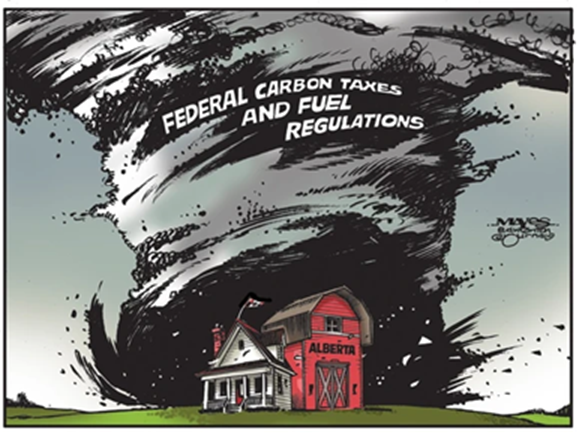

Had the Great Smith-Carney Pipelines and Climate Pact of 2025 emerged say, five years ago, it would have been considered squarely within the realm of Liberal environmentalism. Instead, because former prime minister Justin Trudeau brought in several anti-business policies, the current prime minister is being feted/scorned as being pro-energy industry by disappointed Liberals and relieved conservatives alike. While Mark Carney deserves credit for negotiating this deal with Alberta Premier Danielle Smith, and bringing a rival onside, we’re skeptical at the chances a pipeline ever gets built.

