Why the US letter re. Paris Accord

August 5, 2017 Update to Climate Law post

Media are reporting on the State Department letter informing the UN that the US will be withdrawing from the Paris Accord. Some climatists are encouraged that the three-year waiting period is acknowledged and that the next president could return to the fold. Others are disappointed that the Trump administration is not more assertive against both the accord and the United Nations Framework Convention on Climate Change (UNFCCC) itself.

Everyone should breathe through the nose and recognize the game and the stakes. Paris agreement is not binding and is without penalties (except for blame and shame). So following the protocol costs the US nothing, and does provide some opportunities. As the world’s leader in actually reducing CO2 emissions, the US wants and needs to be at the table to convince others to follow the US example. There is also 1 billion US$ from Obama put into the green fund that could be disbursed in accordance with US current priorities regarding energy and climate.

But the most important reason for this letter is to document that the Paris accord does not have legal authority for and within the United States. Putting the US intent in writing is necessary to deter legal claims to hold the US accountable to Paris terms and conditions. The post below explains why Paris accord is so important to legal climate actions around the world.

On the same day POTUS announced US withdrawal from Paris accord, a majority of Exxon Mobil shareholders approved a resolution asking management to assess the value of corporate assets considering a global move toward a low-carbon future. Here is the resolution, filed by the New York State Comptroller:

RESOLVED: Shareholders request that, beginning in 2018, ExxonMobil publish an annual assessment of the long-term portfolio impacts of technological advances and global climate change policies, at reasonable cost and omitting proprietary information. The assessment can be incorporated into existing reporting and should analyze the impacts on ExxonMobil’s oil and gas reserves and resources under a scenario in which reduction in demand results from carbon restrictions and related rules or commitments adopted by governments consistent with the globally agreed upon 2 degree target. This reporting should assess the resilience of the company’s full portfolio of reserves and resources through 2040 and beyond, and address the financial risks associated with such a scenario.

Background:

This century climatists woke up to their losing the battle for public opinion for onerous and costly reductions to fossil fuel usage. They turned toward the legal system to achieve their agenda, and the field of Climate Law has become another profession corrupted by climate cash, along side of Climate Medicine.

In addition to numerous court lawsuits, and also civil disobedience cases, there has been a concerted, well-funded and organized divestment move against companies supplying fossil fuels to consumers. The intention is to at least tie up in red tape Big Oil, indeed Small Oil as well. The real hope is to weaken energy producers by depriving them of investors to the point that reserves are left in the ground, as desired by such activists as 350.org.

In 2016 virtually the same resolution was dismissed by shareholders with only 38% approving. The difference this year was the switch by BlackRock Inc. and Vanguard Group, two of the world’s largest asset managers. As reported by Fox News (here):

Investment products such as exchange-traded funds that track the performance of indexes often come at a lower cost than traditional mutual funds and have gathered assets at a clip in recent years. That growth has given firms like BlackRock and Vanguard increasing sway on shareholder votes. But the firms in turn have come under activist pressure to take stances on issues such as climate disclosure.

When BlackRock sided with Exxon and against a similar proposal at the company’s annual meeting a year ago, it faced backlash from investors and environmental activists. This year BlackRock said the disclosure of climate risks would be among its key engagement priorities with senior executives.

Exxon Mobil board must now show they are taking this proposal seriously, and activists will be looking for company assets to be “stress tested” with the hope that the shares become more risky. At the very least, management will have to put more time and energy into opining on various scenarios of uncertain content and probabilities relating to the wish dreams of climatists.

Balancing on a cascade of suppositions.

We can look into the climate activist mental frame thanks to documents supporting the current strategy using the legal system to implement actions against fossil fuel consumption.

For example, there is this recent text explaining the shareholder proposal tabled at ExxonMobil annual meeting. From Attorney Sanford Lewis:

The Proposal states:

“RESOLVED: Shareholders request that by 2017 ExxonMobil publish an annual assessment of long term portfolio impacts of public climate change policies, at reasonable cost and omitting proprietary information. The assessment can be incorporated into existing reporting and should analyze the impacts on ExxonMobil’s oil and gas reserves and resources under a scenario in which reduction in demand results from carbon restrictions and related rules or commitments adopted by governments consistent with the globally agreed upon 2 degree target. The reporting should assess the resilience of the company’s full portfolio of reserves and resources through 2040 and beyond and address the financial risks associated with such a scenario.

Now let’s unbundle the chain of suppositions that comprise this proposal.

