Jamie Sarkonak summarizes the bogus start to Canada Federal elections in his National Post article Liberals pledge to make Canada a superpower after years of preventing it. Excerpts in italics with my bolds and added images.

A tattered Canadian flag is shown on top of a building in downtown Calgary on Friday, Jan. 17, 2025 where the U.S. Consulate is located. Photo by Jim Wells/Postmedia

Sunday’s edition of the Financial Times included the oft-made observation that Canada is brimming with potential, and the oft-made conclusion that this country would be much better off if it simply developed its God-given gifts.

The article, Unlocking Canada’s Superpower Potential by Tej Parikh, made the bullish case for this country’s future prospects: Canada is geographically huge and loaded with natural resources — on paper, at least, it has the makings of an actual global superpower.

“‘Canada absolutely has potential to be a global superpower,’ but the nation has lacked the visionary leadership and policy framework to capitalise on its advantages.”

It was, with gentle vagueness, a condemnation of the federal Liberal government and what is now being called Canada’s “lost decade”: a period of 10 years in which the current government ratcheted up onerous environmental and Indigenous-consultation requirements and, where ministerial approvals are concerned, delayed decisions, all geared at keeping undeveloped parts of Canada in their natural state.

Terms like “circular economy” and “just transition” are the Liberal synonyms for this no-growth agenda, which has delivered us a fraction of a percentage of GDP growth per capita from 2014 to the end of 2024 — a time period in which peer countries have managed double-digits.

For anyone who missed out on all the bad governance robbing Canadians of superpower prosperity, this brief video exposes the crimes against the citizenry. For those who prefer reading, I provide below a transcript from the closed captions.

Transcript

This is Alberta the fourth largest Province and home to about 4.6 million people. It ranks third in GDP just behind Quebec and first in GDP per capita primarily off the back of oil and gas extraction. While its discovery in the first half of the 20th century has brought Canada riches, for reasons from political to economic it never reached its full potential as an energy superpower, and Canadians as a whole lose out. We’ll be diving into how its energy policies have evolved and the path it is on whether for natural gas, nuclear, hydrogen and more.

Canada has the third largest proven oil reserves and by most estimates in the top 20 in terms of natural gas reserves. It is a top 10 producer of oil and gas, meaning it is engaged in extracting processing and supplying of these resources for domestic production.

Natural Gas

For natural gas exports it is in the top six, all of which goes to the US via pipelines. To export across water requires Investments to build liquid natural gas or LNG facilities to cool the gas into a liquid state in a process called liquefaction. In 2024 the the first export terminal will finally be completed in Kitimat BC called LNG Canada with gas coming through the coastal gas tank pipeline set to complete after 5 years of construction and a price tag that jumped from 6.6 billion to 14.5 billion.

But don’t expect other facilities to be constructed anytime soon. On February 9th 2022, 2 weeks before the Russian invasion of Ukraine, the federal and Quebec governments rejected approval of an LNG plant in Saguenay that would have allowed for the export of Western Natural Gas to European markets.

They cited increased greenhouse gas emissions

and lack of social responsibility.

While most of the natural gas is located in Northern Alberta and BC in the Montney formation, there is also gas in the Atlantic provinces. However New Brunswick, Newfoundland and Labrador, and Nova Scotia have all banned the process of fracking used for shale gas development over safety fears, thereby losing out on tens of billions of economic potential. Ironically the same provinces import a lot of natural gas extracted from the US through the process of fracking, Quebec also has natural gas resources but in April 2022 banned all oil and gas extraction in the province.

This means not only are pipelines from western Canada rejected from going through Quebec, natural gas extraction and export facilities in these provinces have been rejected as well. The demand if not met by Canada will be filled by other countries that might not share the same values nor care about the environment, with the jobs, millions in royalties and taxes going elsewhere. Since 2011, of the 18 proposed LG export projects including five on the East Coast. only the Kitimat project has proceeded with the others being cancelled, blocked or abandoned.