The $20 Trillion Question

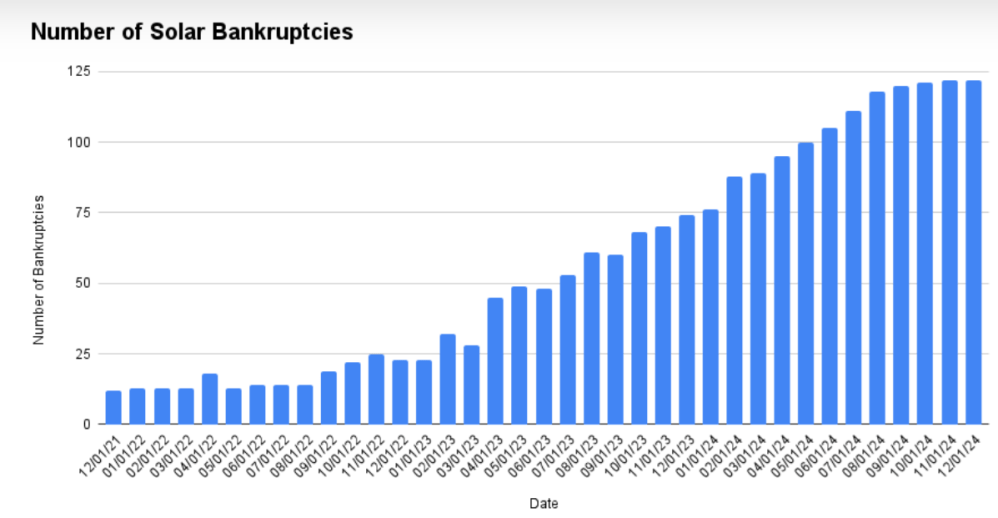

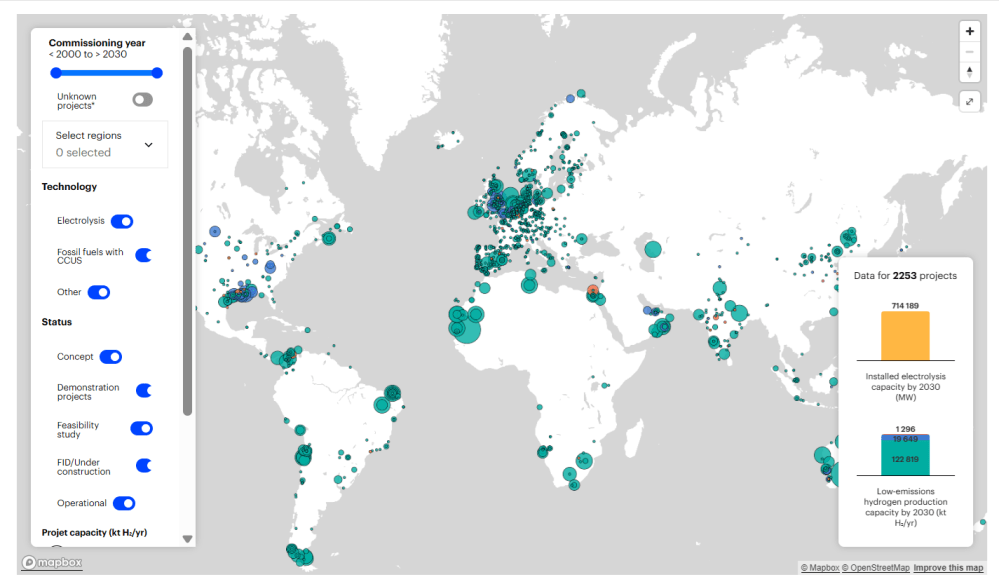

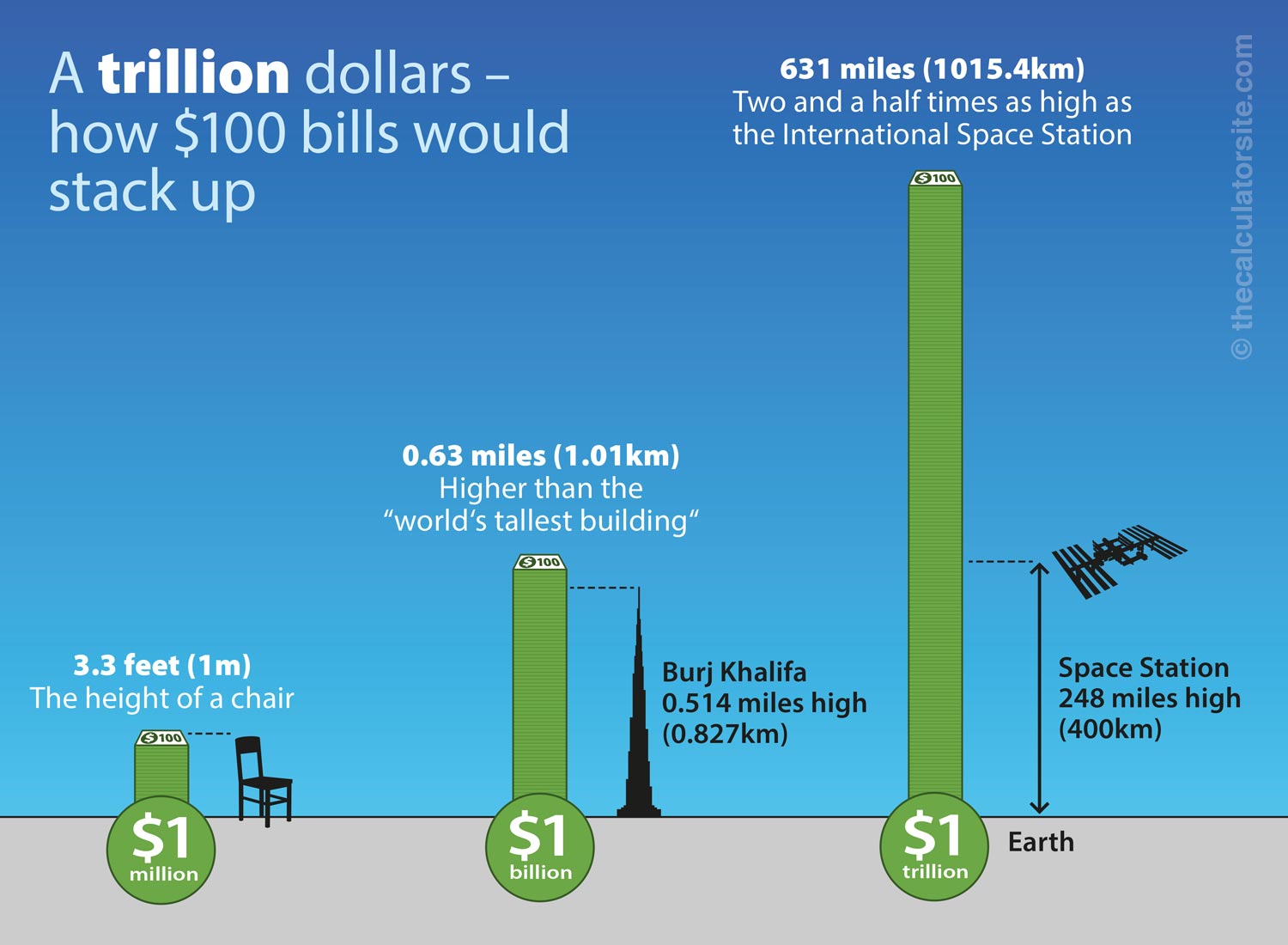

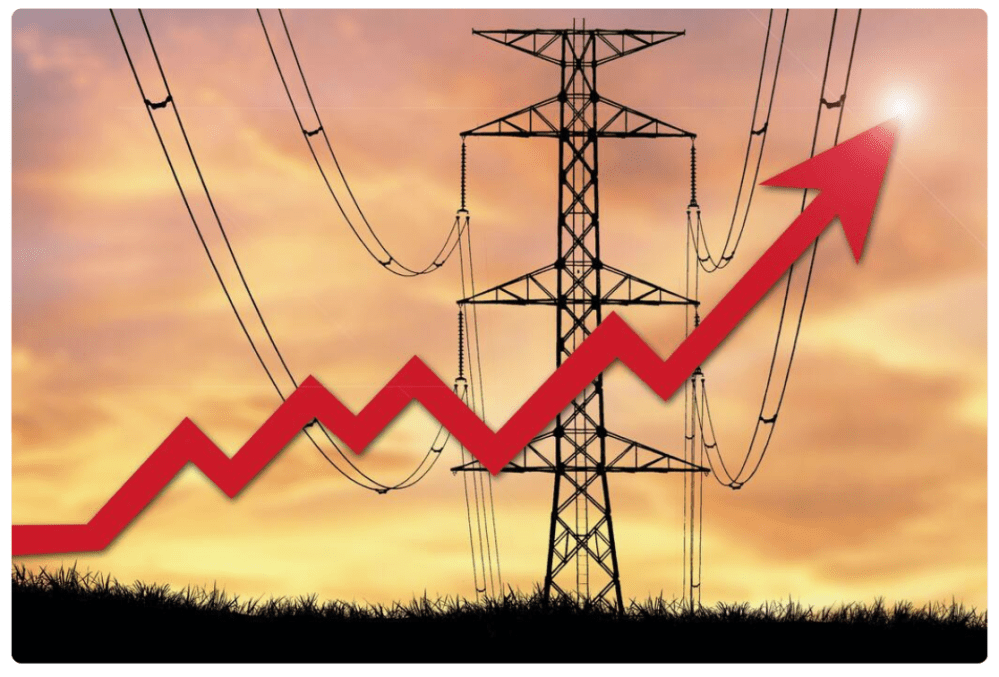

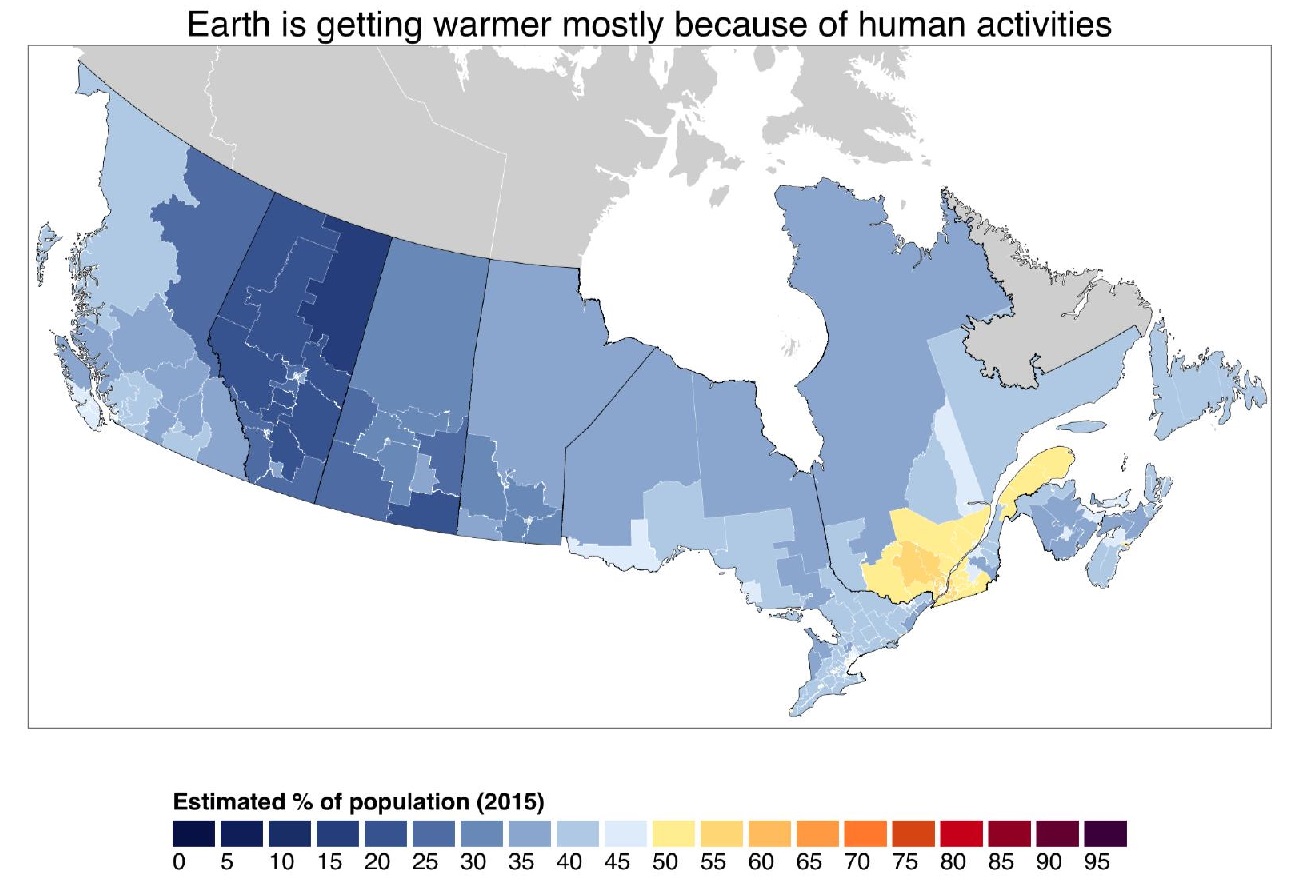

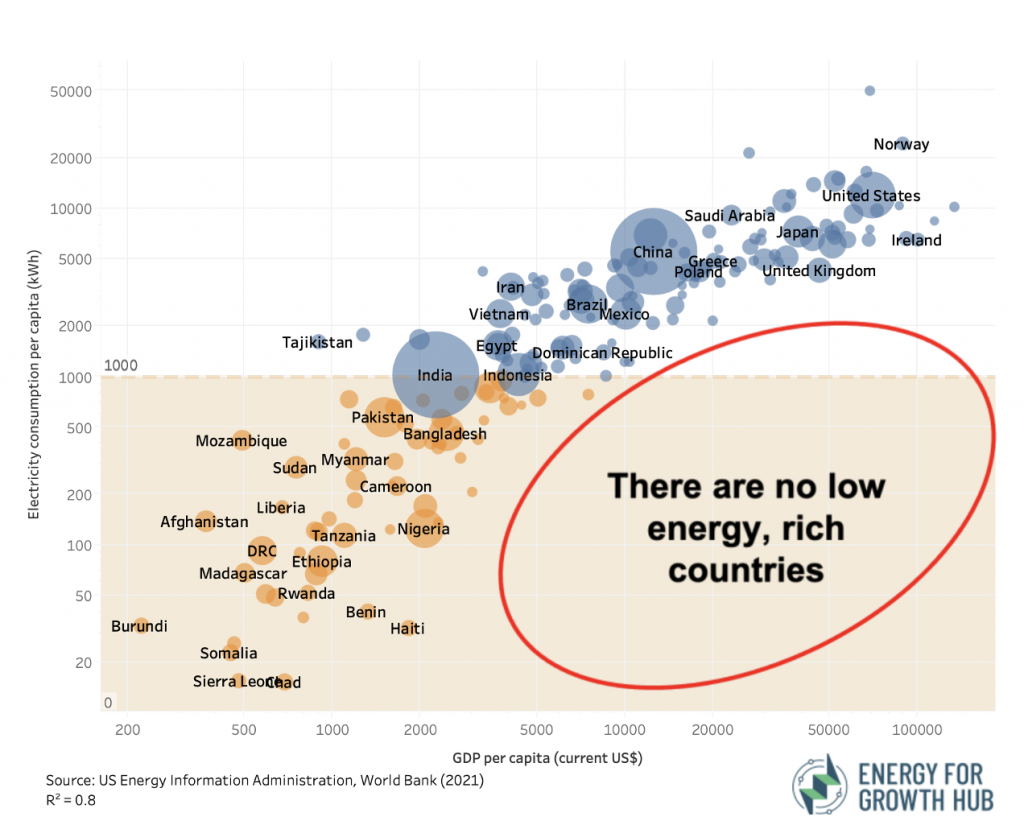

