McKitrick: New PM Carney Tried for Years to Defund Canada

Mark Carney, governor of the Bank of England (BOE), reacts during a news conference at the United Nations COP21 climate summit at Le Bourget in Paris, France, on Friday, Dec. 4, 2015. Photo by Chris Ratcliffe/Bloomberg

Ross McKitrick writes at National Post Carney to lead Canada after trying for years to defund it. Excerpts in italics with my bolds and added images.

The soon-to-be prime minister’s plan for net-zero banking

would have devastated the country

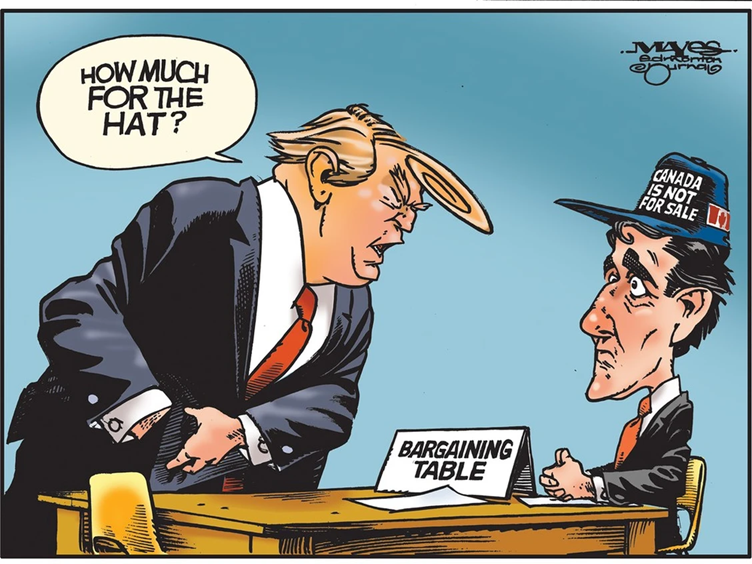

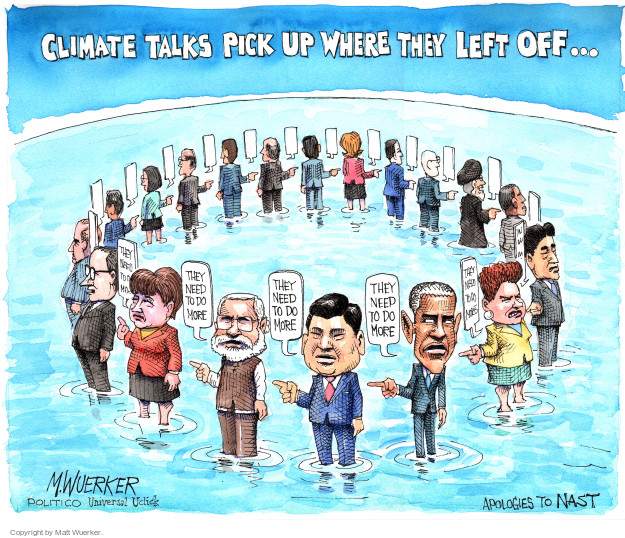

Conservative leader Pierre Poilievre is very concerned about financial conflicts of interest that new Liberal leader (and our next prime minister) Mark Carney may be hiding. But I’m far more concerned about the one out in the open: Carney is now supposed to act for the good of the country after lobbying to defund and drive out of existence Canada’s oil and gas companies, steel companies, car companies and any other sector dependent on fossil fuels. He’s done this through the Glasgow Financial Alliance for Net Zero (GFANZ), which he founded in 2021.

Carney is a climate zealot. He may try to fool Canadians into thinking he wants new pipelines, liquified natural gas (LNG) terminals and other hydrocarbon infrastructure, but he doesn’t. Far from it. He wants half the existing ones gone by 2030 and the rest soon after.