While the US in the same time frame has built seven LG facilities, five more under construction and approved 15, enabling them to go from a net importer to a top three exporter in the world. Australia has 10 LG facilities with the majority built in the 2010s helping to satisfy energy demand from Asian countries and to help them move away from coal. Qatar too has benefited greatly from extracting its resources as European countries look for alternatives to Russian gas.

These three countries have all signed decades-long deals to supply natural gas. Yet when Japan, South Korea, and Germany showed interest in Canadian LG, the Prime Minister said, “There has never been a strong business case.” While critics point out that natural gas is a fossil fuel contributing to greenhouse gas emissions, it emits 40% less than coal and 30% less than oil.

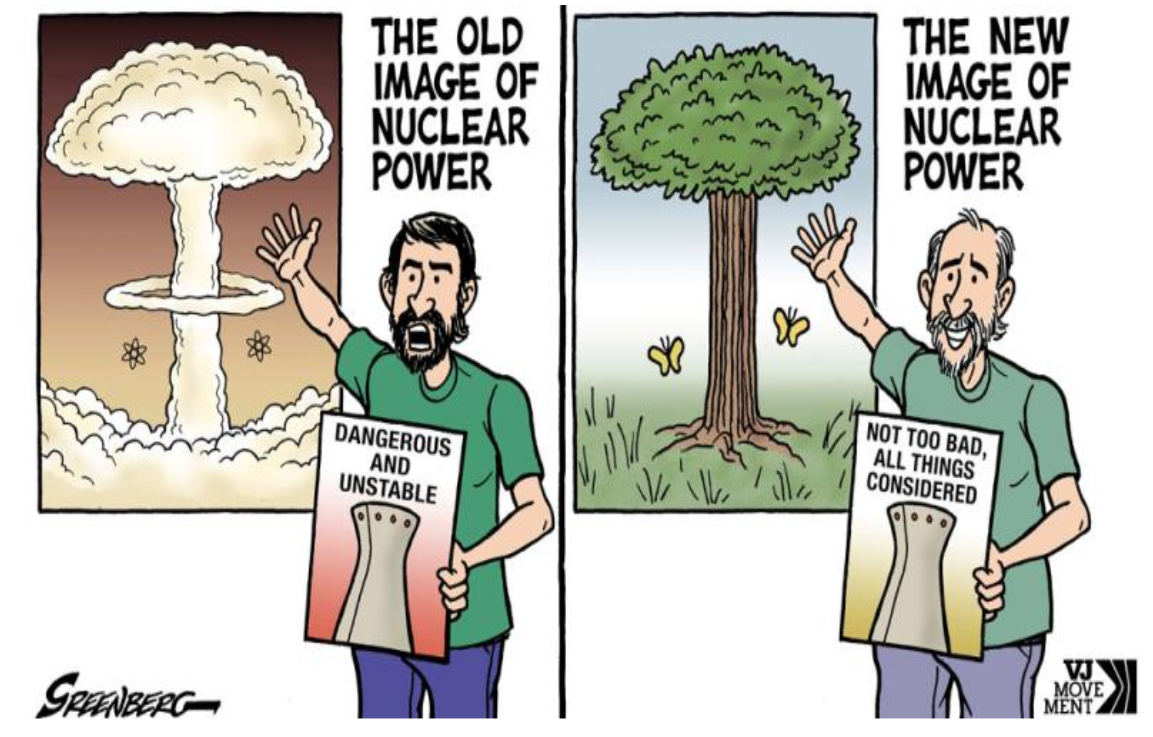

Nuclear Energy

We can’t talk about energy policy without mentioning nuclear, because it does not emit greenhouse gases while being a reliable source of energy, not dependent on the wind blowing or the sun shining. Currently nuclear supplies 58% of Ontario’s electricity needs and 15% Nationwide with all but one of the 19 nuclear reactors. The one located outside of Ontario is in New Brunswick. No new reactors have been completed since 1993. Meanwhile coal is still used to generate 6% of Canada’s electricity needs despite the country having the third largest uranium reserves, the fuel needed for reactors.

But on September 19th 2023, Canada did reach a $3 billion deal to finance nuclear power . . .in Romania. In fairness this deal does support the export of made in Canada Candu style reactors. An industry in which historically Canada has been a leader. Any discussion should include nuclear, as one of the trends in the nuclear industry is small modular reactors or SMRs which should be easier to manufacture and transport enabling its use in remote regions.