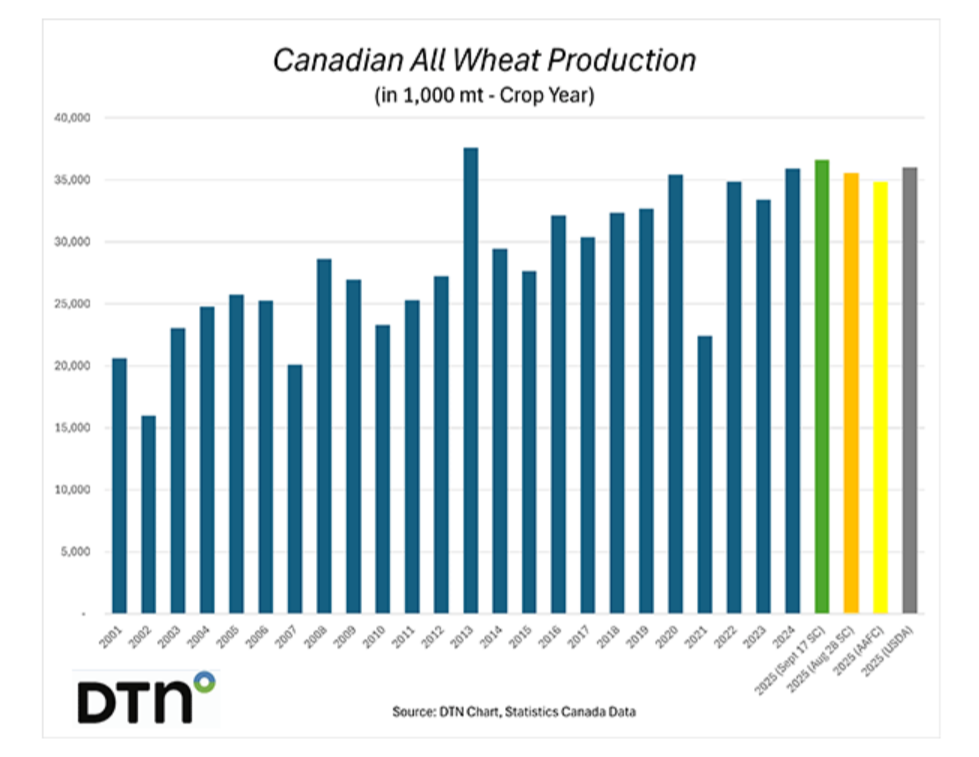

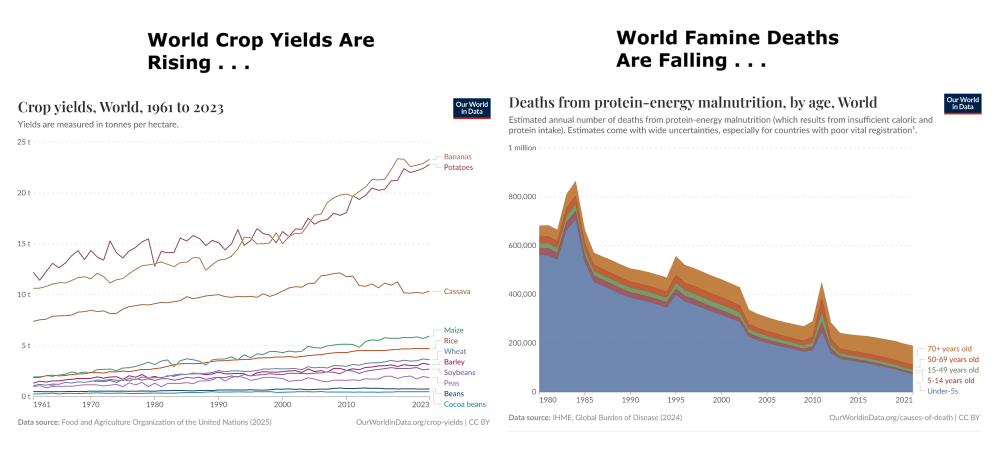

The above images put into perspective the scale of William Murray’s issue in his Real Clear Energy article regarding energy investments The $20 Trillion Question: How to Spend It and How Not To. Excerpts in italics with my bolds and added images.