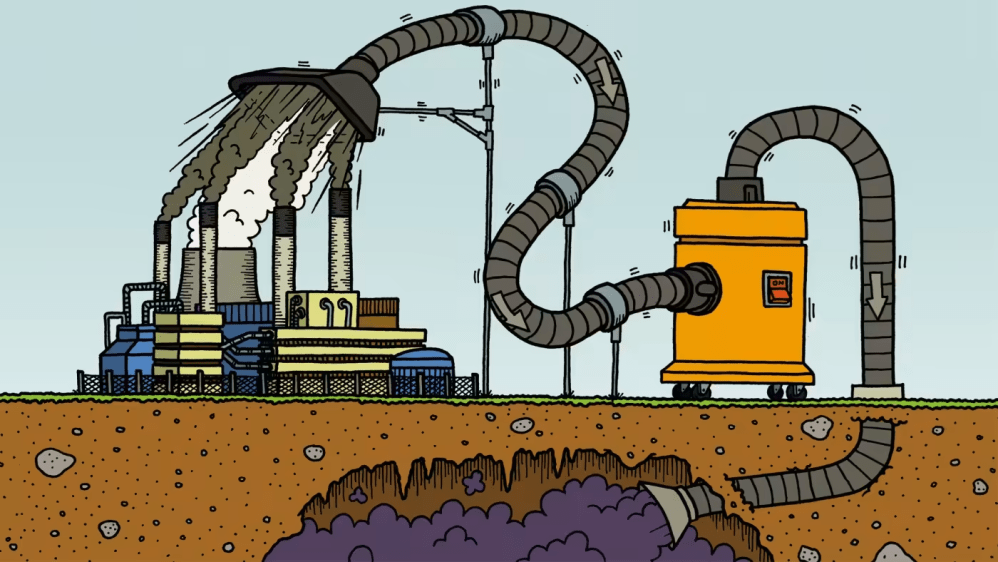

He has said so, repeatedly and emphatically. He believes that the world “must achieve about a 50 per cent reduction in emissions by 2030” and “rapidly scale climate solutions to provide cleaner, more affordable, and more reliable replacements for unabated fossil fuels.” (By “unabated” he means usage without full carbon capture, which in practice is virtually all cases.) And since societies don’t seem keen on doing this, Carney created GFANZ to pressure banks, insurance companies and investment firms to cut off financing for recalcitrant firms.

“This transition to net zero requires companies across the whole economy to change behaviors through application of innovative technologies and new ways of doing business” he wrote in 2022 with his GFANZ co-chairs, using bureaucratic euphemisms to make his radical agenda somehow seem normal.

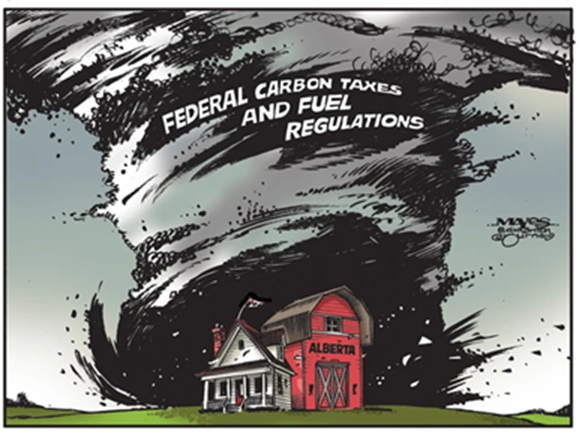

The GFANZ plan they articulated that year put companies into four categories. Those selling green technologies or engaged in work that displaces fossil fuels would be rewarded with financing from member institutions. Those still using fossil fuels, or have investments in others that do, but are committed to being “climate leaders” and have set a path to net-zero, would also still be eligible for financing, as would those that do business with “high-emitting firms” but plan to reach net-zero targets on approved timelines. Companies that own or invest in high-emitting assets, however, would operate under a “managed phaseout” regime and could even be cut off from investment capital.