- Supposition 1: A 2C global warming target is internationally agreed.

- Supposition 2: Carbon Restrictions are enacted by governments to comply with the target.

- Supposition 3: Demand for oil and gas products is reduced due to restrictions

- Supposition 4: Oil and gas assets become uneconomic for lack of demand.

- Supposition 5: Company net worth declines by depressed assets and investors lose value.

1.Suppose an International Agreement to limit global warming to 2C.

From the supporting statement to the above proposal, Sanford Lewis provides these assertions:

Recognizing the severe and pervasive economic and societal risks associated with a warming climate, global governments have agreed that increases in global temperature should be held below 2 degrees Celsius from pre-industrial levels (Cancun Agreement).

Failing to meet the 2 degree goal means, according to scientists, that the world will face massive coastal flooding, increasingly severe weather events, and deepening climate disruption. It will impose billions of dollars in damage on the global economy, and generate an increasing number of climate refugees worldwide.

Climate change and the risks it is generating for companies have become major concerns for investors. These concerns have been magnified by the 21st Session of the Conference of the Parties (COP 21) in Paris, where 195 global governments agreed to restrict greenhouse gas (GHG) emissions to no more than 2 degrees Celsius from pre-industrial levels and submitted plans to begin achieving the necessary GHG emission reductions. In the agreement, signatories also acknowledged the need to strive to keep global warming to 1.5 degrees, recognizing current and projected harms to low lying islands.

Yet a careful reading of UN agreements shows commitment is exaggerated:

David Campbell (here):

Neither 2°C nor any other specific target has ever been agreed at the UN climate change negotiations.

Article 2 of the Paris Agreement in fact provides only that it ‘aims to strengthen the global response to the threat of climate change … including by the holding the increase to well below 2°C’. This is an expression, not of setting a concrete limit, but merely of an aspiration to set such a limit. It is true that Article 2 is expressed in a deplorably equivocatory and convoluted language which fails to convey this vital point, indeed it obscures it. But nevertheless that is what Article 2 means.

Dieter Helm (here):

Nothing of substance has been achieved in the last quarter of a century despite all the efforts and political capital that has been applied. The Paris Agreement follows on from Kyoto. The pledges – in the unlikely event they are met – will not meet the 2C target, shipping and aviation are excluded, and the key developing countries (China and India) are not committed to capping their emission for at least another decade and a half (or longer in India’s case)

None of the pledges is, in any event, legally binding. For this reason, the Paris Agreement can be regarded as the point at which the UN negotiating approach turned effectively away from a top down approach, and instead started to rely on a more country driven and hence bottom up one.

Paul Spedding:

The international community is unlikely to agree any time soon on a global mechanism for putting a price on carbon emissions.

2: Suppose Governments enact restrictions that limit use of fossil fuels.

Despite the wishful thinking in the first supposition, the activists proceed on the basis of aspirations and reporting accountability. Sanford Lewis:

Although the reduction goals are not set forth in an enforceable agreement, the parties put mechanisms in place for transparent reporting by countries and a ratcheting mechanism every five years to create accountability for achieving these goals. U.N. Secretary General Ban Ki-moon summarized the Paris Agreement as follows: “The once Unthinkable [global action on climate change] has become the Unstoppable.”

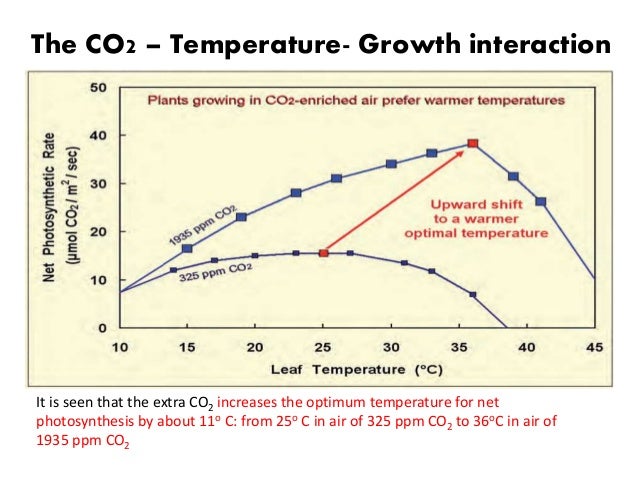

Now we come to an interesting bait and switch. Since Cancun, IPCC is asserting that global warming is capped at 2C by keeping CO2 concentration below 450 ppm. From Summary for Policymakers (SPM) AR5

Emissions scenarios leading to CO2-equivalent concentrations in 2100 of about 450 ppm or lower are likely to maintain warming below 2°C over the 21st century relative to pre-industrial levels. These scenarios are characterized by 40 to 70% global anthropogenic GHG emissions reductions by 2050 compared to 2010, and emissions levels near zero or below in 2100.

