UK Crippled by Own Climate Policy (Darwall)

In the video Rupert Darwall is interviewed by Lee Hall discussing the plight of UK obsessing over global warming/climate change. For those preferring to read, below is an excerpted transcript lightly edited from closed captions. In italics with my bolds and added images. (RD is Rupert Darwall and LH is Lee Hall)

Keynotes

Britain is in a deep in a growth trap and we’ll remain in this growth trap. You know someone says if you’re in a hole stop digging. What we’re doing with Net Zero, we’re just digging harder and harder.

Today environmentalism is against economic growth and the green policies allow the ultra wealthy to feel virtuous. If you’re a multi-billionaire, like say Mike Bloomberg, you love it. Because what can you do to protect yourself from people complaining about your wealth? Well I’m saving the planet he says.

Europe’s green push is bringing economic benefit but not to Europe. German trade unions were promised during at the beginning of the energy transition there would be lots of green jobs and there were . . . in China. That’s where the green jobs went.

Green Policies and Economics

LH: Let’s talk about green policies and economics and how to really understand it all.

RD: So setting the scene: 2008 was quite a tough year and we had the financial crisis but then we also had the Climate Change Act. And was there a connection between Britain’s economic woes and then the introduction of what was arguably the most extreme green policies in the world.

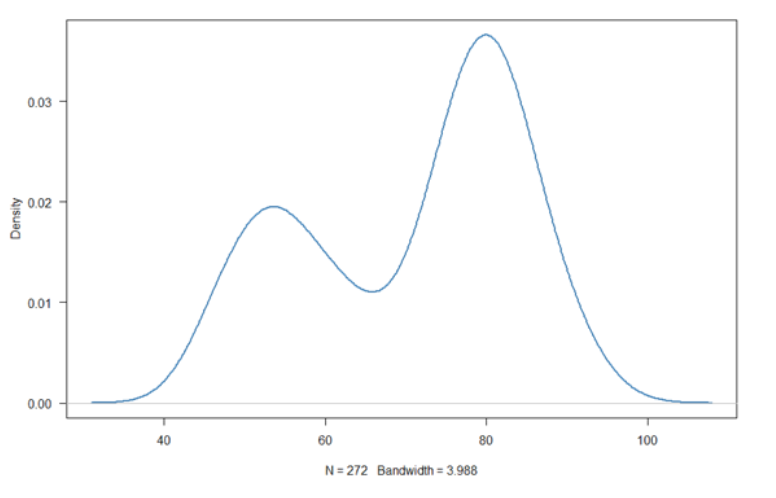

The British economy was deeply scarred by the financial crisis and its trend growth of productivity has basically flatlined since 2008, and as you point out 2008 is the same year that parliament passed the Climate Change Act. Which as a result saw huge amounts of capital deployed on very low yielding to negative yielding assets in the power generation sector; namely wind and solar.