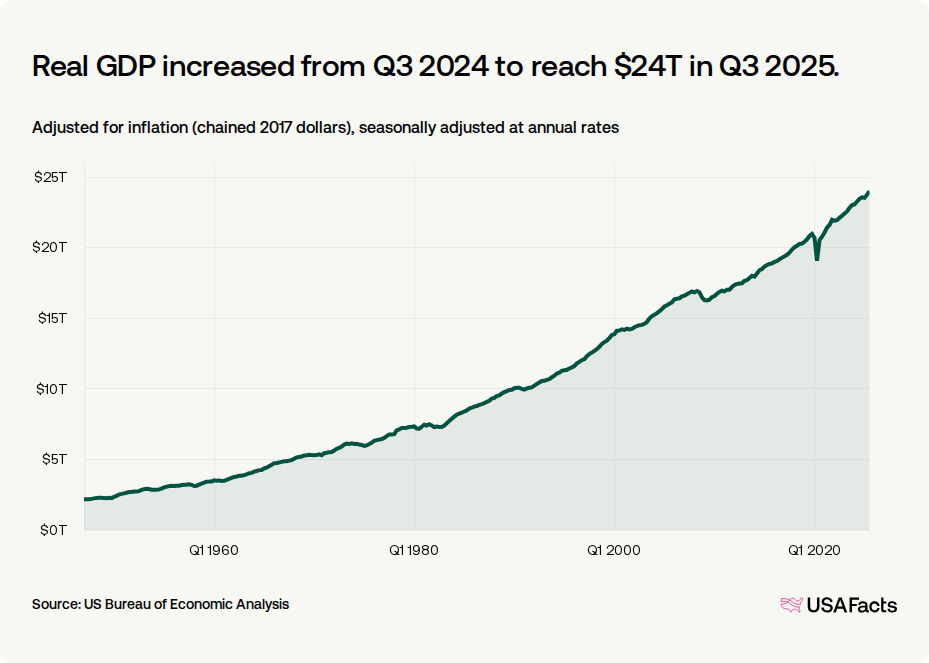

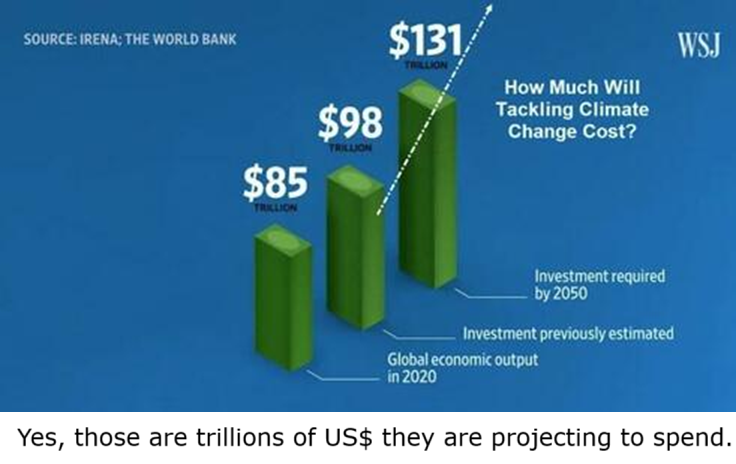

$20 trillion is a lot of money. One would expect a big bang to follow the spending of twenty-thousand billion dollars. It’s a lot of money! It’s pretty much the total present value of America’s GDP.