Thus is born the “450 Scenario” by which governments can be focused upon reducing emissions without any reference to temperature measurements, which are troublesome and inconvenient.

Sanford Lewis:

Within the international expert community, “2 degree” is generally used as shorthand for a low carbon scenario under which CO2 concentrations in the earth’s atmosphere are stabilized at a level of 450 parts per million (ppm) or lower, representing approximately an 80% reduction in greenhouse gas emissions from current levels, which according to certain computer simulations would be likely to limit warming to 2 degrees Celsius above pre-industrial levels and is considered by some to reduce the likelihood of significant adverse impacts based on analyses of historical climate variability. Company Letter, page 4.

Clever as it is to substitute a 450 ppm target for 2C, the mathematics are daunting. Joe Romm:

We’re at 30 billion tons of carbon dioxide emissions a year — rising 3.3% per year — and we have to average below 18 billion tons a year for the entire century if we’re going to stabilize at 450 ppm. We need to peak around 2015 to 2020 at the latest, then drop at least 60% by 2050 to 15 billion tons (4 billion tons of carbon), and then go to near zero net carbon emissions by 2100.

And the presumed climate sensitivity to CO2 is hypothetical and unsupported by observations:

3.Suppose that demand for oil and gas products is reduced by the high costs imposed on such fuels.

Sanford Lewis:

ExxonMobil recognized in its 2014 10-K that “a number of countries have adopted, or are considering adoption of, regulatory frameworks to reduce greenhouse gas emissions,” and that such policies, regulations, and actions could make its “products more expensive, lengthen project implementation timelines and reduce demand for hydrocarbons,” but ExxonMobil has not presented any analysis of how its portfolio performs under a 2 degree scenario.

Moreover, the Company’s current use of a carbon proxy price, which it asserts as its means of calculating climate policy impacts, merely amplifies and reflects its optimistic assessments of national and global climate policies. The Company Letter notes that ExxonMobil is setting an internal price as high as $80 per ton; in contrast, the 2014 Report notes a carbon price of $1000 per ton to achieve the 450 ppm (2 degree scenario) and the Company reportedly stated during the recent Paris climate talks that a 1.5 degree scenario would require a carbon price as high as $2000 per ton within the next hundred years.

Peter Trelenberg, manager of environmental policy and planning at Exxon Mobil reportedly told the Houston Chronicle editorial board: Trimming carbon emissions to the point that average temperatures would rise roughly 1.6 degrees Celsius – enabling the planet to avoid dangerous symptoms of carbon pollution – would bring costs up to $2,000 a ton of CO2. That translates to a $20 a gallon boost to pump prices by the end of this century… .

Even those who think emissions should be capped somehow see through the wishful thinking in these numbers. Dieter Helm:

The combination of the shale revolution and the ending of the commodity super cycle probably point to a period of low prices for sometime to come. This is unfortunate timing for current decarbonisation policies, many of which are predicated on precisely the opposite happening – high and rising prices, rendering current renewables economic. Low oil prices, cheap coal, and falling gas prices, and their impacts on driving down wholesale electricity prices, are the new baseline against which to consider policy interventions.

With existing technologies, it is a matter of political will, and the ability to bring the main polluters on board, as to whether the envelope will be breached. There are good reasons to doubt that any top down agreement will work sufficiently well to achieve it.

The end of fossil fuels is not about to happen anytime soon, and will not be caused by running out of any of them. There is more than enough to fry the planet several times over, and technological progress in the extraction of fossil fuels has recently been at least as fast as for renewables. We live in an age of fossil fuel abundance.

We also live in a world where fossil fuel prices have fallen, and where the common assumption that prices will bounce back, and that the cycle of fossil fuel prices will not only reassert itself but also continue on a rising trend, may be seriously misguided. It is plausible to at least argue that the oil price may never regain its peaks in 1979 and 2008 again.

A world with stable or falling fossil fuel prices turns the policy assumptions of the last decade or so on their heads. Instead of assuming that rising prices would ease the transition to low carbon alternatives, many of the existing technologies will probably need permanent subsidies. Once the full system costs are incorporated, current generation wind (especially offshore) and current generation solar may be out of the market except in special locations for the foreseeable future. In any event, neither can do much to address the sheer scale of global emissions.