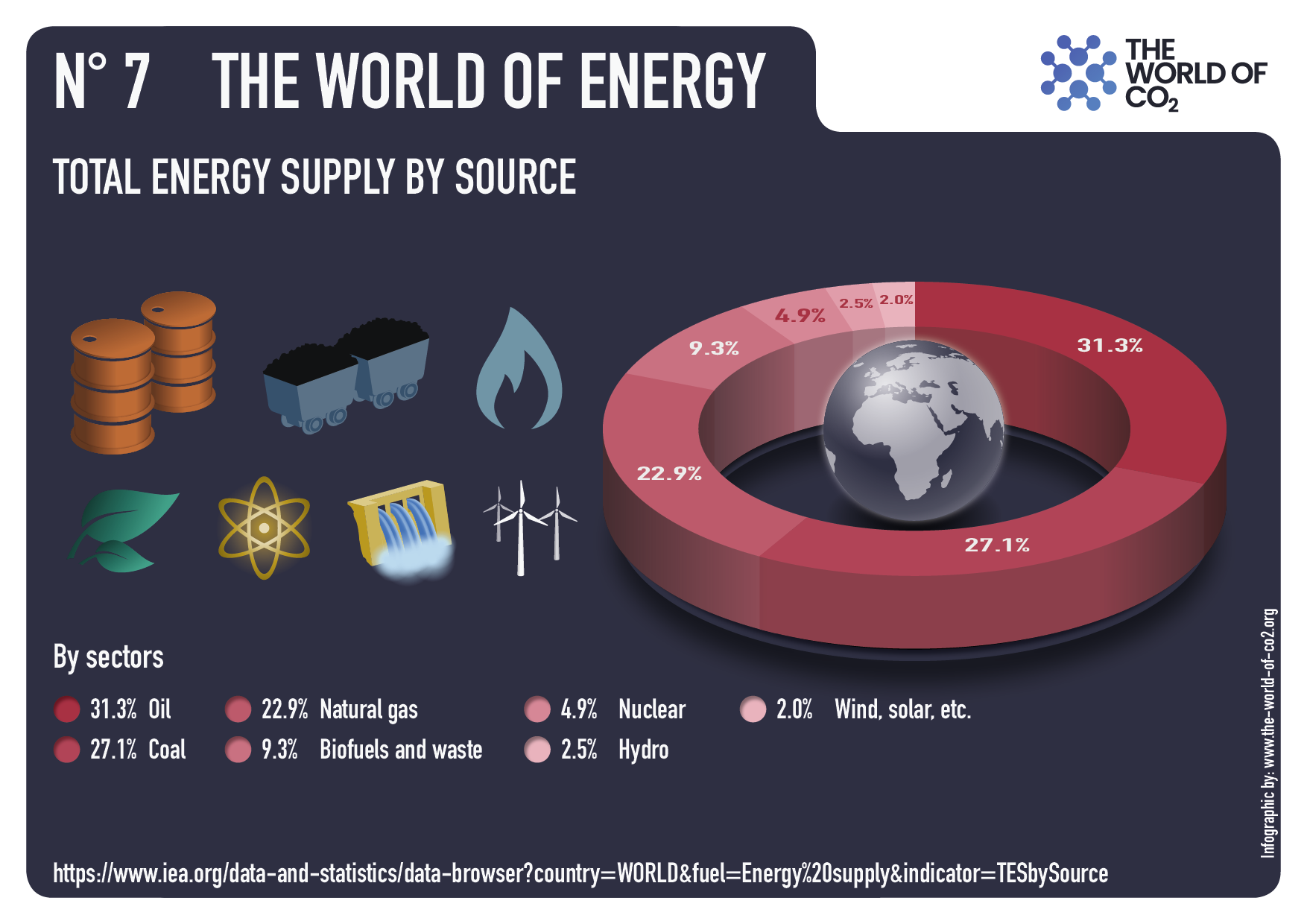

It’s very difficult to disentangle the long-term effects of the financial crisis and the so-called energy transition. But it is unquestionably the case that mandating very aggressive decarbonization worsens the productive potential of the economy. To give you an idea of how bad is the energy transition for a Net Zero: The International Energy Agency produced a net zero plan, and by 2030 under its Net Zero assumptions, the global energy sector will be employing 25 million more people using 16 and a half trillion more dollars of capital. 16 and a half trillion dollars more Capital using vast land areas of the combined size of Mexico, France, California, New Mexico and Texas to produce 7% less energy.

So the the critical thing to understand about the energy transition

is it means you need more more resources to produce less.

That’s exactly what we’re seeing, what effect the push for Renewables has had on our Energy prices, and thus on our economy and our competitiveness. Well it’s made Britain one of the most expensive places in the world for businesses in terms of of the electricity bills. We’re seeing steel making basically being put out of business in this country. We’re seeing oil refining with the Grangemouth oil refinery being closed. The petrochemical industry is going to have a very hard time to survive.

So a lot of industry is basically going to be wiped out. But then you look at the automotive industry where we have effectively mandates for EV adoption requiring rising proportions of car sales must be EV. If car manufacturers don’t meet those targets, they get taxed and that will basically lead to almost obliterating the British automotive industry, apart from some really very upscale names like Bentley. Essentially you’re looking at the death of the British automotive sector.

LH: Could you give us a a Layman’s introduction to what’s happened with wind power in Britain and what this teaches us about environmentalism?

RD: In 2022 Boris Johnson said offshore wind is the the cheapest form of electricity in the country. It was a line fed to him by Carbon Brief, which is heavily funded by the European Climate Foundation, which in turn is funded by multi-billion philanthropic foundations in the US. It is pure propaganda; there is not any basis for saying that.

