Beware Woke Financiers Gambling with Your Money

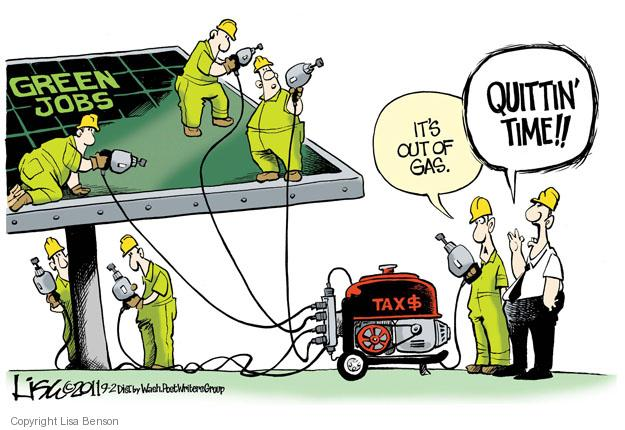

Andrew Stuttaford explains how the Biden regime encourages capitalists to spend investors’ wealth on projects favored by progressives for virtue rather than profit. His National Review article is Rule by Regulation. Excerpts in italics with my bolds.

The fondness of the Biden administration for rule by regulation is hardly a secret by now, and, when it comes to telling corporations that they should run themselves according to the precepts of stakeholder capitalism, the regulatory route comes with an added advantage.

To be sure, many companies, particularly larger ones, are already falling into line without any pressure from the state, because it suits the interests of managers (shareholders can be such a demanding bunch) and/or because they have been pushed to do so by a handful of large investment managers who can see the opportunity that “socially responsible” investing (SRI), an investment philosophy intertwined with stakeholder capitalism, represents for them, if not for their clients.

Other managements, however, would prefer to continue to run their businesses for the benefit of the shareholders (a stance, incidentally, that is rather more sophisticated than the usual Gekko caricature). Forcing such businesspeople to change their ways through legislation might be tricky, even in the current political environment. While SRI will continue to spread through the private sector, many in Washington, D.C., would like this “progress” to move forward at a faster clip. If that is to happen, regulation will have to play a central role. Key regulators seem only too happy to oblige. The last few months have seen a “greening” of the Fed that shows little sign of slowing down.

From the Financial Times last month:

After years of silence on the topic, the Fed has started to put climate issues centre stage. Shortly after Biden won the election, the central bank highlighted climate change as a threat to financial stability and moved to join the Network for Greening the Financial System, a consortium of central banks dedicated to supporting the goals of the Paris climate accord.

Now with Trump out of office and the Biden administration pushing hard to make up lost ground in the climate fight, Fed officials are speaking out more explicitly about climate risk and how they intend to take action.

“Financial institutions that do not put in place frameworks to measure, monitor, and manage climate-related risks could face outsized losses on climate-sensitive assets caused by environmental shifts, by a disorderly transition to a low-carbon economy, or by a combination of both,” said Federal Reserve governor Lael Brainard, at the Institute of International Finance’s inaugural climate finance summit yesterday.

Brainard is wrong, but in two different ways. The idea that climate change represents a material risk to the financial system at any time in the reasonably near future is laughable. I will turn, as I so often do, to the talk given by economist John Cochrane to a conference organized by the European Central Bank (ECB) last fall:

Let me point out the unclothed emperor: climate change does not pose any financial risk at the one-, five-, or even ten-year horizon at which one can conceivably assess the risk to bank assets. Repeating the contrary in speeches does not make it so.

Risk means variance, unforeseen events. We know exactly where the climate is going in the next five to ten years. Hurricanes and floods, though influenced by climate change, are well modeled for the next five to ten years. Advanced economies and financial systems are remarkably impervious to weather. Relative market demand for fossil vs. alternative energy is as easy or hard to forecast as anything else in the economy. Exxon bonds are factually safer, financially, than Tesla bonds, and easier to value. The main risk to fossil fuel companies is that regulators will destroy them, as the ECB proposes to do, a risk regulators themselves control. And political risk is a standard part of bond valuation.

That banks are risky because of exposure to carbon-emitting companies; that carbon-emitting company debt is financially risky because of unexpected changes in climate, in ways that conventional risk measures do not capture; that banks need to be regulated away from that exposure because of risk to the financial system—all this is nonsense. (And even if it were not nonsense, regulating bank liabilities away from short term debt and towards more equity would be a more effective solution to the financial problem.) [More on Cochrane’s thinking in linked post at end.]

The real aim of the emerging central-bank game is two-fold. Firstly, to increase the cost of capital for climate sinners by “discouraging” banks from lending to them and secondly, by mandating disclosure of such risks (and you can be sure that claims that they are minimal will not be acceptable) as a means to give climate warriors information that they can then use as a cudgel against financial institutions lending to the wrong sort of clients.