Primary Energy Demand Projection

4.Suppose oil and gas reserves are stranded for lack of demand.

Sanford Lewis:

Achievement of even a 2 degree goal requires net zero global emissions to be attained by 2100. Achieving net zero emissions this century means that the vast majority of fossil fuel reserves cannot be burned. As noted by Mark Carney, the President of the Bank of England, the carbon budget associated with meeting the 2 degree goal will “render the vast majority of reserves ‘stranded’ – oil, gas, and coal that will be literally unburnable without expensive carbon capture technology, which itself alters fossil fuel economics.”

A concern expressed by some of our stakeholders is whether such a “low carbon scenario” could impact ExxonMobil’s reserves and operations – i.e., whether this would result in unburnable proved reserves of oil and natural gas.

Decisions to abandon reserves are not as simple or have the effects as desired by activists.

Financial Post (here):

The 450 Scenario is not the IEA’s central scenario. At this point, government policies to limit GHG emissions are not stringent enough to stimulate this level of change. However, for discussion purposes let’s use the IEA’s 450 Scenario to examine the question of stranded assets in crude oil investing. Would some oil reserves be “stranded” under the IEA’s scenario of demand reversal?

A considerable amount of new oil projects must be developed to offset the almost 80 per cent loss in legacy production by 2040. This continued need for new oil projects for the next few decades and beyond means that the majority of the value of oil reserves on the books of public companies must be realized, and will not be “stranded”.

While most of these reserves will be developed, could any portion be stranded in this scenario? The answer is surely “yes.” In any industry a subset of the inventory that is comprised of inferior products will be susceptible to being marginalized when there is declining demand for goods. In a 450 ppm world, inferior products in the oil business will be defined by higher cost and higher carbon intensity.

![]()

5.Suppose shareholders fear declining company net worth.

Now we come to the underlying rationale for this initiative.

Paul Spedding:

Commodity markets have repeatedly proved vulnerable to expectations that prices will fall. Given the political pressure to mitigate the impact of climate change, smart investors will be watching closely for indications of policies that will lead to a drop in demand and the possibility that their assets will become financially stranded.

Equity markets are famously irrational, and if energy company shareholders can be spooked into selling off, a death spiral can be instigated. So far though, investors are smarter than they are given credit.

Bloomberg:

Fossil-fuel divestment has been a popular issue in recent years among college students, who have protested at campuses around the country. Yet even with the movement spreading to more than 1,000 campuses, only a few dozen schools have placed some restrictions on their commitments to the energy sector. Cornell University, Massachusetts Institute of Technology and Harvard University are among the largest endowments to reject demands to divest.

Stanford Board of Trustees even said:

As trustees, we are convinced that the global community must develop effective alternatives to fossil fuels at sufficient scale, so that fossil fuels will not continue to be extracted and used at the present rate. Stanford is deeply engaged in finding alternatives through its research. However, despite the progress being made, at the present moment oil and gas remain integral components of the global economy, essential to the daily lives of billions of people in both developed and emerging economies. Moreover, some oil and gas companies are themselves working to advance alternative energy sources and develop other solutions to climate change. The complexity of this picture does not allow us to conclude that the conditions for divestment outlined in the Statement on Investment Responsibility have been met.

Update: Universities are not the exception in finding the alarmist case unconvincing, according to a survey:

Almost half of the world’s top 500 investors are failing to act on climate change — an increase of 6 percent from 236 in 2014, according to a report Monday by the Asset Owners Disclosure Project, which surveys global companies on their climate change risk and management.

The Abu Dhabi Investment Authority, Japan Post Insurance Co Ltd., Kuwait Investment Authority and China’s SAFE Investment Company, are the four biggest funds that scored zero in the survey. The 246 “laggards” identified as not acting hold $14 trillion in assets, the report said.

Summary

Alarmists have failed to achieve their goals through political persuasion and elections. So they are turning to legal and financial tactics. Their wishful thinking appears as an improbable chain of events built upon a Paris agreement without substance.

Last word to David Campbell:

International policy has so far been based on the premise that mitigation is the wisest course, but it is time for those committed to environmental intervention to abandon the idea of mitigation in favour of adaptation to climate change’s effects.

For more on adapting vs. mitigating, see Adapting Works, Mitigating Fails