Remember that at the time of the energy crisis following Russia’s invasion of Ukraine, then about 40% of the increase of the natural gas price was actually artificial carbon taxes and the price of carbon. So take that that out; these are completely artificial. This cost isn’t about supply and demand of fossil fuels, it is simply government imposed taxes to basically tax natural gas production out of the system.

Then offshore wind is inherently expensive. If you think about it, putting very large wind turbines in the middle of a hostile marine environment like the North Sea you need to have a big question mark over it. This defies common sense. What happened was the wind industry telling the government and the government believing that the cost of offshore wind was about 50 pounds per megawatt hour. In fact analysis of the accounting data for the financial entities shows that the break even price of North Sea power above 100 pounds per megawatt hour.

Basically the wind industry had conned the government into saying wind is cheap. And of course then they’ve now turned around and said actually our costs are a lot higher than you thought. But you’ve got the climate change act which gives a legal Duty on the government to reach Net Zero. So if you don’t give us more subsidy you’ll be defying your legal duty to reach Net Zero, and we just might take you to court to to have the courts decide whether you are.

LH: We heard recently Constraint Payments that there may be a watchdog investigation into wind farms for overcharging on constraint payments, the constraint payments being getting paid to not produce electricity. Can you help us understand the logic behind this? So they get paid to not produce something then they’re overcharging on the nothing?

RD: Yes, the problem is kind of obvious when you see that the more wind capacity you have, when the wind’s blowing the more electricity is produced and that creates two problems. It may be in excess of demand so you have a sharp fall in the wholesale price of electricity. Which incidentally means that gas generators start to be loss making, and it’s very bad for the economics of the power stations that are needed to keep the lights on. It can actually go negative so you pay them to constrain.

The other thing is that the wind turbines are in remote windy locations and they have to be connected to the grid and there’s simply not enough grid connection. So the wind operators are saying well you need to you need more grid infrastructure. Well that’s not free, but they won’t pay for it, they’re expecting consumers to to pick up the tab. And indeed ofgem the energy regulator has a sort of policy, what they call socializing the cost of grid connection, so they’re picked up by customers rather than by the investors.

LH: People that push Green Growth, the green policies, are talking about green growth and green jobs a lot of the time. It seems they they don’t really materialize and we end up paying more to produce less in a less efficient way. I mean is the environmentalism actually an anti-growth strategy?

RD: In Germany for example the German trade unions were promised during at the beginning of the so-called energy transition there’ll be lots of green jobs. And there’s workers in China, that’s where the green jobs are, they’re not in Europe. I mean Europe is not competitive, doesn’t have the low energy cost that China has. To make this kit is very, very energy intensive.

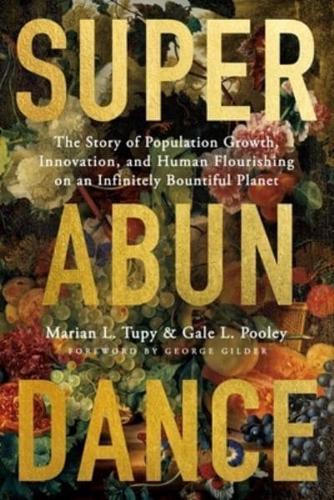

Since the limits to growth debates of the early 1970s in fact limits to growth came out in 1972, greens have argued that economic growth will destroy the planet. And therefore growth is bad. Now they’re turning around and saying well we’re going to have green growth. Well don’t believe it, you should really believe that they are against growth and that their policies are designed have to knock growth on the head. That’s what we’re seeing now.

This kind of degrowth, anti-growth push is very bad news, for people’s living standards, for their aspirations, for their wanting to have a better life for their children; having greater opportunities, more enjoyable ways to to spend money, to spend your life. All that’s true but also growth is needed to fund the state and to fund fund public services. Having had very little growth since 2008, essentially green policies mean endless austerity, it means extremely high tax rates. The tax burden in Britain is the highest it’s been since since I think the late 1940s, since the post war period. So yes it’s very bad both for private consumption but also for public consumption, also public investment.

Britain has a very low level of public investment. Also we have a very low level of private investment So all together in Britain we find ourselves deep in a growth trap. And we’ll remain in this growth trap. You know someone says if you’re in a hole stop digging. What we’re doing with Net Zero is we’re just digging harder and harder.