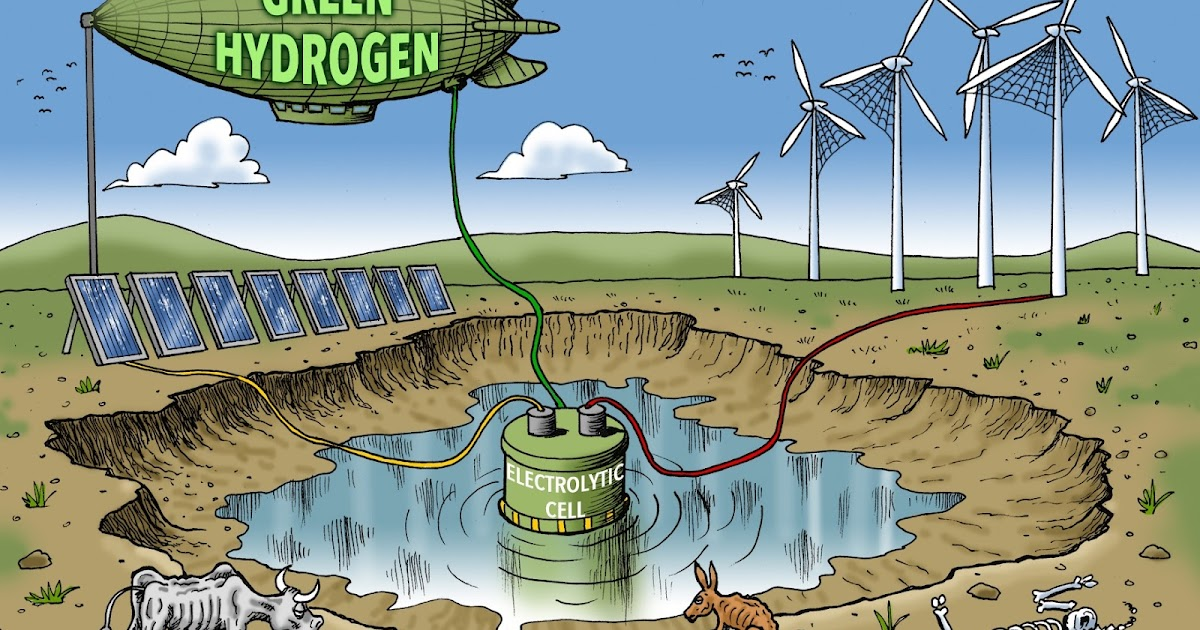

Hydrogen

Another Trend that the federal government has prioritized in the 2023 budget relates to hydrogen. 16.4 billion has been allocated over 5 years for “clean” Technologies and “clean” hydrogen tax credits, which are subsidies for costs in setting up equipment to produce green hydrogen. When the German Chancellor Olaf Schultz arrived in Canada in August 2022 asking for LNG, Canada instead offered green hydrogen created by wind turbines generating electricity to perform electrolysis by splitting water to produce hydrogen. It is both inefficient and expensive to produce green hydrogen meaning there is little business case for it without subsidies, since more than 99% of hydrogen is currently produced using fossil fuel. While green hydrogen will likely play a role in industrial processes, such as replacing coal used in steel production or creating ammonia in fertilizer production, its role in transportation is likely negligible. Furthermore using hydroelectricity, nuclear or natural gas to create hydrogen plays into Canada’s strengths in a way that solar or wind does not, as we’ll see shortly.

Solar and Wind

A big part of Canada’s net zero emissions by 2050 plan involves solar and wind energy, yet one of the biggest beneficiaries of that shift would be China given its dominance in the Clean Energy Solution space, whether solar panels, wind turbines or EVS. From the mineral extraction to the processing, refining and Manufacturing, there is much demand for critical minerals like copper cobalt nickel lithium and Rare Earth elements chromium zinc and aluminum. China owns stakes in many mines around the world including Canadian ones extracting these minerals to control the supply chain. According to 2022 data from the International Energy Agency, their share of refining is 35% for nickel, 60% for lithium, 70% for Cobalt and a whopping 90% for Rare Earth.