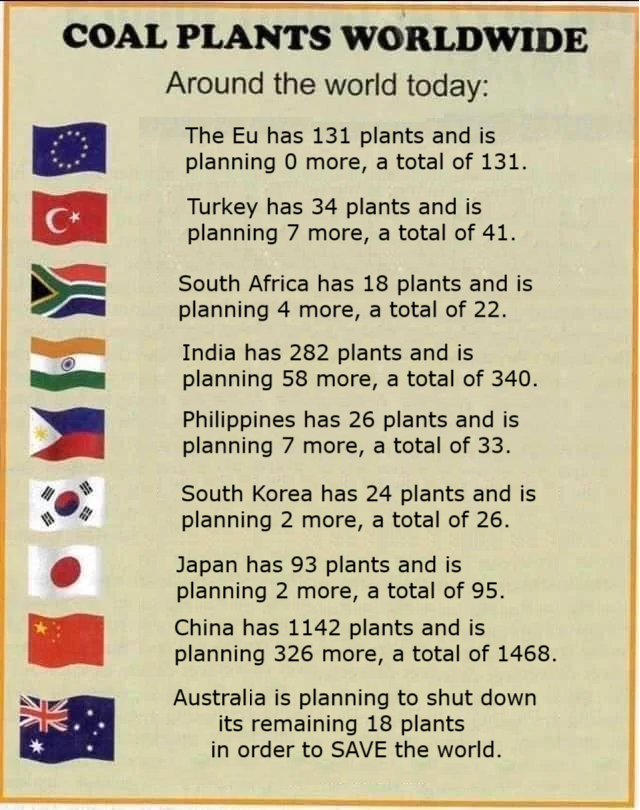

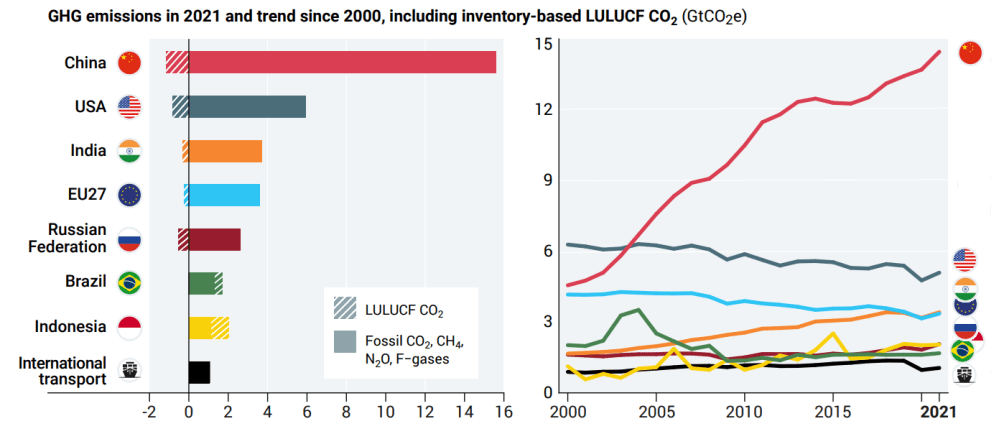

This is the sum that was globally spent — largely by Europe and the United States — in a coordinated effort by the developed world to decarbonize the global economy. China, in contrast, sold the world windmills and solar panels while it opened a new coal-fired power plant per month.