LH: Marxism policy is to take the means of production away from private ownership whereas what we’re looking at now is to almost destroy the means of production. I often make the point, that in some respects environmentalism is a more radical ideology. Marxism is about changing the ownership of the means of production. This is about changing the means of production themselves.

RD: The early marxists like Karl Marx and Friedrich Engels, actually if you look at the Communist Manifesto, there’s this great Paean of praise to capitalism and the Bourgeois for creating these fantastic means of production that that have unlocked hitherto unknown levels of prosperity. Of course as we just discussed the greens are very much against that. But what where the greens score is although it’s a radical ideology in terms of changing the means of production and degrading the means of production, it is very socially conservative. It doesn’t challenge the existing social hierarchy.

So if you’re a member of the a feudal royal family like King Charles, you like green stuff. It doesn’t say Dethrone him or cut off their heads. If you’re a plutocrat, if you’re a multi-billionaire like say Mike Bloomberg in the US, you love it because again is what you do to protect yourself from people complaining about your wealth. You say well I’m I’m saving the planet. I’m using my money, my business and my philanthropy is about saving the planet.

So on the one hand, economically it’s very radical, but socially it’s all about

maintaining existing social stratifications and of course denying

people lower down the means to rise up, to better themselves.

LH: So in the original Marxism the rich guy or the top was the bad guy, but now those Rich guys can actually be the good guys in the environmentalism.

RD: The way I put it is that green policies and decarbonization are ethics for the super wealthy. You see Bill Gates when he gets asked in interviews, what about your carbon foot footprint, he’s got so much money he pays an enormous amount to have carbon dioxide sucked out of the air, direct air capture. Well of course you can do that if you’re if you’re one of the richest people on the planet. But of course but for ordinary people when they take their holiday to the Mediterranean if you’re going to expect them to pay hundreds of pounds extra, I mean it’s not going to happen. So yes this is about the super wealthy.

Another example of virtuous contradictions would be to look at say wind farms or solar panel farms. That’s supposed to be good for the environment but they’re destroying the landscape and they’re destroying the habitats and they’re chopping up birds, killing insects and threatening whales.

LH: This environmentalism expects us to suspend our beliefs to some degree yeah this is what you pointed out is a fundamental contradiction deep in the heart of modern environmentalism. It’s like saying, to save the village we had to destroy it.

RD: It is absolutely clear that the environmentalists don’t care about this. Fundamentally it’s about the precautionary principle so you’ve got to be extra specially careful. But not when it comes to wind power; they’re perfectly okay with with wind turbines destroying nature, since they see it as saving the planet.

So for the greater good we need to ruin some of the planet

to save the the greater Planet.

The error is that as soon as you go from the local to the global, you sacrifice the local. And of course the global is an aggregate of the locals but for them it isn’t. This maniacal obsession with carbon dioxide emissions which has led to this tragedy that so much nature is being destroyed in the name of saving nature which it won’t do.

LH: When Rishi Sunak was Chancellor Exchequer he talked about rewiring the global financial system for Net Zero and then redeploying $130 trillion dollar of assets can you help us understand like how that would be possible and and tell us about the role that ESG is playing.

RD: He made that that speech at the Glasgow climate conference, in my opinion the single worst speech ever given by any Chancellor of Exchequer of either party. It was an absolutely appalling speech because essentially he’s saying private savings should be socialized to meet public policy objectives. ESG is very much a part of the socialization of private savings. ESG is basically politics by other means Instead of government saying we’re going to pass laws and regulations and raise taxes and spend lots of money ourselves doing it. We are going to pass regulations and we’re going to browbeat business to do this for us.

There’s a twofold cost in that. One is to investors whose capital is being basically expropriated, is being used by politicians. And the other is to Consumers who pay higher prices as a result. ESG is a very malign trend in in finance. It’s very interesting to look what’s been happening in the United States where it’s in retreat for for basically two reasons. First of all because the anti-green stocks, if you like, that is the oil and gas sector suddenly in the covid recovery suddenly put on great growth spurt in the stock market. So if you weren’t in oil and gas stocks you lost out.

And secondly there’s been a big reaction in in Republican states against these ESG mandates. However in Britain and Europe ESG continues. The government is effectively telling businesses they have to come up with Net Zero transition plans, so ESG is alive well and doing a lot of damage in Britain and Europe. In the US we saw Texas divest about 8 billion dollars from Black Rock because of their ESG measures.