What are “high-emitting assets”? Carney’s group hasn’t released a complete list, but a June 2022 report listed some examples: coal mines, fossil-fuel power stations, oil fields, gas pipelines, steel mills, ships, cement plants and consumer gasoline-powered vehicles. GFANZ envisions a future in which the finance sector either severs all connections to such assets or puts them under a “managed phaseout” regime, which means exactly what it sounds like.

So when Carney jokingly suggested it won’t matter if his climate plan drives up costs for steel mills because people don’t buy steel, he could have added that there likely won’t be any steel mills before long anyway. If his work as prime minister echoes his work as GFANZ chair, we can expect steel mills to be phased out, along with cars, gas-fired power plants, pipelines, oil wells and so forth.

Mark Carney, former Co-Chair of GFANZ, accompanied by (from left) Ravi Menon, Loh Boon Chye, and Yuki Yasui, at the Singapore Exchange, for the GFANZ announcement on the formation of its Asia-Pacific (APAC) Network.

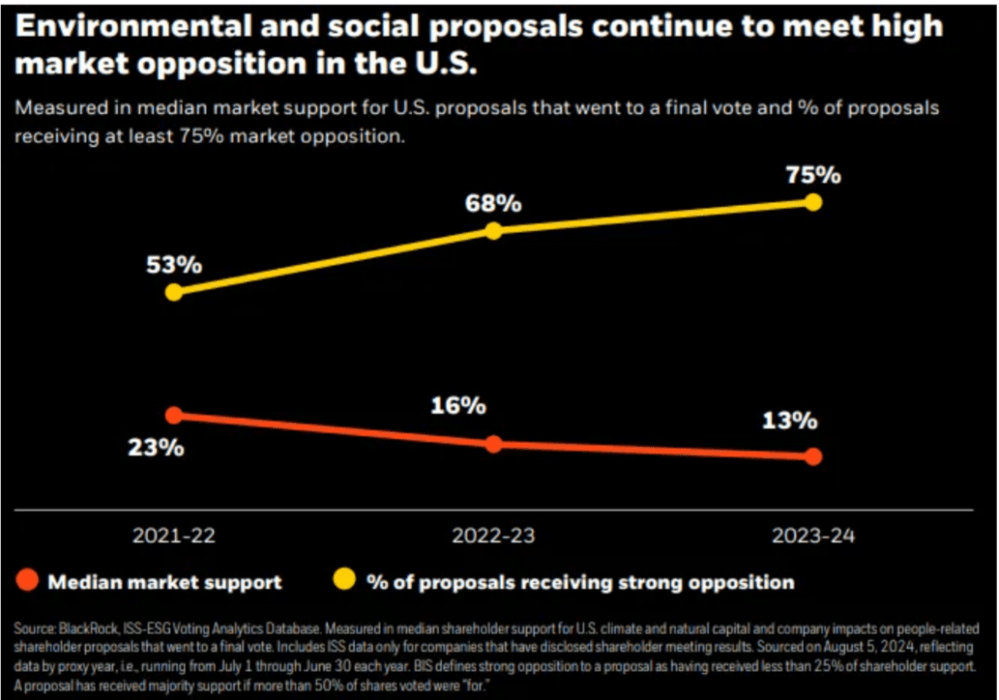

GFANZ boasts at length about its members strong-arming clients into embracing net-zero. For instance, it extols British insurance multinational Aviva for its climate engagement escalation program: “Aviva is prepared to send a message to all companies through voting actions when those companies do not have adequate climate plans or do not act quickly enough.”

