Water is a precious resource.

One industry source told Oilprice that the production of one ton of hydrogen through electrolysis required an average of nine tons of water. But to get these nine tons of water, it would not be enough to just divert a nearby river. The water that the electrolyzer breaks down into constituent elements needs to be purified

The process of water purification, for its part, is rather wasteful. According to the same source, water treatment systems typically require some two tons of impure water to produce one ton of purified water. In other words, one ton of hydrogen actually needs not nine but 18 tons of water.

Accounting for losses, the ratio is closer to 20 tons of water for every 1 ton of hydrogen.

Speaking of water purification, organic chemists explain that the simplest way to do this is by distilling it. This method is cheap because it only needs electricity, but it is not fast. Regarding the electricity cost, distilling a liter of water requires 2.58 megajoules of energy, which translates into 0.717 kWh, on average.

So, providing the right kind of water for hydrolysis costs money, and while $2,400 per ton of hydrogen may not sound like much, the cost of purifying water is not the only water-related expense in the technology that seeks to make hydrogen from renewable sources. Besides being pure, the water to be fed into an electrolyzer has to be transported to it.

Transporting tons upon tons of water to the site of an electrolyzer means more expenses for the logistics. To cut these, it would make sense to pick a site where water is abundant, such as by a river or the sea, or, alternatively, close to a water treatment facility. This puts a limit on the choice of locations suitable for large-scale electrolyzers. But since an electrolyzer, to be green, needs to be powered by renewable energy, it would also need to be in proximity to a solar or a wind farm. These, as we know, cannot be built just anywhere; solar farms are most cost-effective in places with a lot of sunshine, and wind farms perform best in places where there is sufficient wind.

Not all costs associated with the production of hydrogen from renewable energy sources are the costs of those renewable energy sources. Water is the commodity that the process needs, and it is a little odd that nobody seems willing to discuss the costs of water, including the European Commission’s Green Deal Team.

Summary: We now know it was a big mistake to divert corn from food production into biofuel. Will we make an even worse mistake converting drinking water into hydrogen fuel?

Best title I have seen in a long time. Thanks for the laugh.

LikeLike