LH: I mean do you think we we’ll see anything like that here or is that very much an American approach

RD: If you like the strength and vibrancy of capitalism in America there is not a peep of that in the UK or Europe. Britain’s largest asset manager is LGIM, Legal & General Investment Management, and it is completely signed up to the Net Zero ESG agenda. There’s very little sign of a backlash. Local authorities turn to be green they want to they say they want they invest want to invest their pension funds in in some nice ESG ways. You have the university superannuation funds. Universities are all kind of green and woke and so forth. so there there is unfortunately. You’ve seen that the London Stock Market until just recently, the last few weeks or so, has massively under performed the S&P 500 in the states.

LH: We seeing this contradiction again, but if I invest some money in a big investment firm, I’d expect them to use it to make money instead they’re using it for ideological means.

RD: There was this the ESG sales patter that it was doing well by doing good. They said we’ll use your money to do good and by the way you will make more money doing that than you otherwise would. That was always rubbish, it defied modern Financial portfolio Theory. But they got away with it until about 2022 when oil stocks did extremely well, had a very strong run on on the stock market.

The other thing to point out, ESG used to exclude any defense stocks because armor manufacturers are evil and so forth. Then Putin invades Ukraine and they suddenly wake up saying, well actually we should have defense contractors in there. So it’s completely muddled, an ill-defined concept that is made up as it goes along.

And there’s also why should it be fund managers taking these really important decisions about things like defense and National Security. These are preeminently decisions and policies for politicians not for market traders.

LH: You’ve very much got your finger on Green and economic issues. Are there any things coming up that you think we should keep an eye out for that are going surprises in the coming year?

RD: The big thing will be what happens in the American elections in November. On the one hand you have the Biden Administration which has set itself a net zero policy goal. The EPA is making a rule which will really take coal Off the Grid. It will cut massively the amount of natural gas power they’ve got on the grid. Biden has imposed a moratorium on new permits for export of natural gas.

On the other hand you have Trump who believes in what he calls American Energy dominance, he’s a hydrocarbon politician. He’s actually the only Western leader of the last couple of decades who is what I call an energy realist, who really understands energy. In his first term as president he pulled out of the Paris climate agreement. I think he would do the same again, and if that happens it will raise a huge question mark. What is the sense of persisting with Net Zero if the second largest emitter in the world pulls out of the the Paris agreement?

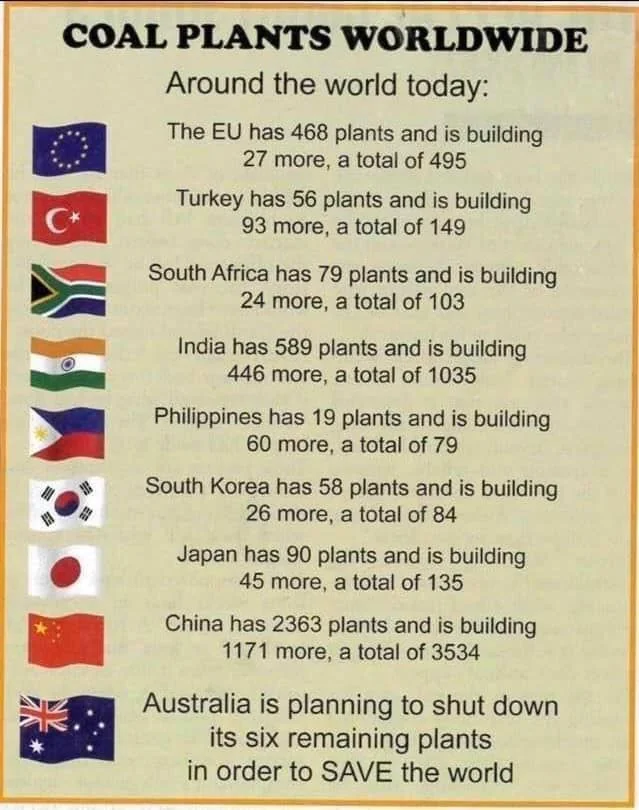

LH: I think it will it really kill Net Zero to anyone intelligent looking at it. We already had India and China not really buying in, but for America to join them?