Such a disclosure regime would be designed to help activists, not shareholders. It would have nothing to do with “risk.”

The biggest risk to those climate sinners (specifically the fossil-fuel companies) may well come from the steps that regulators may take against them, a fact with more than a hint of a circular argument about it.

To the extent that they apply to all companies, the underlying aim will be to use disclosure not for the purposes of investor protection, but, one way or another, to ensure that every public company is browbeaten into ideological conformity.

Beyond that, it is easy to see that mandated disclosure of what companies are doing might well become, in time, the basis for setting standards for what they should be doing. And the more that the ability to impose that requirement is within the power of regulators alone (as opposed to having to involve legislators), the greater the likelihood that this will take place.

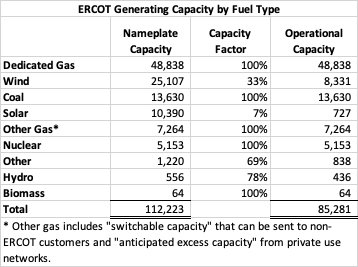

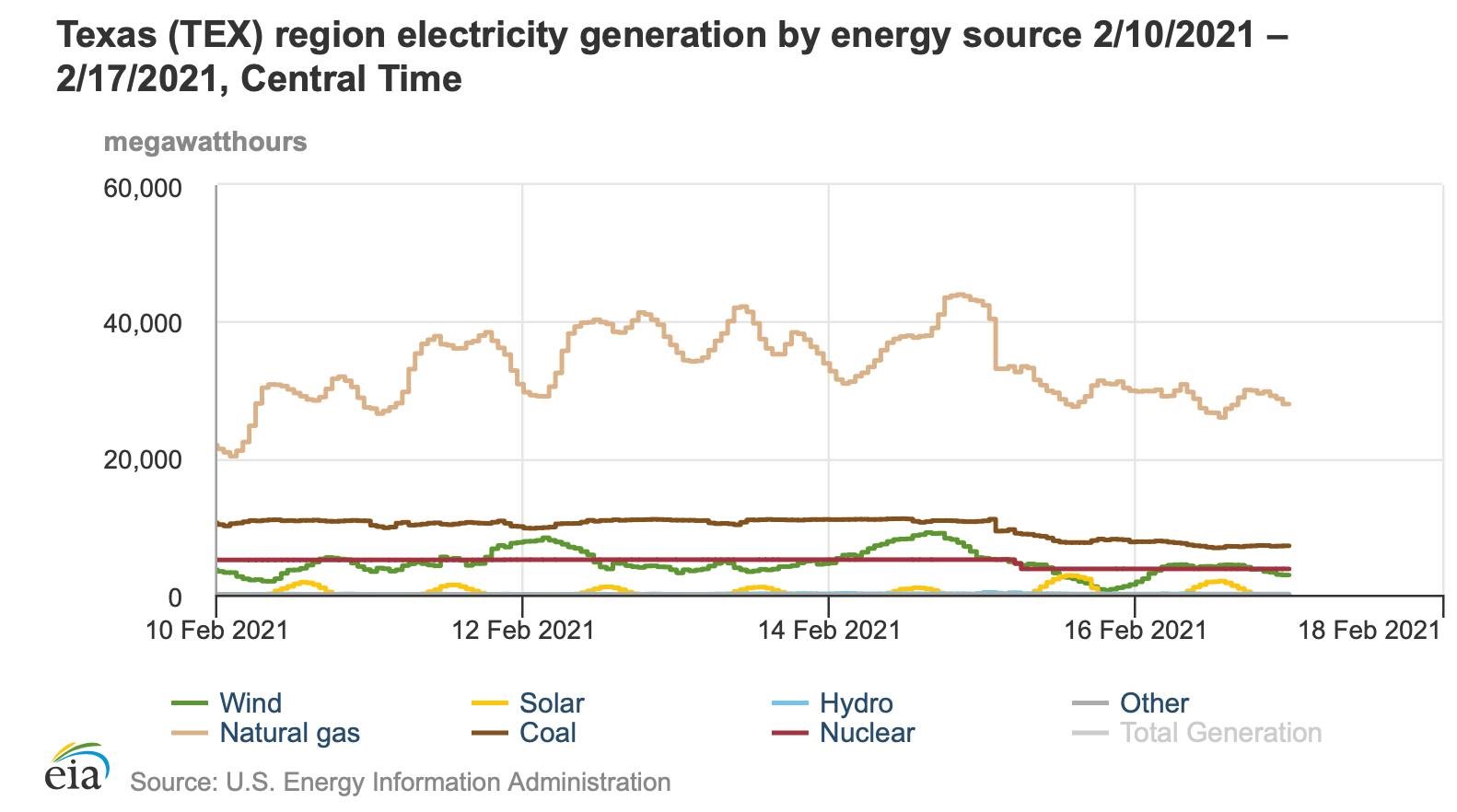

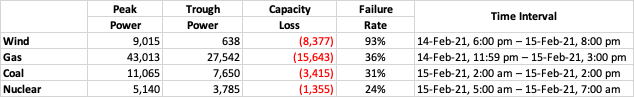

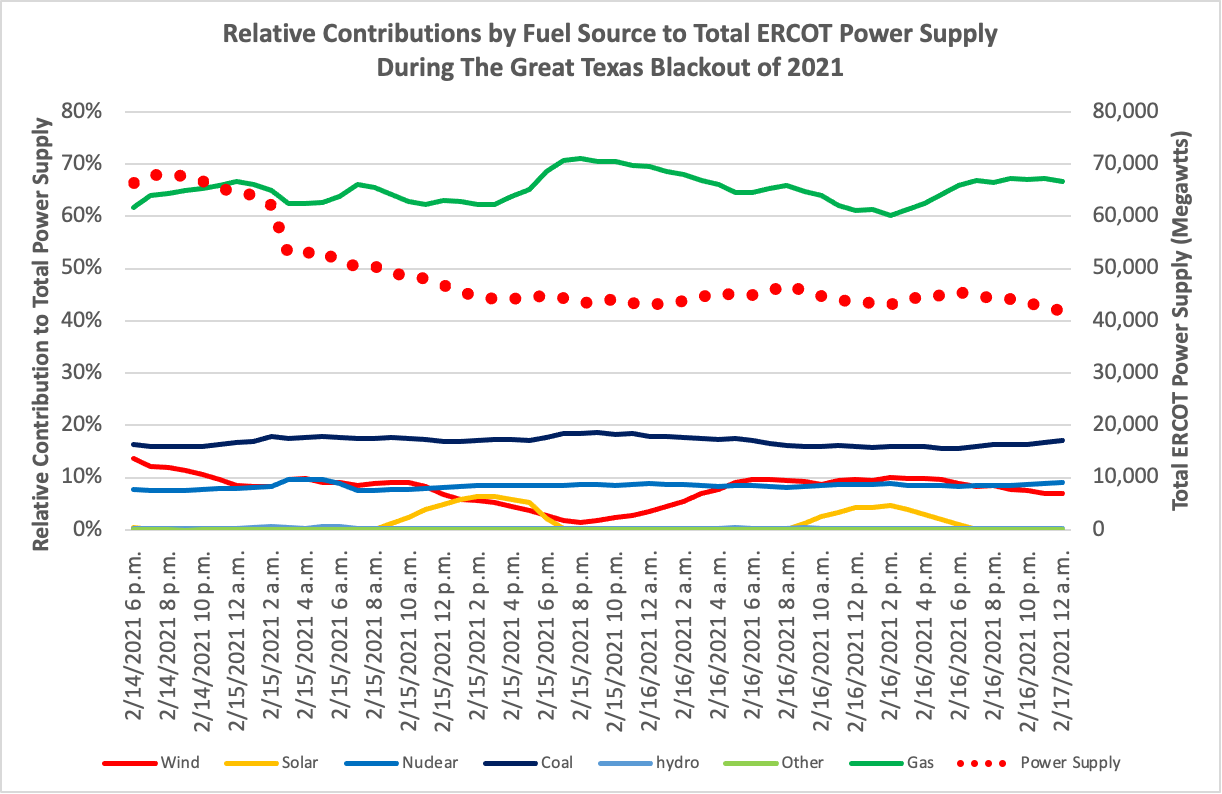

Then there’s Brainard’s reference to the risk posed by a “disorderly” transition to a low-carbon economy, whatever she means by that. If there is to be a transition to a low-carbon economy it would best be achieved in (so to speak) a “disorderly” fashion, without the command-and-control measures that much of the establishment now appear to favor, measures that are almost guaranteed to prove immensely destructive. Those who think otherwise should take a look at California or Germany’s disastrous Energiewende. The contribution of government should consist of some support for basic research, the odd legislative nudge, and the big bucks should go toward infrastructure programs to toughen our resilience to “weather,” whatever the climate may do: sea defenses for low-lying cities, winterizing the Texas grid, and so on. Much of the spending in that last category would likely pay for itself within a relatively short time.

All in all, this does not look like good news for those shareholders who prefer to focus on profitability, return on capital and other such ancient metrics.

And it won’t be too great for the economy either.

Resources: John Cochrane’s Central Banking Presentation at post Bankers Should Mind Their Own Business, not the Climate

See also: Financiers Failed Us: Focused on Fake Crisis