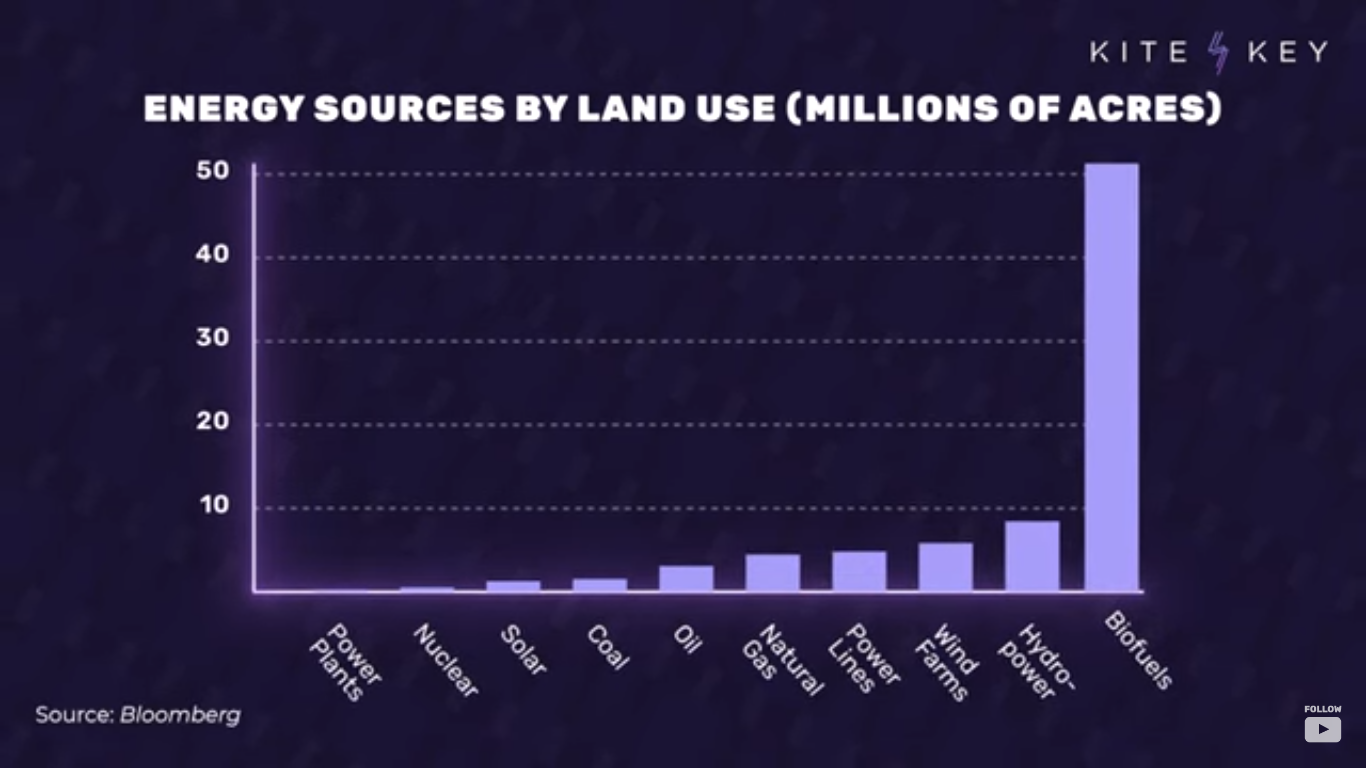

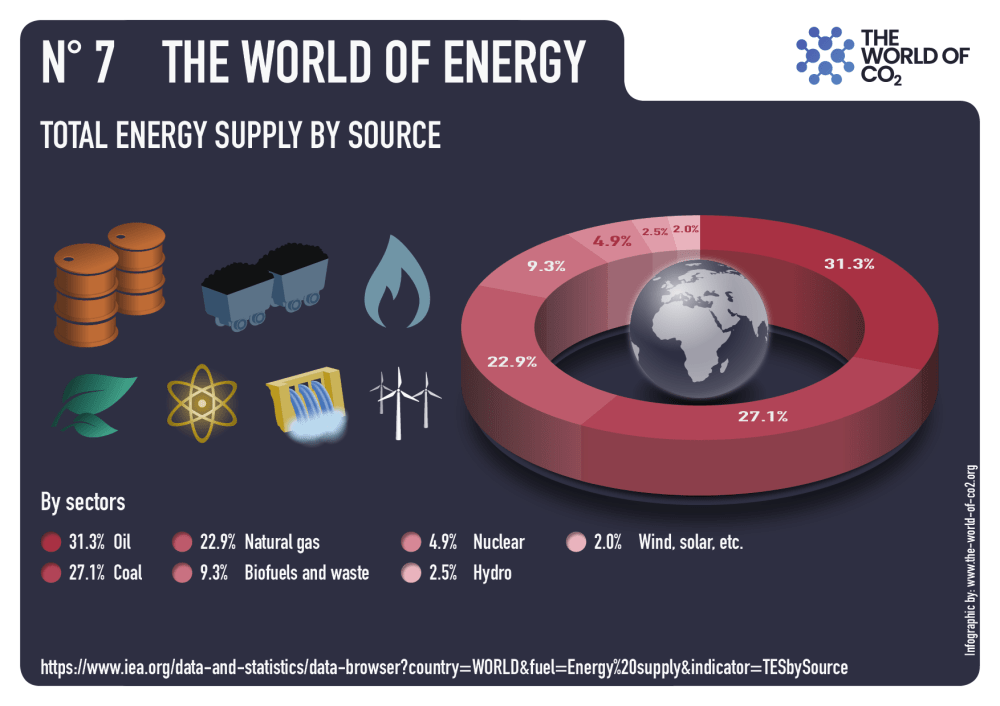

What was the net effect of this “Green” Marshall Plan? Hydrocarbon consumption continued to increase anyway. All that was achieved was a tiny reduction, just 2%, in the share of overall energy supplied by hydrocarbons. Put simply, as the energy pie got bigger and all forms of energy supply increased, hydrocarbons ended up with a slightly smaller share of a larger pie.

We also saw the de-industrialization of the European and American economies — not just with higher prices at the gas pump and on electric bills, but a stealth green tax that was passed on to consumers on everything. This is the culprit of our American and global affordability crisis.

So much treasure and pain for a 2 percent reduction in the share of hydrocarbons.

What a tilting-at-windmills waste. The worst bang for the public and private buck ever. Yet, the Chicken Little believers of the Church of Settled Science and the grifters who profited from it will still sing in unison that it failed because they did not go far enough. If only the global community spent and regulated more!

In contrast, the actual Marshall Plan (which ran from 1948 to 1951) rebuilt a decimated Europe into an industrial, interconnected, peaceful powerhouse. It was a great success by any measure. At the time, its price tag was huge: $13.3 billion in nominal 1948-1951 dollars, which is the equivalent of approximately $150 billion in today’s dollars.

Since a trillion is such a large number, let’s divide $20 trillion by an inflation-adjusted Marshall plan of $150 billion and we have 133 Marshall opportunities. Money was not the problem. To give a sense of the comparative bang-for-buck, by the Marshall program’s end, the aggregated Gross National Product (GDP) of the participating nations rose by more than 32 percent, and industrial output increased by a remarkable 40 percent.

President Trump has been on the global-funding rounds and has secured upwards of $18 trillion in investments. He has secured the equivalent of 120 Marshall Plans — just 2 shy of $20 trillion — to be invested here and nowhere else.

Unlike NAFTA — where the rich got richer under the banner of free markets and in exchange America’s underemployed families got cheaper goods — Trump’s is a recipe for prosperity for all Americans.

Making these investments an American reality will require a growing army of blue- and white-collar workers. With the wealth that it creates, our debt could be paid down and, finally, off. Social Security and Medicare would be placed on a solid footing for time immemorial. All our public obligations to each other would be paid from ever-growing prosperity and not from borrowed money and strangling debt service.

Nothing approaching this level of intentional investment in one country has ever been done. Yes, a similar tranche of greenbacks was burnt to no noticeable environmental benefit and great economic hardship for all. And yes, the American economy under the guise of comparative advantage sent trillions to our south and east — putting America second, hollowing out the American middle class, and neutering the American dream.