RD: There is the conceit of the structure of the Paris agreement in these nationally determined contributions. So what China and India have been doing is they they’re not pledging any Cuts. They say well the carbon intensity of our economy will decline over time, which it will do anyway. One of the interesting facts of Britain is that when Rishi Sunak and British politicians boast about Britain cutting its carbon emissions. Britain’s CO2 emissions peaked in 1972 and you know as economies mature they tend to become less carbon intensive; that’s been the case in Britain.

What has happened since 2008 as we discussed at the beginning, that has been massively accelerated with quite a lot of damaging effect on manufacturing, on Energy prices um on the grid reliability and so forth.

LH: If Trump did get in and and pulled out of the agreement in that way, do you think the UK will follow along or oppose? What do you think will happen here?

RD: I don’t think a Keir Starmer government would follow particularly given Ed Miliband in the position of Energy Secretary, who was Energy Secretary when the 2008 climate Act was passed. He was at the Copenhagen conference in 2009 and played quite an important part there. There is no way they are going to have second thoughts on it.

What will change or what could change is the conservatives in opposition might actually begin to smell the coffee and say actually this is this is a really bad idea this Net Zero costs us votes, it costs people money, and therefore we need to question it. so I think the I think it will change the dynamic of politics in this country particularly if Trump were to repeat what he did between 2016 and 2020.

LH: Will there be an opposition Conservative party think in like five years time we could be seeing an opposition conservative party that’s against a lot of the green policies and quite different from what it is now?

RD: That’s a possibility. The problem is that when when a party goes into opposition quite often as happened in 1997 essentially the conservative party had a collective nervous breakdown and gave up on conservatism. That’s essentially what happened and it went through that long period and it was completely enamored with with Tony Blair and the promise of David Cameron and George Osborne.

Well are we are going to emulate Tony Blair and we’re going to get the conservative party to love the leftward drift of British politics? Will that happen again? Well Keir Starmer is no Tony Blair is he? But on the other hand the ability of the conservative party to really screw things up should never be underestimated.

There is no charge for content on this site, nor for subscribers to receive email notifications of postings.

To me, it is wild that people would protest against energy production during an energy crisis. That they would have a fit of the vapours over energy subsidies, coal use and gas exploration at a time when people are struggling to keep the lights on. It’s not just dumb – it’s cruel. Imagine how out of touch with ordinary people’s concerns you would need to be to swan into a country experiencing a severe energy crisis and essentially say: ‘Stop supporting energy production.’ What was Greta thinking? She’s become a globetrotting enemy of progress, popping up all over the place to demand that we turn off the lights and don a hairshirt in keeping with her dystopian dream of restoring a pre-capitalist idyll that never actually existed.

To me, it is wild that people would protest against energy production during an energy crisis. That they would have a fit of the vapours over energy subsidies, coal use and gas exploration at a time when people are struggling to keep the lights on. It’s not just dumb – it’s cruel. Imagine how out of touch with ordinary people’s concerns you would need to be to swan into a country experiencing a severe energy crisis and essentially say: ‘Stop supporting energy production.’ What was Greta thinking? She’s become a globetrotting enemy of progress, popping up all over the place to demand that we turn off the lights and don a hairshirt in keeping with her dystopian dream of restoring a pre-capitalist idyll that never actually existed.

A centrepiece of postmodern ideology is DEI which, by dividing us all into oppressor or oppressed, is neither diverse, nor equitable nor inclusive but conformist, unfair and exclusionary. It undermines excellence, productivity and competitiveness and is largely responsible for the assault on truth and inquiry at schools and universities, which have become left-wing breeding grounds for Gen Z.

A centrepiece of postmodern ideology is DEI which, by dividing us all into oppressor or oppressed, is neither diverse, nor equitable nor inclusive but conformist, unfair and exclusionary. It undermines excellence, productivity and competitiveness and is largely responsible for the assault on truth and inquiry at schools and universities, which have become left-wing breeding grounds for Gen Z. As for climate catastrophism, there are innumerable examples of the zany policies it has led to. Toronto’s fiscal situation is so dire it has just increased property taxes by 9.5 per cent. Yet its TransformTO 2022

As for climate catastrophism, there are innumerable examples of the zany policies it has led to. Toronto’s fiscal situation is so dire it has just increased property taxes by 9.5 per cent. Yet its TransformTO 2022