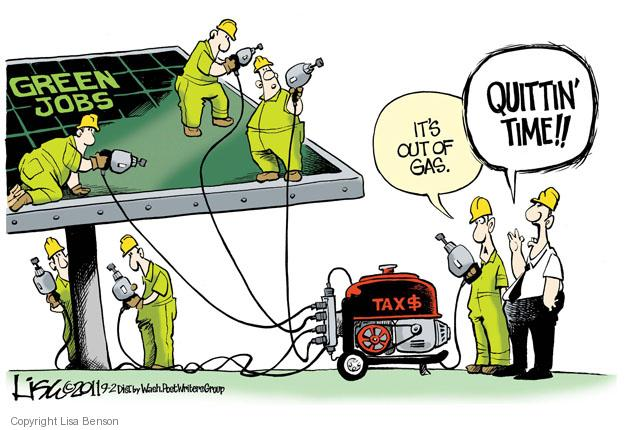

To support these coercive goals, Carney’s lobbying helped secure a requirement in Canada for banks, life insurance companies, trust and loan companies and others to develop and file reports disclosing their “climate transition risk,” set out by the federal Office of the Superintendent of Financial Institutions (OSFI).

The rule, Guideline B-15 on Climate Risk Management, was initially published in 2023 and requires federally regulated financial institutions (other than foreign bank branches) to conduct extensive and costly research into their holdings to determine whether value may be at risk from future climate policies. The vagueness and potential liabilities created by this menacing set of expectations could push Canada’s largest investment firms to eventually decide it’s easier to divest altogether from fossil fuel and heavy industry sectors, furthering Carney’s ultimate goal.

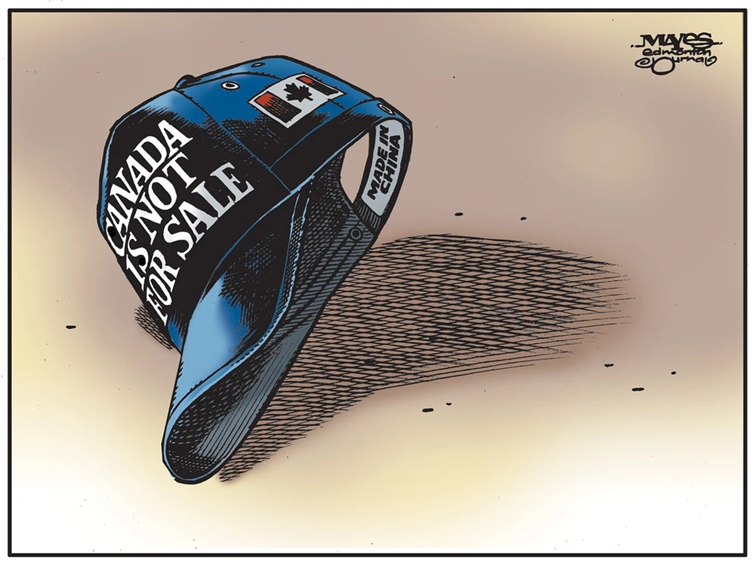

Yet Carney will become prime minister just when Canadians face a trade crisis that requires the construction of new coastal energy infrastructure to ensure our fossil fuel commodities can be exported without going through the United States. He has said he would take emergency measures to support “energy projects,” but I assume he means windmills and solar panels. He has not (to my knowledge) said he supports pipelines, LNG terminals, fracking wells or new refineries. Unless he disowns everything he has said for years, we must assume he doesn’t.

Canadian journalists should insist he clear this up. Ask Carney if he supports the repeal of OSFI’s Climate Risk Management guideline. Show Carney his GFANZ report. Ask him, “Do you still endorse the contents of this document?” If he says yes, ask him how we can build new pipelines and LNG terminals, expand our oil and gas sector, run our electricity grid using Canadian natural gas, heat our homes and put gasoline in our cars if banks are to phase out these activities.

If he tries to claim he no longer endorses it,

ask him when he changed his mind,

and why we should believe him now.

The media must not allow Carney to be evasive or ambiguous on these matters. We don’t have time for a bait-and-switch prime minister. If Carney still believes the rhetoric he published through GFANZ, he should say so openly, so Canadians can assess whether he really is the right man to address our current crisis.

Chris Morrison provides the analysis in his Daily Sceptic article

Chris Morrison provides the analysis in his Daily Sceptic article

Steve Goreham explains in his Heartland article

Steve Goreham explains in his Heartland article