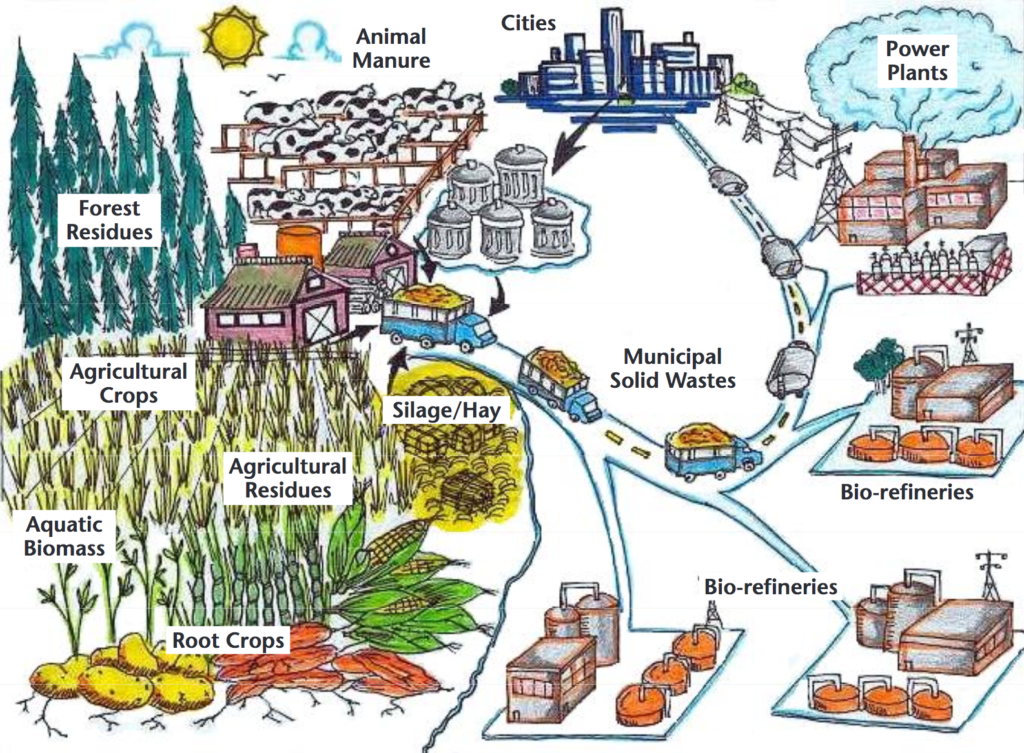

Trump’s Plan is the opposite of both failed experiments. Like the original Marshall plan, Trump’s is a recipe for the re-industrialization of the American economy and military, and it is not going to be fueled by windmills and solar farms but with hydrocarbons and uranium. That’s the Trump Plan. It has merit.

Yet, if we look at the polls, Trump is underwater and his base show signs of stress fractures. You bring peace to the Middle East, stop 6 other wars, and bring in some $20 trillion in America First-investments within your first year, and you come home to find yourself underwater and called a lame duck. Democracies — even Democratic Republics — are known to be fickle and hard to please, but this is still rich — and it will result in poverty, which is the opposite of affordability if it continues.

Without the use of tariffs and his deal making, there would not be $20 trillion looking to onshore to the United States. You can blame Trump for higher costs on bananas and coffee. But it’s the cost of electricity and healthcare — not the cost of coffee and bananas — that are roiling kitchen-table economics.

Vice President JD Vance recently made the right call for popular and populist patience. Those who are impatient should look at the offsets already passed, like no taxes on social security, tips, and overtime. That helps pay for bananas and coffee and then some.

My fellow Americans, these sovereign wealth funds that are presently lining up on our water’s edge are coming here based on promises made from a can-do president speaking for a can-do nation. While Trump is a can-do guy, are “We the People” presently a can-do people? Or, do we at least want to return to becoming a can-do people again? The “can’t do” forces are legion and they are the ones now championing the affordability crisis that they caused.

When America was a can-do nation, we built the Empire State Building

in a year. Today, it would take years to get a permit.

Those willing to invest such money will require some certitude that the power they’ll need will be there to “build, baby, build.” If not, the money and the opportunity will pass before it has the possibility to take needed root.

And what about us, the American family, worker, and business that continues to struggle under the legacy of throttling energy privation? In short, we all have a common good — a shared interest — in righting the wrongs that control our grid and our nation’s future.

The good news is that a bill was introduced in the House during the government shutdown. It’s called the “Affordable, Reliabile, Clean Energy Security Act.” Unlike Obamacare, which clocked in at 903 pages, this bill is a lean 763 words, that, if it became law — and it should — would change everything for the better. (Unlike Obamacare, which is recipe for un-affordability).

Mr. President, your one beautiful bill was missing this one thing. Your short- and long-term, America First ambitions are dramatically increased by making this bill into law before the midterm elections. Connect the state siting of these investments to Democrat support of the bill and you will find it on your desk before the midterms. Executive orders don’t offer the energy security that these investors require and that the American people deserve.

$20 trillion is a lot of money. Coming to our shores is a new lease on the American experiment as we enter our 250th birthday hopelessly divided and broke. Let us come together and solve not just the affordability crisis but set the conditions of greatness for the next 250 years.

See also:

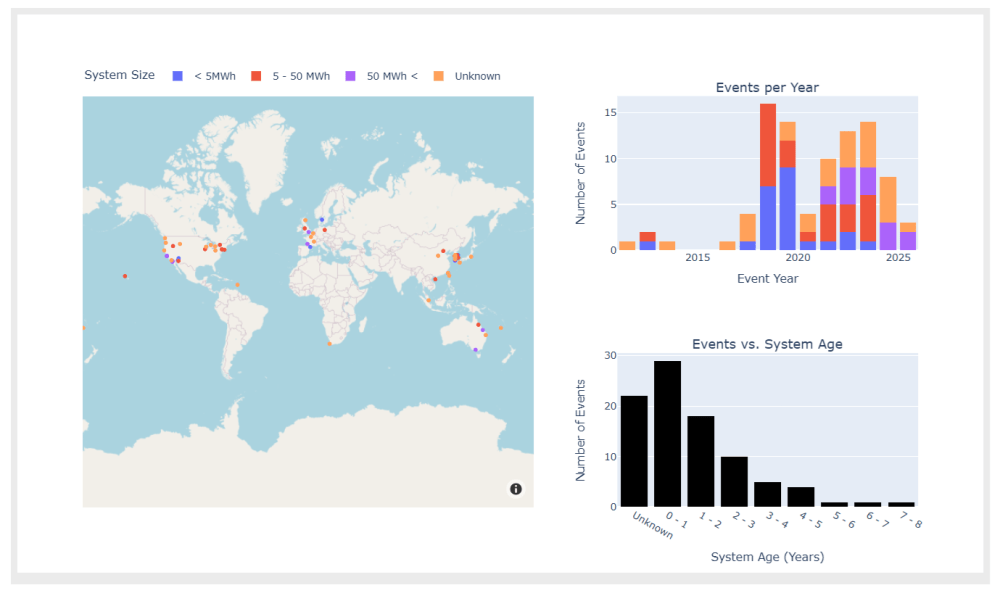

The system is under strain even without electrification

The system is under strain even without electrification

a

a

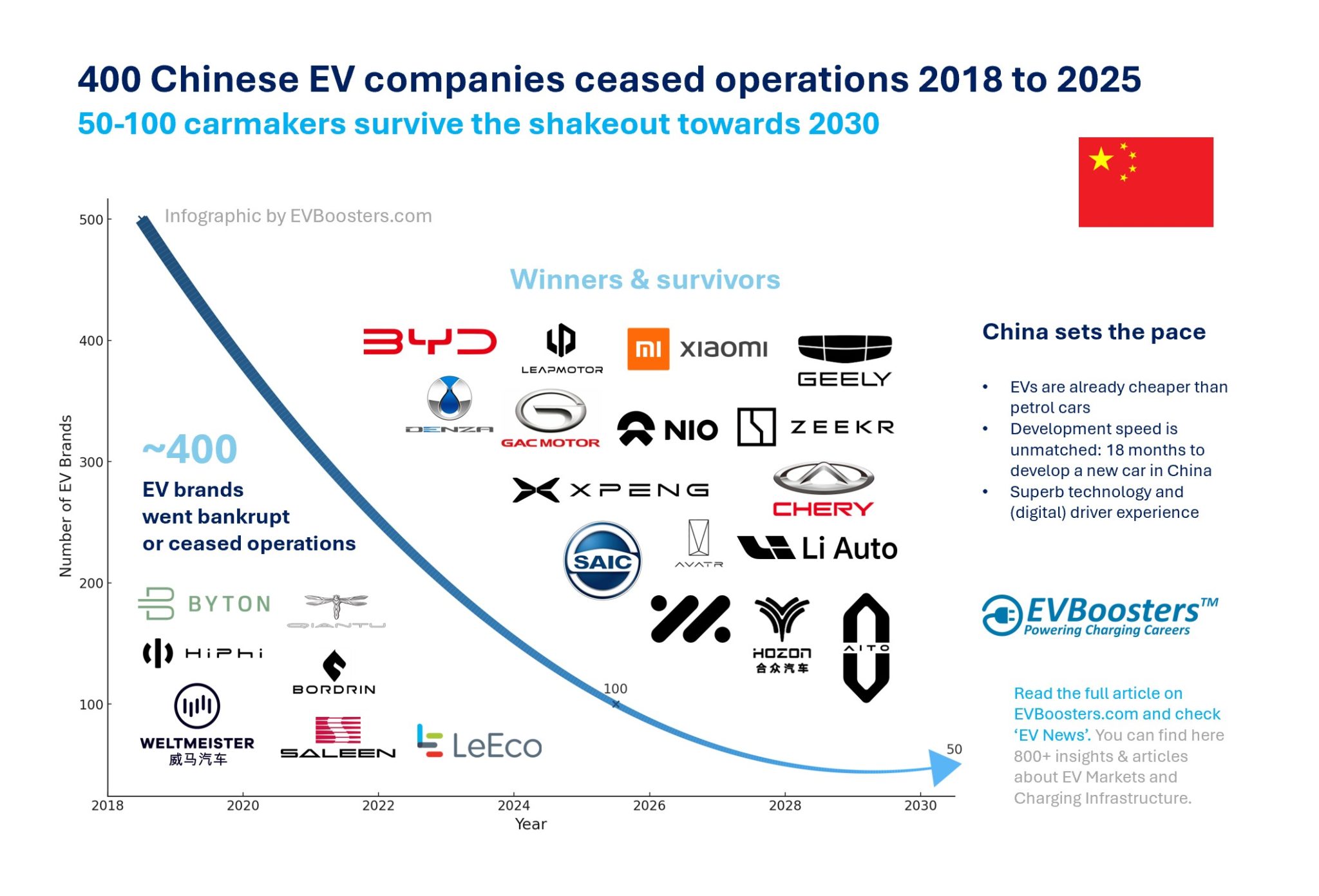

The Chinese electric vehicle (EV) boom has turned into a dramatic shakeout. Around 2018, China had more than 500 EV startups registered. These included everything from serious automotive disruptors to local government-backed ventures that never made it past the prototype phase. What do we mean by “EV startup”? In this context, it includes any newly registered Chinese company involved in the design, development, or production of new energy vehicles (NEVs) — including electric, plug-in hybrid and hydrogen cars. Many were speculative projects, created quickly to benefit from generous state subsidies, often with minimal automotive expertise. While a few had serious ambitions and advanced prototypes, the vast majority never got a vehicle on the road. By 2025, only around 100 of these brands remain active. Analysts from McKinsey predict that by 2030, fewer than 50 Chinese EV companies will survive. This is not just a story of collapse, but also of market maturation, consolidation, and strategic realignment.

The Chinese electric vehicle (EV) boom has turned into a dramatic shakeout. Around 2018, China had more than 500 EV startups registered. These included everything from serious automotive disruptors to local government-backed ventures that never made it past the prototype phase. What do we mean by “EV startup”? In this context, it includes any newly registered Chinese company involved in the design, development, or production of new energy vehicles (NEVs) — including electric, plug-in hybrid and hydrogen cars. Many were speculative projects, created quickly to benefit from generous state subsidies, often with minimal automotive expertise. While a few had serious ambitions and advanced prototypes, the vast majority never got a vehicle on the road. By 2025, only around 100 of these brands remain active. Analysts from McKinsey predict that by 2030, fewer than 50 Chinese EV companies will survive. This is not just a story of collapse, but also of market maturation, consolidation, and strategic realignment.