This dependence on one country means the power to squeeze Supply or raise prices at any moment, which is a big reason why on August 16th 2022 the Biden Administration signed the ironically named Inflation Reduction Act which provides 369 billion of funding for clean energy projects. The intention is to not only reshore to the US but also Near shore or Friend shore to allies like Canada, Whether in mining of critical minerals to manufacturing.

Canada acted decisively a few months later in the same year to force

three Chinese companies to sell their stakes in Canadian mining companies

. . . Oh wait just kidding.

In all seriousness the country and especially Quebec can play a role in the supply chain so long as projects can be approved in a timely manner which really is the underlying theme of this video. Having these minerals also incentivizes battery and auto manufacturing companies to invest in factories, helped massively by subsidies of course. 13 billion over 10 years is what took Volkswagen to commit to a battery plant in Southern Ontario. Likewise 15 billion in subsidies was committed for a Stellantis LG battery plant in Windsor and other projects like this. That’s a lot of money with these two subsidy awards not expected to break even for 20 years according to the Parliamentary budget office. And that’s if these Legacy auto companies like Stellantis and Volkswagen will be relevant by that time.

That’s the kind of energy policy decisions made in Canada in recent times,

and why we haven’t leveraged our natural resources into Superpower.

Mark Carney’s Climate Obsession Worse than Trudeau’s

The future of Canada’s badly governed energy sector is further threatened by replacing Trudeau with Carney. Terry Newman explains in his National Post article Mark Carney’s climate obsessions will put Trudeau to shame. Excerpts in italics with my bolds and added images.

Don’t trust his pledge to turn Canada into an energy superpower

The Liberal party may have a new face, but Carney’s insistence on keeping an emissions cap and industrial carbon tax in place — both products of Justin Trudeau’s Liberal government — doesn’t invoke much confidence in his energy superpower plan.

The Liberal party may have a new face, but Carney’s insistence on keeping an emissions cap and industrial carbon tax in place — both products of Justin Trudeau’s Liberal government — doesn’t invoke much confidence in his energy superpower plan.

Since the Liberals came to power in 2015, they implemented the Impact Assessment Act, which slowed approvals, the federal industrial carbon pricing system (2018) and the oil and gas emissions cap (slated for 2026) — all with the goal of reducing greenhouse gas emissions from the oil and gas sector to net zero by 2050.

Since 2015, many projects have been stalled or cancelled, including the Northern Gateway Pipeline (cancelled by government in 2016, citing a federal ban on tanker traffic and Indigenous opposition); the Energy East Pipeline (cancelled by the company in 2017, citing regulatory hurdles and low oil prices); Pacific NorthWest LNG (cancelled in 2017 due to market conditions and regulatory delays); the MacKenzie Valley Pipeline (cancelled in 2017 due to low gas prices and regulatory uncertainty); Énergie Saguenay LNG (cancelled in 2021, rejected by Quebec government over emissions concerns, not challenged by the federal government); Bay du Nord Offshore Oil (shelved in 2022, citing high costs and regulatory uncertainty); Teck Frontier Mine (cancelled in 2020, amid climate policy debates); and the Keystone XL Pipeline (cancelled 2021, due to failure to secure a U.S. permit and Canadian regulatory costs).

The only thing that’s changed about the Liberal party is the addition of Carney, and his record suggests that he will be driven by climate policy, at least as much as the Liberals have been, and potentially much more so. He was, not so long ago, the United Nations’ special envoy on climate action and finance and he founded and co-chaired the Glasgow Financial Alliance for Net Zero (GFANZ), resigning on Jan. 15, the day before he threw his hat into the Liberal leadership race.

Where’s the evidence Carney will be less stringent on energy projects and, therefore, better for the Canadian economy than his predecessor? If anything, especially given his longstanding ESG obsessions, all evidence appears to point to the contrary — that Mark Carney could be even more dedicated to strangling Canada’s resource economy than Trudeau.

2 comments